M

M

any tanker owners have kept their ships out of the second hand market, despite enticing prices, looking to take advantage of the favorable freight market conditions during the first half of the year. In its latest weekly report, shipbroker Intermodal said that “the first half of 2024 has been a dynamic period for the tanker market, characterised by a number of significant events and evolving trends that have collectively influenced freight rates, fleet developments and commodity flows”.

Source: Intermodal’s Research Analyst

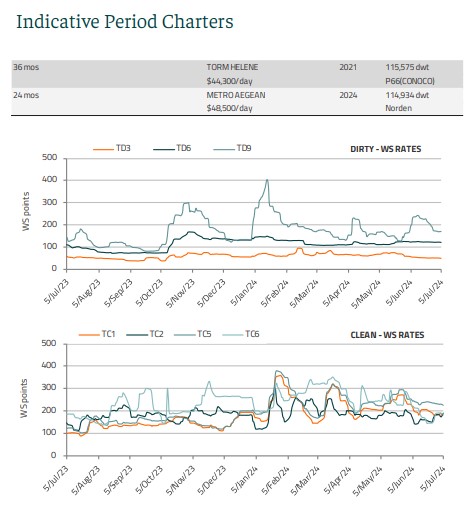

According to Intermodal’s Research Analyst, Mr. Fotis Kanatas, “in terms of freight rates, the dirty market has shown a mixed performance over the two quarters, in the first half of 2024 both Suezmax TCE and Aframax TCE are down by 11%, while VLCCs are marginally up by 3%. On a quarterly basis, the story is different between VLCCs and their smaller counterparts. VLCCs gained 40% in Q1, while Suezmax and Aframax were down 20% and 21% respectively. In Q2, VLCCs lost 27%, while Suezmax and Aframax each gained 15%. Despite the fact that the market is looking for direction amidst the seasonal drop in earnings, VLCC rates are higher so far in 2024 compared to the previous two years, with the TCE currently at $29k/day and Q1 and Q2 averaging $45k/day and $41k/day respectively. As far as Suezmax and Aframax tankers are concerned, Q1 and Q2 of this year are not stronger than those of 2023, but they seem to be following the seasonal patterns. At the time of writing, Suezmax is at $41k/day, while it averaged $47k/day in Q1 and $44k/day in Q2. Aframax is at $38k/day, averaging $50k/day in Q1 and $46k/day in Q2”.

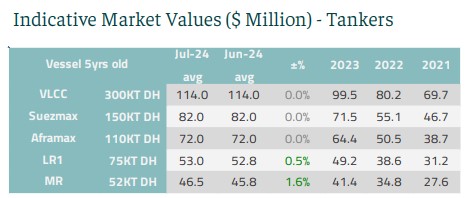

Mr. Kanatas added that “the increased rates have kept owners out of the sale and purchase market as we have seen sales volumes well below the previous two years as owners prefer to hold their vessels in this high yield environment. In fact, around a third of the SNP transactions that were completed in 2022 and 2023 have already been completed in 2024. More specifically, only 24 VLCCs changed hands in the first half of 2024, compared to 77 in both 2023 and 2022. Similarly, 11 Suezmaxes have been sold so far, compared to 38 and 55 in 2023 and 2022 respectively, while 31 Aframaxes have been sold (99 in 2023, 133 in 2022)”.

“As a result, asset values are at their highest levels since the surge in 2008, while newbuilding values are close to those of a 5-year-old vessel, encouraging owners to turn to the newbuilding market. For example, a 5-year-old VLCC costs around $115m, up more than 15% year-to-date, while a newly ordered vessel costs around $10-15m more. Margins are even tighter for smaller sizes. This is leading to increased newbuilding activity, with VLCC orders so far in 2024 exceeding orders in 2023 and 2022 combined. In H1-2024, 43 VLCCs were ordered, compared to 18 in 2023 and just 3 in 2022. As of now the orderbook-to-fleet ratio for VLCCs stands at 7%, 14% for Suezmaxes and 15% for Aframax/LR2 vessels, numbers that have been steadily increasing, hindering market strength once the expected tonnage hits the water”, Intermodal’s analyst said.

Source: Intermodal’s Research Analyst

He concluded that “the first half of 2024 has thus set a complex stage for the tanker market, marked by fluctuating freight rates, high asset values, and a surge in newbuilding orders. These trends, driven by geopolitical tensions, evolving trade patterns, and regulatory changes, indicate a market in transition. As we move into the second half of the year, stakeholders will need to navigate these dynamics carefully, balancing between immediate gains from high rates and strategic investments in newbuildings. The ability to adapt to these evolving conditions will be crucial in maintaining market stability and capitalizing on emerging opportunities”.

Nikos Roussanoglou, Hellenic Shipping News Worldwide