One month after the inauguration of Donald Trump, his impact on the freight market was front and center in the FreightWaves February State of Freight webinar.

Here are five takeaways coming out of the discussion between Craig Fuller, founder and CEO of FreightWaves and SONAR, and SONAR Director of Freight Market Intelligence Zach Strickland.

Trump has added to market uncertainty

“The reality is that Donald Trump’s willingness to implement policies really quickly without a lot of warning is certainly in vogue,” Fuller said. “And I think the issue or the challenge is that you really don’t know what’s next.”

That risk is across the board, “whether you’re pro-tariff, anti-tariff, pro-DOGE or you think it’s the worst thing to happen since whatever,” he said, referring to the newly formed Department of Government Efficiency.

In the freight sector, uncertainty is the “overriding theme,” Fuller said. Some reactions to that uncertainty have already shown up, he added, such as the inventory “pull forward” that has resulted in extremely strong import numbers at the ports of Los Angeles and Long Beach in recent months. “So that continues to be a constant struggle for a lot of these companies to figure out, OK, regardless of what we think about demand, what are we going to do?” in the face of Trump-created uncertainty, according to Fuller.

But Fuller said he still believes that tariffs, at least in the short term, are “generally good for domestic trucking.”

The drop in volume

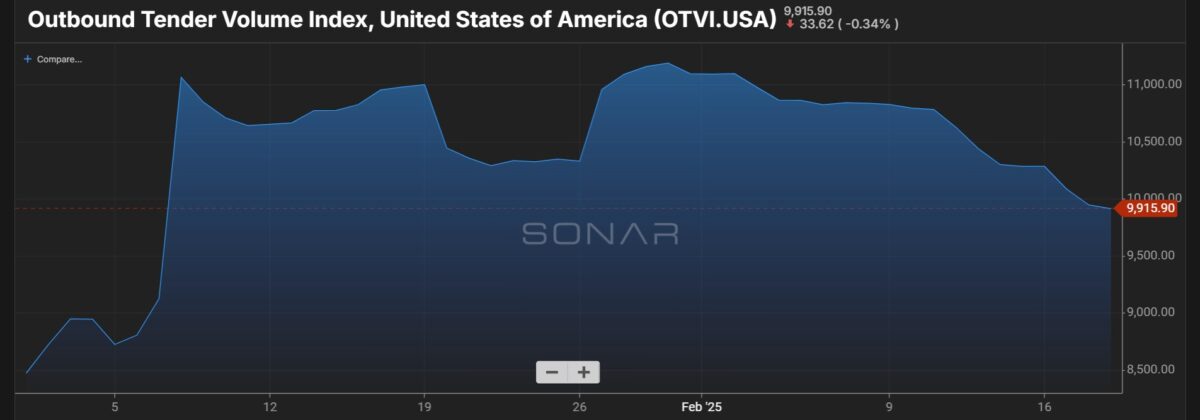

Strickland noted an unusual decline in the Outbound Tender Volume Index (OTVI) in SONAR, which measures freight volume. The OTVI has held relatively steady during the three years of the freight recession, lending support to the idea that the issue in the market is not one of inadequate freight moving on trucks but rather too much capacity to haul it.

Strickland said while some decline into February might usually start the month, at some point “we’d start to see a pickup.” But that hasn’t been the case this month. Strickland suggested that a tough winter – one of the harshest in many years in parts of the country – has had some impact on volumes. “I think we’re seeing a little bit of death by a thousand cuts,” he said.

Strickland cited data from ports that suggested imports should be rising soon. “The imports, when they come back in March, should recover a lot of that softness in February,” Fuller added.

Jack Cooper and other impacts on capacity

Auto hauler Jack Cooper shut down earlier this month, though it does not appear to have filed for bankruptcy yet. (And the family that owns the company has headed off in a new direction in the less-than-truckload business.) What does that mean for capacity?

Strickland noted that the Outbound Tender Reject Index (OTRI), a proxy for capacity, has not declined in sympathy with the drop in the OTVI.

Fuller chimed in that even with “all the other elements in the economy,” tender rejections were in “a pretty good spot compared to where they were over the last couple of years.”

