T

T

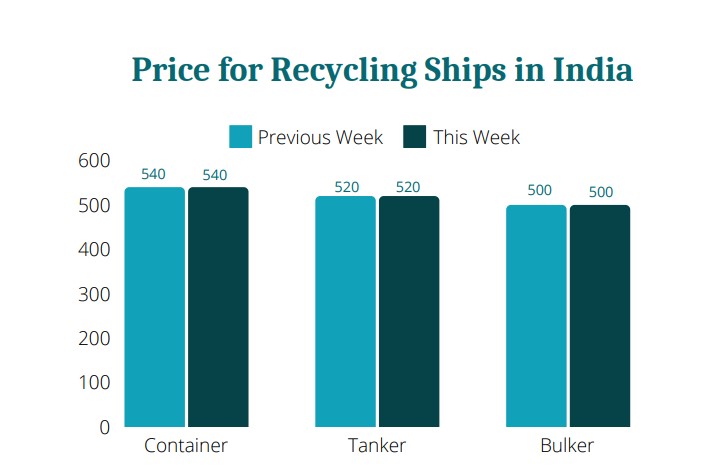

he ship recycling market has remained in stagnant mode throughout the course of the past week. In its latest weekly report, Best Oasis (www.best-oasis.com), a leading cash buyer of ships said that “this week was marked by stagnation and challenges across the four ship recycling destinations. In India, the market showed no signs of improvement due to a persistent shortage of tonnages, worsened by the ongoing monsoon season expected to last until late August or early September. Bangladesh faced similar difficulties, with declining demand exacerbated by the seasonal impact. Pakistan’s market remained on a downward trend with minimal activity despite recent tax adjustments”.

Source: Best Oasis

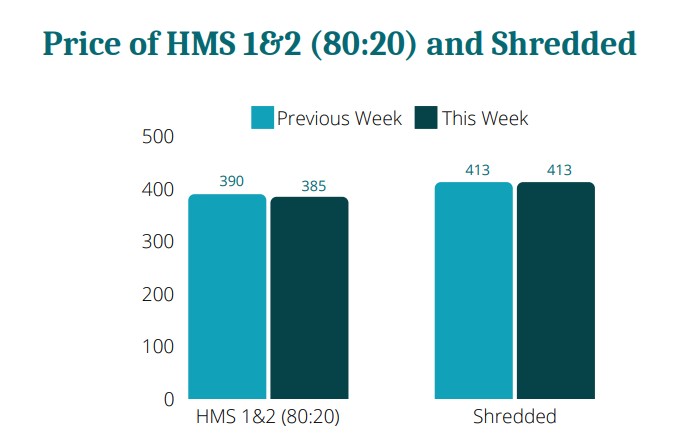

Meanwhile, “Turkiye saw subdued import demand and a shortage of vessels available for recycling, reflecting a quiet period in the industry. The global steel rebar market saw a slight 0.4% price drop by June end, reflecting ongoing supply and demand imbalances. Germany faced significant declines in steel sales and production due to slowdowns in construction and manufacturing, while China’s market struggled with high inventory levels, weak construction demand, and a significant 4% decline in home prices in May. Despite a robust manufacturing sector, Chinese mills were forced to offload excess inventory at reduced prices. Despite these challenges, potential price increases of steel rebars are expected in the US, Germany, and China, driven by robust demand, low inventories, and rising freight charges.

Overall, while current challenges persist, anticipated demand and geopolitical factors suggest potential price recoveries, urging industry stakeholders to stay vigilant and adaptable. Global oil demand is expected to peak in 2025, with both BP and OPEC forecasting positive growth. BP anticipates stable consumption until the end of the decade before a gradual decline. OPEC predicts robust demand through 2024 and 2025, driven by economic growth and increased air travel. Meanwhile, the IEA projects slower growth, with an increase of just under a million barrels per day (bpd) this year and next, mainly due to temporary economic issues in China. Overall, BP and OPEC’s positive forecasts indicate a healthy, near-term energy market. It will be interesting to see how these projections unfold”, Best Oasis said.

Source: Best Oasis

More specifically, in India, “the market remains unchanged, continuing to exhibit softness and lack of positive development, with no significant improvements observed in recent weeks. Additionally, the market is experiencing a lack of tonnages, further contributing to the sluggish performance. The current monsoon season, with heavy rains impacting various sectors, is contributing to the industry’s slowdown, a trend expected to persist over the next 1-2 months until late August or early September. Cheap Chinese steel imports have disrupted India’s ship recycling market, causing a 25 USD-per-tonne drop in rerolled steel prices, alongside the increased availability of competitively priced steel from other global sources, as highlighted in our reports previously”, Best Oasis concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide