Marten Transport’s Truckload segment, which provided a little less than 48% of its earnings in the third quarter, had a negative operating ratio (OR) during the period for the third time in the last five quarters, though the company overall remained profitable.

In an earnings release delayed about a week after its normal date–Marten (NASDAQ: MRTN) usually comes out with its earnings right after the leader of the trucking pack, J.B. Hunt–the company also reported that the OR net of fuel in its Truckload group was the worst of the last five quarters, going back to the corresponding quarter of 2024.

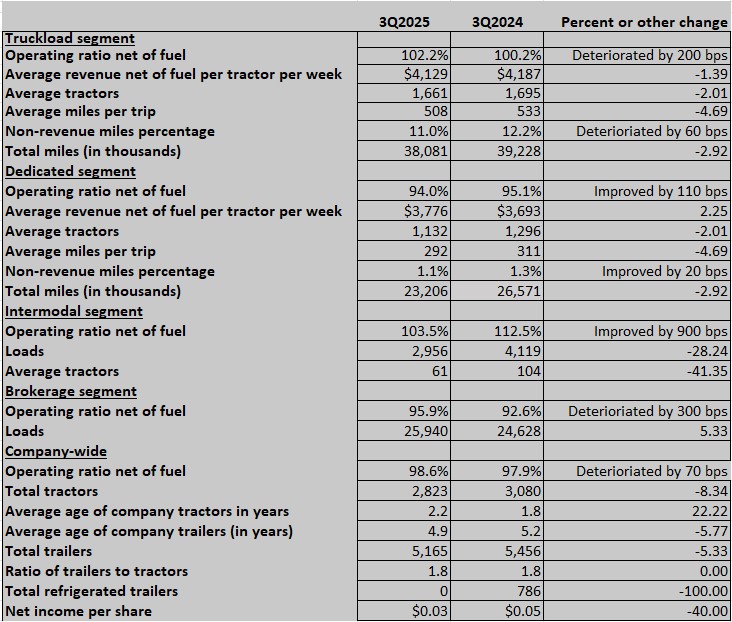

Sequentially, starting with the third quarter of 2024, the OR in the Truckload segment at Marten has been 100.2%, 98%, 100.3%, 97.5% and 102.2% in the just completed quarter.

The weaker performance of the Truckload segment could be seen in a compilation of data points. Its average revenue net of fuel per tractor per week dropped about 1.4% to $4,129. Average tractors were down about 2% to 1,661. Average miles per trip dropped about 470 to 508. And total miles declined a little more than 3% to 38,081.

But Marten recorded improvements in its Dedicated segment which helped lead to the overall profitability. Dedicated recorded an OR of 94%, compared to 95.1% a year earlier. Sequentially, the Dedicated OR net of fuel was 91.1% in the second quarter.

The improvement in the Dedicated OR on an operating basis came in part from the average revenue net of fuel per tractor per week rising to $3,776 from $3,693. The improved OR in Dedicated came despite total miles dropping 2.9% to 23.2 million.

Intermodal sale to Hub Group done

Marten’s sale of its intermodal division to Hub Group (NASDAQ: HUBG) closed September 30. The beleaguered segment had an OR of 103.5% in the quarter. But that was actually a significant improvement from a year ago, when it came in at a whopping 112.5%.

The sale to Hub Group included more than 1,200 refrigerated containers. That was reflected in the earnings as the line of “total refrigerated trailers” dropping to zero.

The third quarter was the final quarter Marten will report an intermodal segment. The quarter’s revenue of $9.85 million was about 4% of total revenue.

The brokerage division weakened to an OR of 95.9% from 92.6%, with an 8.3% decrease in the number of loads it handled to 2,823. Revenue was down 1.6% to $38.78 million.

Net income at Marten declined 40.7% to $2.226 million. For the nine months, net income is down 13.4% to $13.74 million. Marten’s overall OR net of fuel for the quarter was 98.6%, compared to 97.9% a year ago.

Marten’s ability to stay profitable also was helped by its cost containment. Total expenses declined to $217.7 million from $233 million in the corresponding quarter of 2024. Salaries and wages dropped to $79 million from $83.44 million.

Lot more cash to spend

One area where Marten has strengthened its finances is on the balance sheet. At the end of the third quarter, the company showed cash and cash equivalents of $49.49 million. At the end of last year, that figure was $17.27 million. That is not all from the Intermodal sale, as significant increases also were reported at the end of the first and second quarters, before the sale to Hub Group was completed.

Chairman and CEO Randolph Marten, in a prepared statement released with the earnings (the company does not conduct a call with analysts) referred indirectly to that growing cash pile. “Our strong, debt-free balance sheet enhances our ability to continue investing in our technology and modern fleet and position our operations to capitalize on future profitable organic growth opportunities,” he said.

And in a theme heard frequently in trucking circles, Randolph Marten said current efforts in Washington are likely to bolster Marten’s fortunes. “We expect the current administration’s recent immigration enforcement efforts including stricter standards for non-domiciled commercial driver’s licenses and increased enforcement of English Language Proficiency and B-1 visa regulations to positively impact such opportunities,” Marten said.

CEO Kohl departs

The third quarter at Marten also featured the departure of Tim Kohl as CEO and the return of Randolph Marten as CEO. Randolph Marten had been executive chairman–a position he continues to hold–and CEO between 2005 and 2021.

In a filing with the SEC made after Kohl’s departure (effective September 30), described by the company as a retirement, the company spelled out some of the details of Kohl’s separation agreement.

The outgoing CEO received a severance payment of $620,000. Kohl also is obligated to provide “cooperation” to the company for six months on a variety of issues, and essentially forever–“at any time”–regarding litigation that might arise.

There is also a “non-disparagement” clause and Kohl is barred for a year from trying to “solicit” any Marten employees or customers for a year after his September 30 departure date.

In Marten’s proxy filed with the SEC earlier this year, Kohl was listed as having 264,225 shares of Marten stock. (By contrast, Randolph Marten owns about 17.7 million shares, 21.7% of the total.)

Kohl’s 2024 salary in the company’s 2025 proxy was listed as $762,554. The company’s officers took a pay cut toward the end of the year owing to the freight market.

Kohl also received stock awards of $327,840 and other compensation of $8,509 for total compensation of just under $1.1 million.

Marten’s stock closed Thursday at $10.69. It is down about 32% in the last year, 17.7% in the last 3 months and 42.6% from a 52-week high set November 11.

More articles by John Kingston

China expert Miller: why supply chain ‘choke points’ matter most

Trailer manufacturer Wabash’s nuclear verdict lawsuit settled

Factoring companies squeezed by slowing shipper payments: Alsobrooks

The post Truckload segment at Marten again a plus 100% OR in third quarter appeared first on FreightWaves.