Colossal levels of newbuilding, waning demand and a discontented and resentful customer base is a recipe for a run on rates that had been expected last year but is now predicted to be only marginally affected by a United States East Coast port strike.

Global Shippers Forum (GSF) director James Hookham will tell a FIATA World Congress in Panama today (26 September) that shippers have had enough and will be fighting back against what they see as a poor service offered at extremely high rates with little visibility in how charges are made and a suspicion that lines are manipulating capacity to suit them.

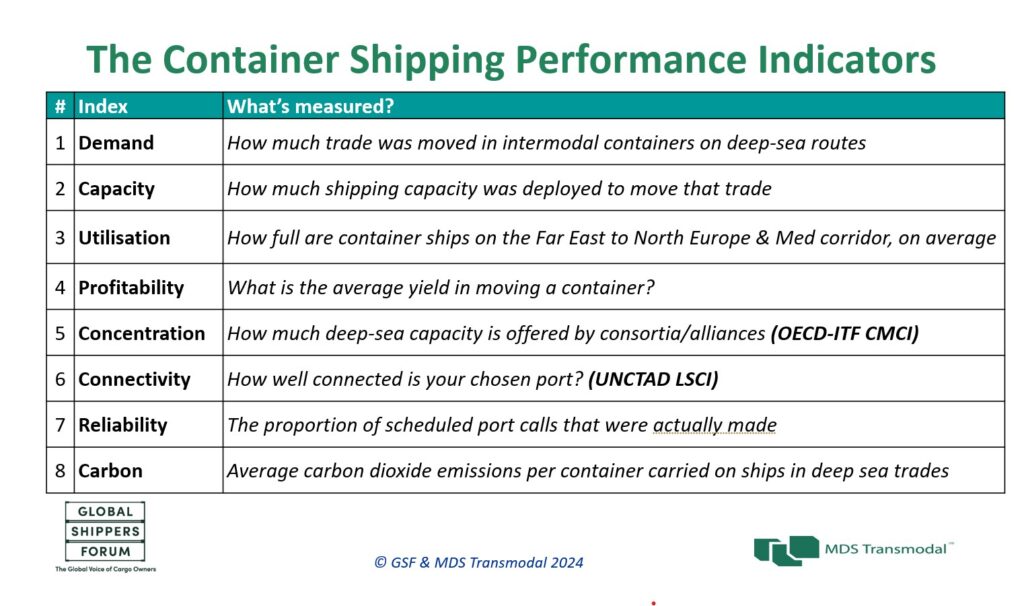

GSF along with consultant MDS Transmodal have designed the Container Shipping Performance Indicators (CSPI) to aid shippers in coming rate negotiations arming them with data that can bring visibility to contract discussions.

Following last year’s false dawn, which saw the Middle East war erupt, closing the Suez route, and forcing carriers around the Cape of Good Hope to absorb newbuilding capacity that had been expected to rebalance the supply and demand equation, shipper confidence is again growing.

“The market is too unpredictable at the moment to confidently make projections,” pointed out Hookham, “but we can look at trends in the current circumstances.”

Those trends will initially take the form of quarterly market reports compiled by MDS Transmodal using publicly available sources and the company’s own algorithms to detect those trends and inform shippers.

Hookham will tell the FIATA delegates that shippers are looking for three things from this data, the numbers to use when they are in discussions with the shipping lines; to understand trade routes more fully, so that when a problem arises they can rapidly assess their options; and, when considering re-sourcing to other parts of Asia or closer to the consumer market, what are the available services, what is the quality of those services and can they make a detailed risk assessment before taking major decisions.

In an effort to address these questions, GSF and MDST have put together the CSPI which has eight indices, three of which – capacity, profitability and connectivity – will be presented by Hookham in his Panama speech today.

CSPI’s will be available to shippers by region, trade route, or by ports, but the major issue for Hookham at this point is, “how much of the deployed capacity is available to book?”