Two years ago, the OTRI was a little more than 3%. A year ago it was hanging around 5%. On Thursday, SONAR reported the OTRI at 5.6%.

“It is telling us what we want to hear, which is that capacity is resetting,” Fuller said. “That reset is continuing.”

As far as the exit of Jack Cooper, Fuller said it “would create some level of disruption inside the market, “even though the act of hauling cars, which is Jack Cooper’s business, is different than dry van transportation. The Jack Cooper drivers will be absorbed into the market, he said, though not likely in a union job like the rank and file had at Jack Cooper.

“From a long-term perspective, this is sort of what you want to see if you’re able to hang in there,” Fuller said. A significant closure or bankruptcy could result in bankers becoming skittish about lending money to the industry, he said, “and I think those things are generally positive if you’re operating in the business and you’re not Jack Cooper.”

Rates are probably at their lowest

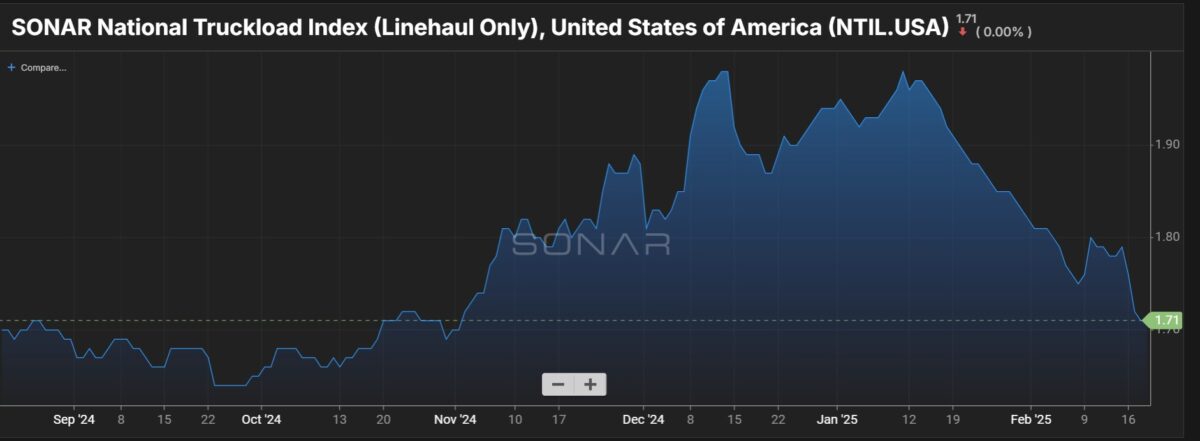

If the weakness in volume has shown up anywhere, it has been in spot rates. Strickland highlighted a chart of the National Truckload Index Linehaul Only (NTIL) rate that showed it was at $1.98 per mile on Jan. 11 but was down to $1.71 per mile on Wednesday.

Fuller said the rates “suck.” But he said that “the fact that in mid-February and where it’s at when Chinese New Year is also in effect, I think I consider it a positive. And I think I’ve been looking at the spot market as the effective bottom end of the market in terms of rates.”

He noted that the spread between spot and contract rates, which got as wide as spot being $1 less than contract deals in 2022, is now at about 50 cents. While that is still low, “it hasn’t gotten worse. To that, that says that again we are largely in a recovery phase.”

Intermodal still having an impact

All the data coming out of the intermodal sector has been bullish. Strickland said he has been watching “how intermodal has been really a drag on the demand side of the trucking sector. I’m looking to see how that sustains.”

“A lot of shippers have shown that they’re OK with some level of dwell time and increased service deterioration, as they kind of have this rolling storage situation moving,” Strickland said. “How long does that persist?”

The strength in intermodal means there’s been a boom in short-haul trucking. Should that trend stick, he said, “a lot of the trucks are being utilized for much shorter movements around these cities, and that’s going to change the way that a lot of these carrier networks operate.”

More articles by John Kingston

XPO lawsuit against 2 ex-employees gives look into noncompete agreements

Manhattan Associates’ sudden C-suite change not what it seemed, executives say

Missouri truck company owner gets 9 years for PPP fraud, other felonies

The post State of Freight: taking stock of the market after a month of Trump appeared first on FreightWaves.