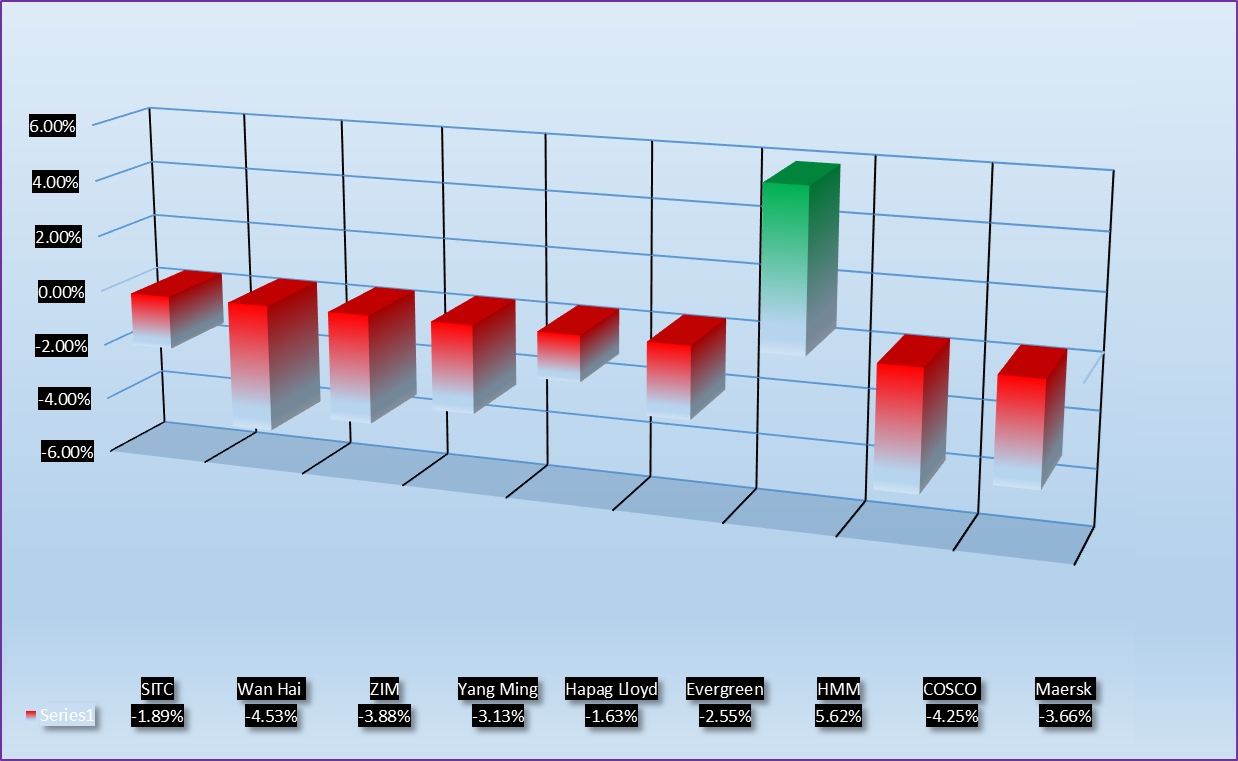

The container shipping sector experienced a dynamic week marked by fluctuations in stock prices, reflecting broader economic trends, trade dynamics, and geopolitical developments.

Amid concerns about global trade demand and cost pressures, the sector showed mixed performances, with certain players defying the general downtrend. Below is an analysis of key players in the container shipping industry over the past week.

