U.S. Bank and DAT Freight & Analytics announced Tuesday a collaboration to launch a new quarterly research report on U.S. truck freight rates. The new report complements the existing U.S. Bank Freight Payment Index, which the bank has published quarterly since 2017.

While the Freight Payment Index focuses on shipment volumes and spending data derived from $43 billion in annual freight payments, the Rates Edition focuses on contract rates, spot rates and fuel surcharges using DAT data and analytics.

The inaugural Q1 2026 edition examined the final months of 2025, revealing subtle but meaningful shifts.

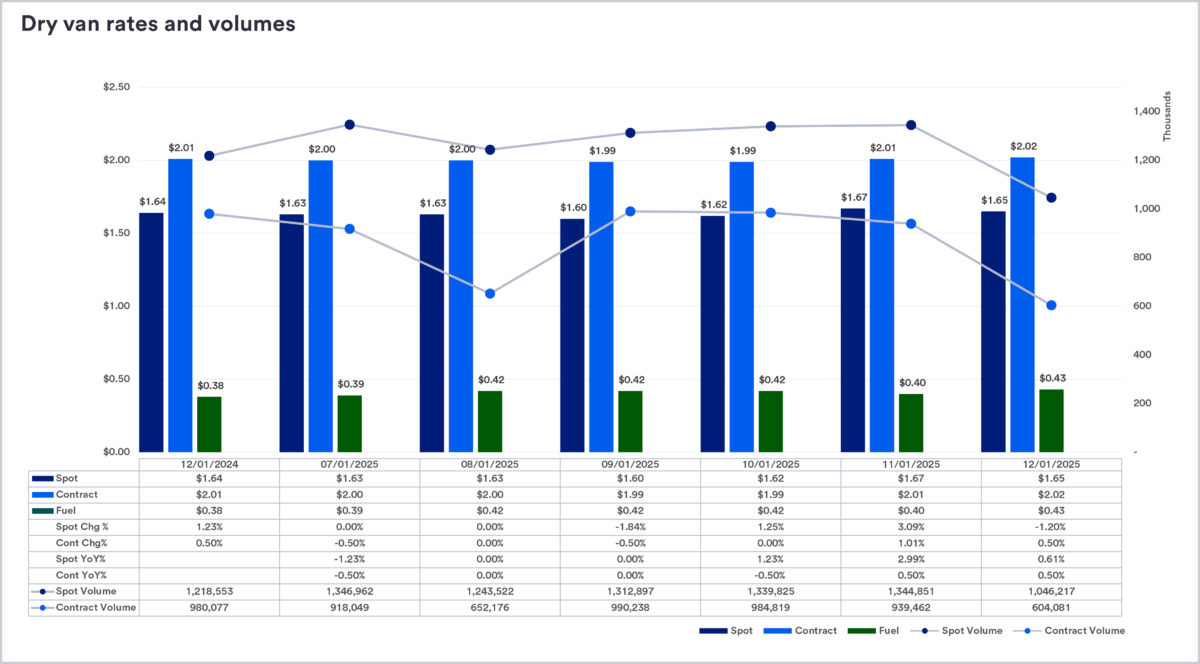

Spot market rates ended September at $1.62 per mile, rose 3% to $1.67 per mile by the end of October, then dropped 1.1% to $1.65 per mile by the end of November.

Contract rates held steady at $1.99 per mile in September and October before rising 1% to $2.01 per mile in early November. By Dec. 1, they had risen less than 0.5 percentage point to $2.02 per mile.

The report noted that fuel surcharges remained a major variable. They held steady at $0.42 per mile from late August through October. By early November, they declined to $0.40 per mile before increasing to $0.43 per mile by Dec. 1. The 7.5% increase from November into early December was due in part to refinery outages in the Gulf Coast and Midwest.

“The November spike stood out, especially since national diesel prices dropped that month. It’s a reminder that fuel surcharges don’t always track pump prices in real time, so it pays to keep a close eye on how those fees are calculated and updated,” the report said.

Compared with the previous year, both spot and contract rates were less than 1% higher. The report described the modest gain as reflecting “typical seasonal patterns rather than structural change, as holiday-driven demand often tempers year-over-year comparisons.” Steadier contract rates, it added, continued to provide shippers and carriers a reliable baseline.

Regional breakdowns revealed notable differences. The Northeast saw stronger outbound freight volumes, driven by manufacturing and retail activity. The Southeast, on the other hand, lagged due to weaker job markets and softer consumer spending.

Market Shifts, New Opportunities and Fewer Carriers Could Shape 2026

Behind these rate movements were structural changes, including a narrowing gap between contract and spot rates. The report said this created a brief window for shippers to renegotiate lanes or run mini-bids and take advantage of the convergence.

The spot-to-contract gap widened in November despite declines in load volumes for both.

“For shippers, this was the time to test routing guides and see if primary carriers could handle more loads without risking service failures. Carriers benefited by securing commitments for the new year, when freight typically ramps up,” the report said.

The report also highlighted a critical but less visible trend: ongoing reduction in carrier capacity.

According to Transportation Insight: “More carriers are exiting the market than entering, driven by new regulations and rising operating costs. This shrinking pool of available trucks has not yet caused a dramatic spike in rates, but it sets the stage for rapid increases if freight demand rebounds.”

Avery Vise, FTR’s vice president of trucking, noted in the November Trucking Conditions Index: “The latest available data indicates a substantial reduction of trucking capacity over the past year — a conclusion supported by stronger spot market rates than trend over the past month or so. It’s quite possible that capacity has bottomed out, so the attention now is squarely on freight demand, which still looks sluggish with both upside and downside potential. Trucking companies cannot get to sustained margin recovery on capacity reductions alone.”

For shippers heavily reliant on the spot market, the report cautioned that as carrier supply shrinks, the risk of unexpected rate hikes will grow if market conditions shift.

Trade and tariffs also played a major role in shaping the 2025 freight market. Tariffs of 25% on certain imports from Mexico, including trucks, contributed to higher equipment costs. When those tariffs were announced in early 2025, shippers front-loaded freight, causing a temporary spike in demand and rates, followed by a lull as they worked off excess inventory.

Overall, the report’s authors concluded that the first 11 months of 2025 were neither booming nor busting.

“In this environment, it’s smart for shippers to diversify carrier relationships and keep a close watch on regulatory and international developments.”

The post U.S. Bank, DAT launch quarterly truck freight rates report appeared first on FreightWaves.