US-China tensions and environmental regulations create opening for city-state’s specialized yards.

ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”1,2,3,5,6,7″ ihc_mb_template=”3″]

Singapore’s shipbuilding industry is positioning itself to capitalize on geopolitical tensions, environmental regulations, and supply chain diversification that is reshaping the global maritime construction landscape.

As US-China trade tensions intensify and shipowners seek alternatives to Chinese yards that control nearly 50% of global production, Singapore’s specialized shipbuilding capabilities are attracting renewed attention from international maritime companies seeking reliable, technologically advanced partners.

The city-state’s shipbuilding sector, valued at US$4.9 billion with projected growth despite broader industry headwinds, has built a reputation for high-value vessels including LNG carriers, offshore platforms, and complex marine engineering projects.

This specialization is proving advantageous as the industry undergoes fundamental restructuring.

Singapore cannot compete with Chinese yards on volume production of standard container ships, explains a senior maritime industry analyst.

But in specialized, high-technology vessels requiring sophisticated engineering, Singapore offers compelling advantages that geopolitical shifts are making more valuable.

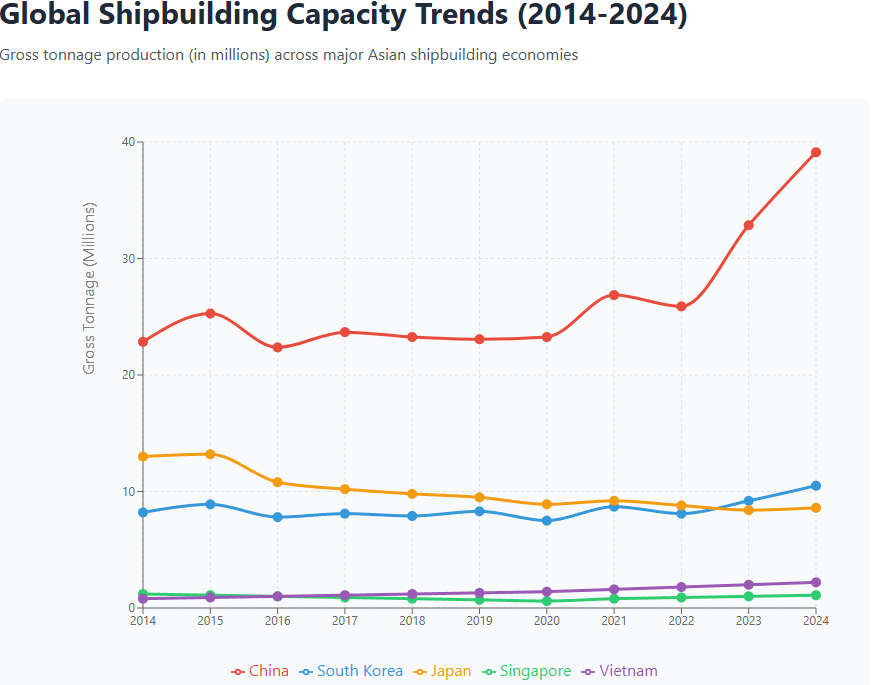

Traditional shipbuilding powerhouses Japan and South Korea are experiencing declining market share, with projections showing Korea’s share falling from 34% in 2010 to around 22% by 2030, while Japan’s drops from 21% to just 9-10%.

This decline creates opportunities for alternative suppliers like Singapore to capture market share in specialized segments.

The formation of Seatrium Limited in 2023, merging Sembcorp Marine and Keppel Offshore & Marine, consolidated Singapore’s shipbuilding capabilities and created one of the world’s largest offshore marine engineering companies. This consolidation positions Singapore to better compete for complex projects requiring advanced technical expertise.

Environmental regulations are providing another boost to Singapore’s prospects. The International Maritime Organization’s increasingly stringent emissions standards and upcoming decarbonization requirements favor shipyards with advanced green technology capabilities.

Singapore’s early adoption of environmental standards and expertise in LNG propulsion systems and alternative fuel technologies positions it favorably for this transition.

Recent investments illustrate the trend. Ningbo Ocean Shipping announced plans to invest US$406.5 million through its Singapore arm to establish two new subsidiaries for constructing container vessels, demonstrating international confidence in Singapore’s shipbuilding capabilities.

However, challenges remain significant as the global shipbuilding market faces overcapacity concerns, and Singapore’s high labor costs limit its ability to compete in price-sensitive segments.

Emerging markets including Vietnam, India, and the Philippines are rapidly expanding their shipbuilding capacity, primarily targeting cost-competitive standardized vessels.

Singapore’s path to prominence lies not in competing with low-cost producers but in leveraging its technological advantages and strategic location. The city-state’s world-class port infrastructure, including the developing Tuas Mega Port, combined with its skilled workforce and business-friendly regulatory environment, creates a compelling proposition for specialized maritime projects.

The geopolitical dimension adds urgency to Singapore’s positioning as Western governments increasingly scrutinize technology transfers to Chinese shipyards and seek supply chain diversification, Singapore’s neutral status and alignment with international standards become strategic assets.

Singapore needs to act decisively in the next three to five years to capture this geopolitical momentum while the traditional market structure is shifting.

The success of Singapore’s shipbuilding ambitions will ultimately depend on maintaining focus on high-value specialization rather than attempting to match the scale of mass production centers.

As the global maritime industry navigates choppy geopolitical waters, Singapore’s steady course toward technological leadership and specialized expertise may prove to be exactly what shipowners are seeking.

/ihc-hide-content]

The post Singapore could grab the shipbuilding opportunity appeared first on Container News.