XPO returned another solid quarter as it readies its network to take advantage of both the next market upturn and longer-term growth opportunities.

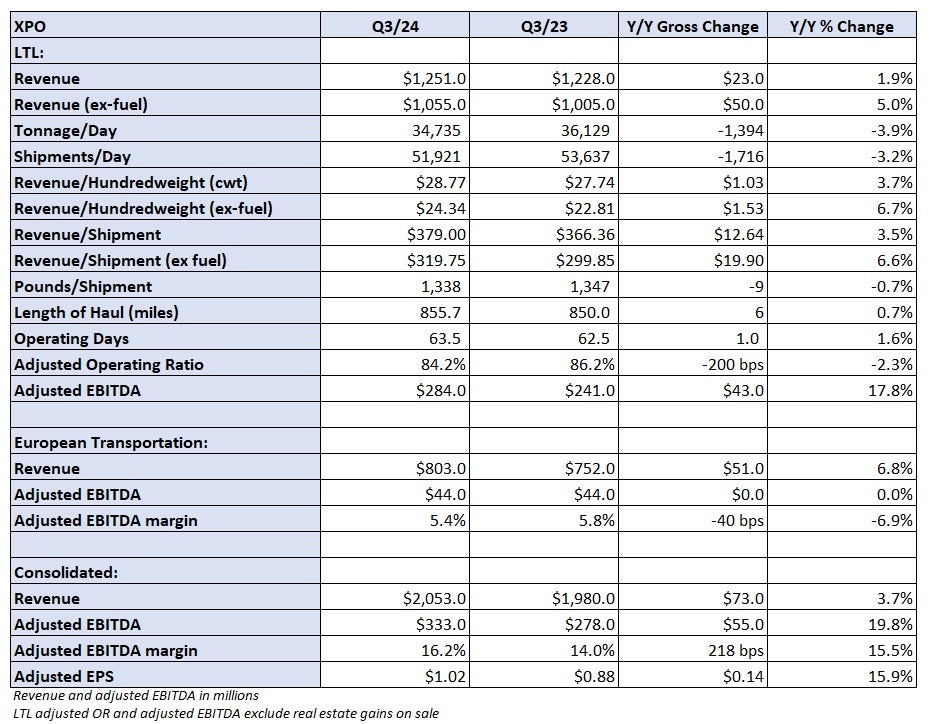

The less-than-truckload carrier reported third-quarter adjusted earnings per share of $1.02, 11 cents better than the consensus estimate and 14 cents higher year over year. Consolidated revenue increased 3.7% to $2.05 billion. It outpaced peers by logging 200 basis points of margin improvement in its LTL segment.

Shares of XPO (NYSE: XPO) were up 13.3% at 12:46 p.m. EDT on Wednesday compared to the S&P 500, which was up 0.2%.

XPO has opened 21 of the 28 terminals it acquired from bankrupt Yellow Corp. (OTC: YELLQ). Eight of the terminals represent new markets for the carrier while the other 13 are relocations into larger or better-suited spaces. The remaining seven service centers will be open by early 2025.

The additions will boost door count 10% to 15%, giving the carrier as much as 30% latent capacity across its network, which it says is key to improving its service offering and winning market share.

Efficiency in its city operations has improved by a low- to mid-single-digit percentage in these markets. The company has seen a similar efficiency improvement in its linehaul network. The new sites are operating at or above management’s initial expectations.

XPO also added more than 4,000 tractors and nearly 15,000 trailers to its fleet over the past three years.

The update was shared on a quarterly call with analysts on Wednesday.

LTL margins improve as industry backs up

The company’s LTL segment generated revenue of $1.25 billion, a 1.9% y/y increase. Tonnage per day declined 3.9% y/y, but revenue per hundredweight, or yield, increased 3.7% (6.7% higher excluding fuel surcharges). The yield calculation was only partially aided by a 0.7% decline in weight per shipment.

Tonnage declines accelerated throughout the quarter. Tonnage per day was down 0.8% y/y in July, 4.7% in August and 6.1% in September. The year-ago period included the closure of Yellow, which redistributed roughly an 8% market share to competitors.

Tonnage is expected to be off 8% y/y in October as demand trends have experienced normal seasonality during the month. The industry benefited from a cyberattack at Estes in the early part of October 2023, which contributed about 1,000 shipments per day to XPO’s network. Management said October tonnage is down approximately 6% y/y after excluding that event.