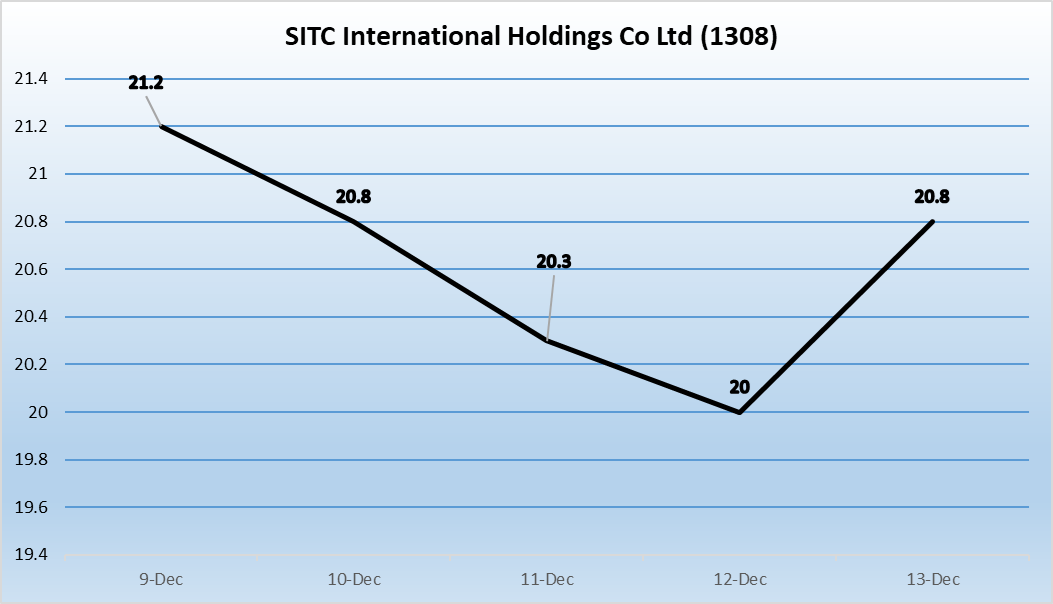

- SITC International Holdings Co. Ltd (1308)

HK$

HK$

SITC’s stock displayed a consistent downward trend this week, opening at HK$21.2 and closing at HK$20.8, marking a 1.89% decrease. The company’s movement could be attributed to concerns over softer demand in intra-Asia trade lanes, a significant market for SITC. Despite the dip, SITC remains well-positioned given its focus on cost efficiency and diversified services, which could buffer against long-term volatility in regional trade.

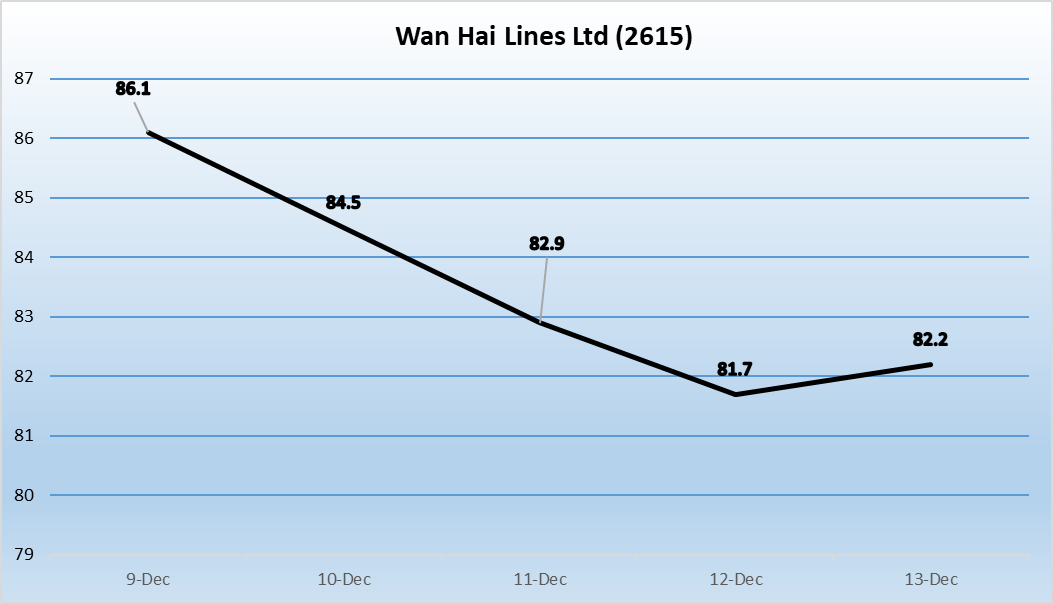

- Wan Hai Lines Ltd (2615)

NT$

NT$

Wan Hai’s shares dropped from NT$86.1 at the start of the week to NT$82.2 by Friday, translating to a 4.53% decline. The company has been navigating challenges posed by slowing demand for transpacific routes and higher operational costs. While Wan Hai’s financial fundamentals remain solid, recent geopolitical tensions in East Asia and fluctuating freight rates could weigh on its short-term outlook.