“The number of slots available are a quarter of the given capacity on the water,” claimed Hookham, “but the amount that can be booked will depend on the speed of the vessel, the frequency of port calls, which ports and how many are skipped and blanked sailings, as lines manage the actual capacity and number of slots.”

Antonella Teodoro, analyst at MDS Transmodal responsible for building the CSPI, explained that MDST started developing the indicators by following vessel deployments, through its database, which is updated on a monthly basis and allows the consultant to accurately measure capacity. That data is supplemented with trade flow data to calculate average utilisation for capacity deployed.

Latest CSPI data suggests that carriers on the headhaul routes of the three major trade lanes have adequate spare capacity to carry cargo, with Pacific utilisation at 70%, Asia to Europe 80% and utilisation of just 65% on the westbound Atlantic.

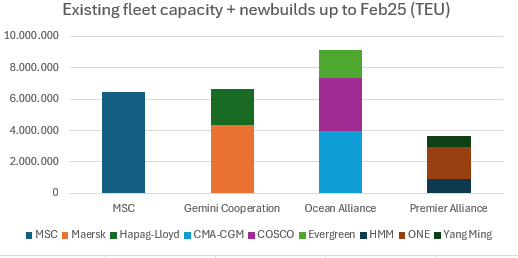

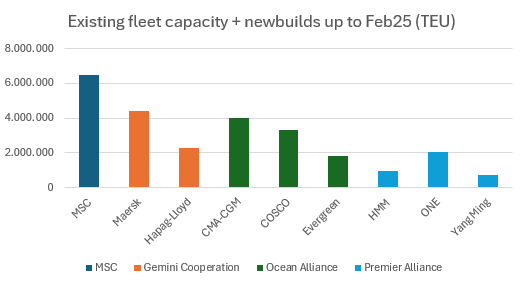

“There is likely to be severe over-capacity by February next year with the newbuild capacity being deployed, there will likely be disruption from the US East Coast strike, but I don’t think this will be serious enough, or long enough, to bring similar levels of disruptions as seen during the pandemic,” said Teodoro.

According to MDST, standing capacity is expected to increase by 1.7 million TEUs by February next year, from a global total of around 29.9 million TEUs to close to 31.6 million TEUs.

Some of this newbuild capacity will be offset by demolitions, but most scrapping will begin with older tonnage, meaning smaller vessels, while the bulk of the orderbook remains for ships in excess of 15,000 TEUs.

Darron Wadey, an analyst at Dynamar, explained: “Even if scrapping resumed at ‘normal’ levels, its impact will be marginal when compared to the numbers being delivered, about 470 vessels, around 3.2 million teu, is expected to be delivered in 2024. In the last decade average annual scrapping was 247,000 TEUs, with 2016 a record year with 699,000 TEUs scrapped, 3.5% of the fleet.”

Wadey does not believe that a sustained demolition programme could achieve a 3.5% scrapping programme of about 1.1 million TEUs, neither is there much more scope to slow steam, with vessel speeds already reduced. It is more likely that there will be a return to cancelled newbuilding orders and lay-ups.

“We will know when things start getting really bad when we start talking about ‘cold’ and ‘hot’ lay-ups again and ships start appearing at anchor, apparently devoid of life, in estuaries, lochs and fjords,” said Wadey.

Container trades have been artificially buoyed by events such as the Red Sea crisis, believes Wadey.

“When the markets do correct therefore, the falls will only be more dramatic because the inevitable has been delayed whilst the stream of new ships coming online continues,” he said.

He added: “In the long term, nothing other than a combined steady growth in trade, a rebalancing of the trade flows and a strategic rather than knee-jerk ship ordering policy will achieve a balanced market.”

Wadey considers market changes to be “generational shifts”, but in the short term, political events in the US could see a late 2024 cargo spike, “but then where does that leave 2025 and beyond?” Wadey asks.

Mary Anne Evans

Correspondent at Large