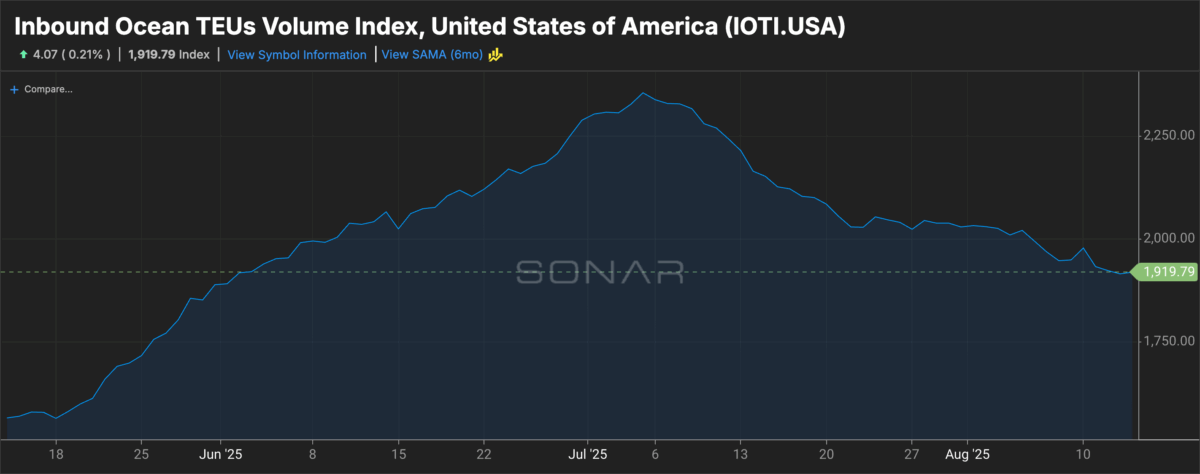

As Shakepeare may have put it, when it comes to container shipping, the past, very much, is prologue.

So while the busiest U.S. ports hailed tariff-averse volume records in July, that elation was short-lived as container rates continue to fall on demand apparently sated by frontloading.

Market average rates on the benchmark trans-Pacific trade from the Far East to U.S. West Coast ports were just above $2,000 per forty foot equivalent unit for the week ending August 13, consultant Xeneta said in an update, the lowest it has been since the end of 2023, as the Red Sea crisis was unfolding.

That compares to $2,098 for the week ending August 6.

Far East to U.S. East Coast prices were $3,174 per FEU, down from $3,311 w/w. North Europe to the U.S. East Coast was $1,941 per FEU, from $2,015.

Xeneta said capacity management by carriers and less tariff uncertainty had helped brake the overall rate decline to 6% in July, after prices plunged by as much as 53% on the trans-Pacific in June.

No immediate cargo rush is expected, after the Trump administration extended the pause on higher tariffs for Chinese imports another 90 days into early November.

Among Far East fronthauls U.S. East Coast rates have decreased 12.8% or $464 per FEU since the end of July, second only to South America’s 18.3% drop or $1,020 per FEU.

Far East to North Europe rates fell to $3,247 per FEU from $3,330, while Far East to the Mediterranean slid to $3,337 from $3,372.

Prices on the Far East to Mediterranean are down 8.2% since July 31, Xeneta said, adding that expected increases in vessel capacity will only exacerbate declining spot rates absent higher demand.

“The further 90-day extension of current tariff levels between U.S. and China will not have a significant impact on shippers and we should not expect another cargo rush, as we saw immediately following the initial lowering of tariffs mid-May,” said Xeneta Chief Analyst Peter Sand, in a note. “Shippers have already embraced the first 90-day window of opportunity to frontload goods – there is no longer a pent-up demand to get goods into the U.S., so spot rates are expected to decline further in the coming weeks as capacity also increases.“The massive challenge facing carriers is not restricted to the U.S.-bound fronthauls, with offered capacity also increasing from Far East to North Europe and Mediterranean in the coming weeks, potentially putting further downward pressure on spot rates here, too.”

Find more articles by Stuart Chirls here.

Related coverage:

Panic? What panic? Port of Los Angeles sees record 1 million containers in July

Intermodal veteran Cannizzaro to OCEMA carriers group as deputy executive director

China volumes, tariff anxiety helps surging US container imports challenge ’22 record

Retailers: Tariff-battered import volumes to be 5.6% weaker in 2025

The post Past is prologue: Rising container volumes portend falling rates appeared first on FreightWaves.