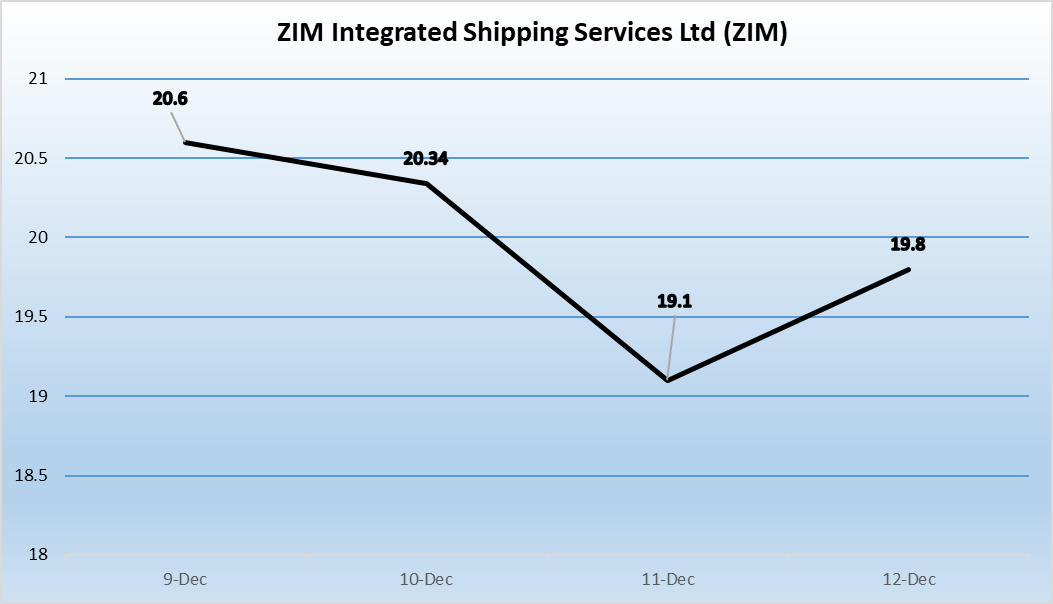

- ZIM Integrated Shipping Services Ltd (ZIM)

US$

US$

ZIM’s stock began the week at $20.6 but slid to $19.8, a 3.88% decline. This drop reflects broader pressures on carriers serving long-haul trade lanes, particularly as spot rates from Asia to the U.S. continue to normalize after pandemic-driven highs. ZIM’s asset-light model offers flexibility, but the recent dip suggests investor caution about the carrier’s ability to sustain its profitability in a more competitive rate environment.

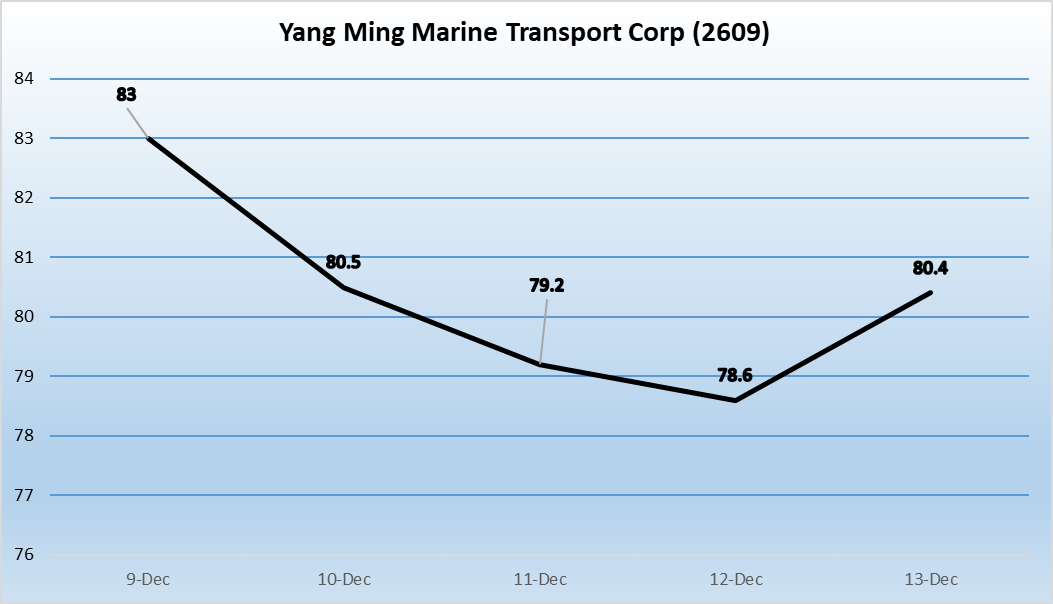

- Yang Ming Marine Transport Corp (2609)

NT$

NT$

Yang Ming’s stock fell 3.13% this week, from NT$83 to NT$80.4. The decline coincides with subdued demand for containerized cargo amidst concerns of a global economic slowdown. Nevertheless, Yang Ming’s focus on digital transformation and operational efficiency may provide resilience against market headwinds in the longer term.

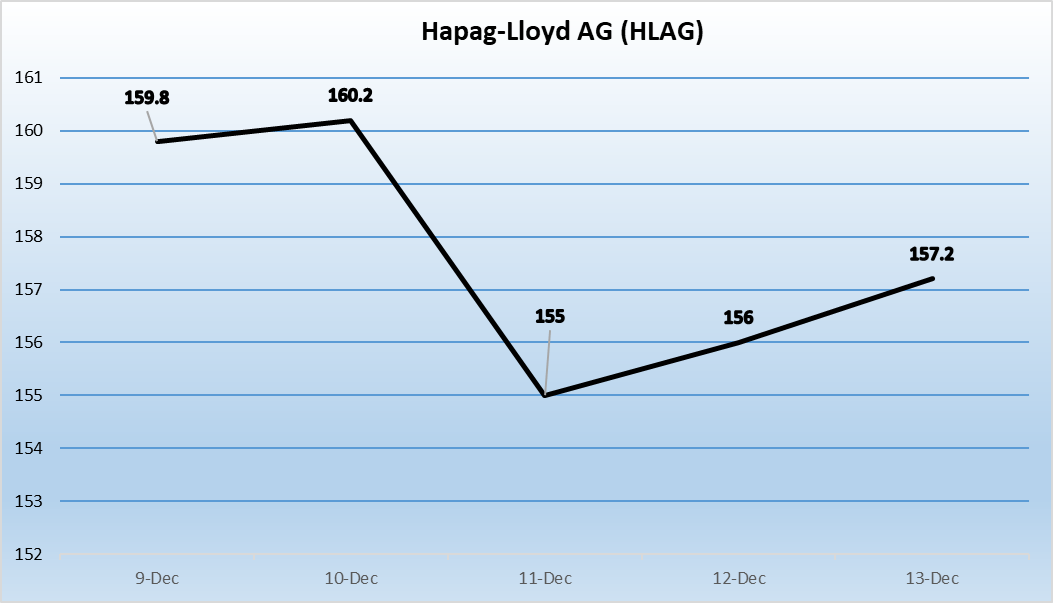

- Hapag-Lloyd AG (HLAG)

EUR (€)

EUR (€)

Hapag-Lloyd showed relative stability, with its stock dipping 1.63%, from €159.8 to €157.2. The company has been leveraging its robust position in European trade lanes while benefiting from strategic investments in fleet modernization. However, the decline reflects concerns about softer demand and the rising costs of decarbonization compliance.

