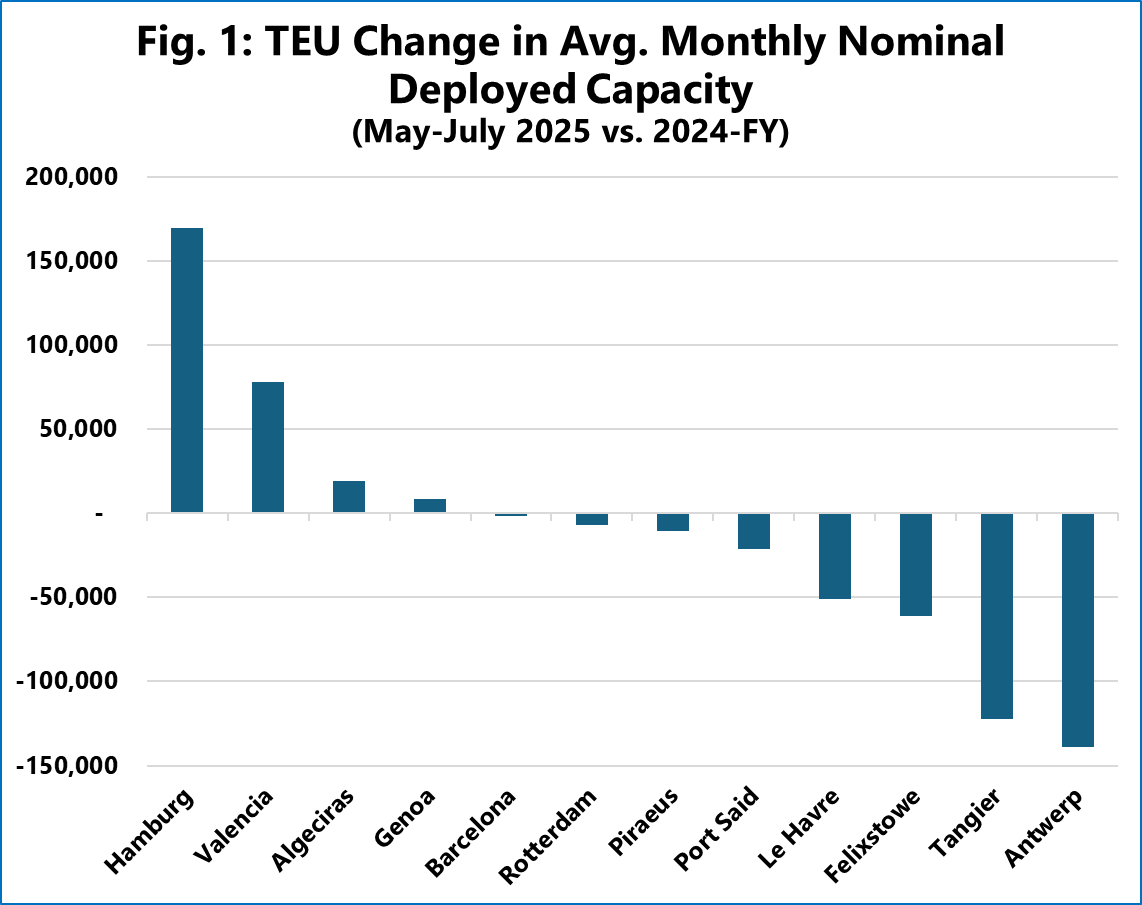

To measure this shift, Sea-Intelligence analysed the total deployed TEU capacity directed to each major European port, comparing the post-reshuffle period of May-July 2025 against the 2024-FY baseline. This metric provided the clearest picture of the strategic realignment underway.

It is important to note, however, that these TEU figures refer to the vessel’s nominal capacity – its theoretical maximum – which serves as a proxy for market size and deployed assets. This represents the maximum cargo opportunity directed to each gateway and is not a representation of the actual cargo volumes exchanged per call.

Sea-Intelligence revealed that the undisputed primary winner is Hamburg, which gained an enormous +169,000 TEU in average monthly nominal vessel capacity. This, along with the increase in port call frequency and vessel size has translated into a huge boost in its overall market power. Valencia was the other clear winner, adding over +78,000 TEU per month in nominal vessel capacity and cementing its status as a rising power in the Mediterranean.

Conversely, the data reveals a significant strategic pivot away from several major hubs. Antwerp (-138,000 TEU) and the transshipment hub of Tangier (-122,000 TEU) both lost a significant volume of average monthly nominal capacity.

Rotterdam, on the other hand, remains in a league of its own, cementing its unshakable position as Europe’s dominant gateway port.

The post Sea-Intelligence: Europe’s new port order appeared first on Container News.