XPO’s tonnage is forecast to decline y/y by a mid-single-digit percentage during the fourth quarter. Management noted softer demand on the call, saying shipments from industrial customers declined at twice the rate of retail customers in the third quarter. It said customers with exposure to electrical equipment manufacturing and machinery are more bullish than construction- and agriculture-oriented shippers.

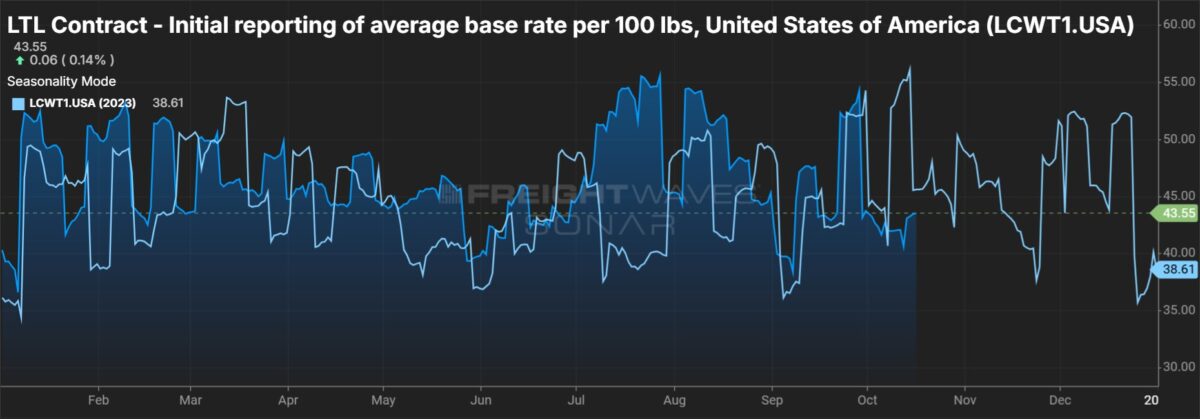

The company reiterated several rate opportunities on the call, which give it confidence that it will be able to price freight approximately 100 to 200 bps above the market next year and beyond.

It said it’s continuing to make investments that will allow it to close a service (and pricing) gap to best-in-class operators. It highlighted that it halved its claims ratio to 0.2% in the third quarter, and has improved on-time performance in 10 straight quarters.

XPO reported a more than 10% y/y increase in shipments from local accounts, which have higher yields and margins. It has grown the sales force in this channel roughly 20%, allowing it to add more than 8,000 local customers this year.

It is also increasing its percentage of revenue tied to premium services, which garner accessorial charges. A little more than 10% of its LTL revenue comes from premium services, and the plan is to move that 1 percentage point higher each year to a goal of 15%.

Average contractual price renewals were up y/y by a high-single-digit percentage for a fifth consecutive quarter.

The LTL unit reported an 84.2% adjusted operating ratio (inverse of operating margin), which was 200 bps better y/y and outpaced declines reported by peers.

The adjusted OR was 100 bps worse than in the second quarter, which was in line with the company’s previous guidance of 100 to 150 bps of deterioration (versus the historical trend of 200 to 250 bps of sequential degradation).

Purchased transportation expense saw the biggest move in the period, down 330 bps y/y as a percentage of revenue. XPO lowered its outsourced miles by 800 bps y/y to 13.6% in the quarter. The goal is to lower the percentage to single digits over time.

The company normally sees 250 bps of OR deterioration from the third to the fourth quarter. It expects to outperform that change rate this year. It also expects to be at the high end, or to outperform, a full-year 2024 OR guidance range that calls for 150 to 250 bps of improvement.

XPO’s European transportation segment reported a 6.8% y/y revenue increase to $803 million. It recorded an adjusted earnings before interest, taxes, depreciation and amortization margin of 5.4%, which was 40 bps worse y/y.

XPO lowered its net debt leverage ratio to 2.5 times adjusted EBITDA in the quarter, down from 3 times at the end of 2023.

It has several levers to further lower leverage and allow it to achieve investment-grade status. Cash flow generation will improve as its margins improve, annual capex will move lower as it concludes the terminal expansion project, and it will likely sell its European business.

More FreightWaves articles by Todd Maiden

- Losses at Heartland Express continue to mount

- Landstar says ‘muted peak season’ weighs on Q4 guidance

- LTL carrier Moran Transportation acquires RMX Freight Systems

The post XPO’s shares surge on strong Q3, favorable outlook appeared first on FreightWaves.