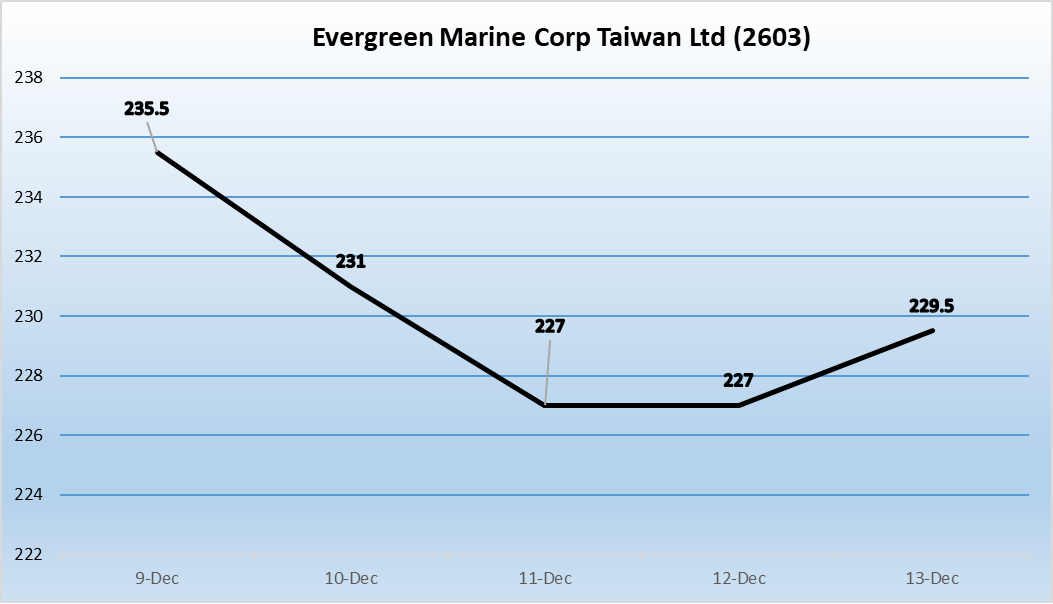

- Evergreen Marine Corp Taiwan Ltd (2603)

ΝΤ$

ΝΤ$

Evergreen’s shares experienced a 2.55% decline, closing the week at NT$229.5. The stock’s movement aligns with ongoing adjustments in global freight rates and persistent inflationary pressures. Evergreen’s strong focus on sustainability and fleet expansion could bolster its long-term growth, even as short-term challenges persist.

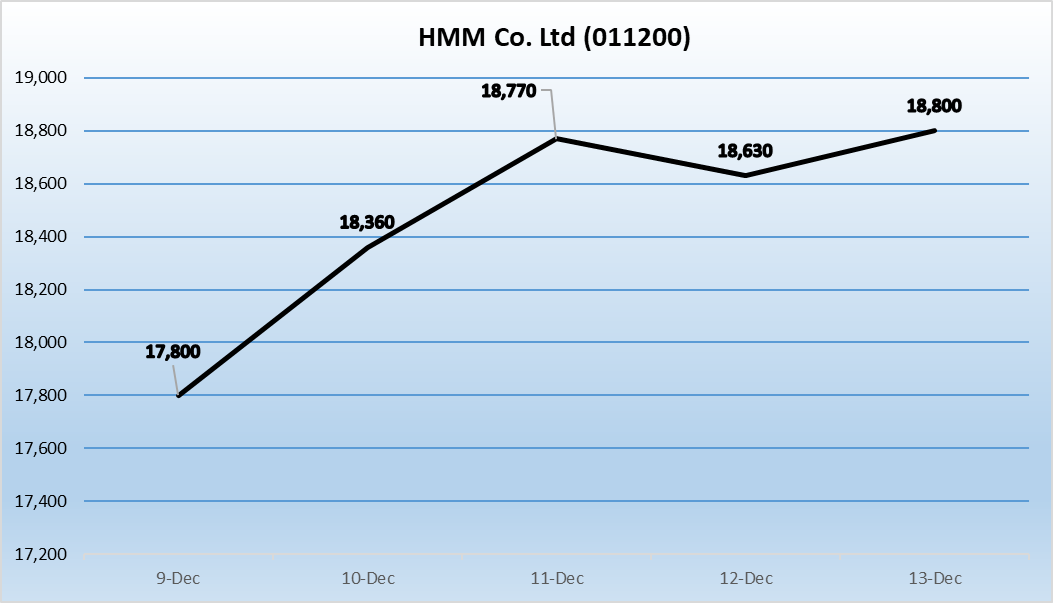

- HMM Co. Ltd (011200)

KRW

KRW

HMM emerged as the sole gainer this week, with its stock rising 5.62% from KRW 17,800 to KRW 18,800. The surge highlights market confidence in HMM’s recent profitability milestones and strategic expansions. Bolstered by favorable freight contracts and strong transpacific performance, HMM’s outlook remains promising amid a challenging industry backdrop.

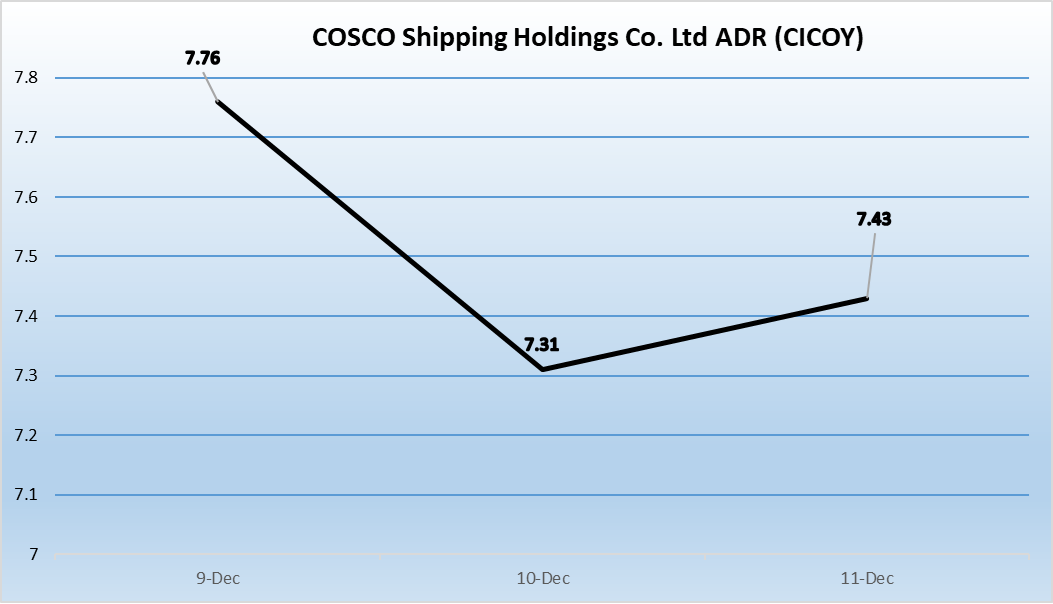

- COSCO Shipping Holdings Co. Ltd ADR (CICOY)

US$

US$

COSCO’s stock declined by 4.25% this week, ending at US$7.43. The drop reflects investor concerns about the Chinese economy’s uneven recovery and its impact on export-driven demand. However, COSCO’s extensive global network and state-backed support position it well for long-term competitiveness.

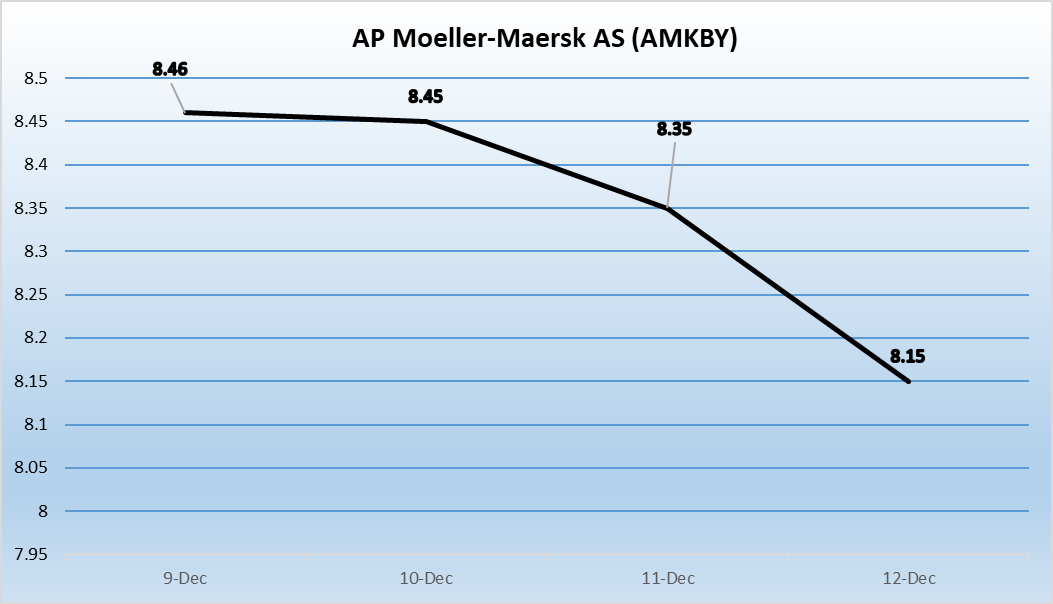

- AP Moeller-Maersk AS (AMKBY)

US$

US$

Maersk’s stock fell 3.66%, closing at US$8.15 after starting the week at US$8.46. The decline underscores the pressures of falling freight rates and shifting global trade patterns. Despite short-term challenges, Maersk’s focus on integrating logistics solutions and its commitment to sustainability initiatives provide a solid foundation for future growth.

The container shipping sector exhibited mixed performance this week, with most stocks trending downward amidst macroeconomic challenges and geopolitical uncertainties. HMM’s impressive gain stands out, showcasing the potential for individual carriers to outperform through strategic positioning.

As the industry navigates a complex environment, factors like fleet modernization, digitalization, and sustainability will remain critical in shaping the fortunes of container shipping companies.