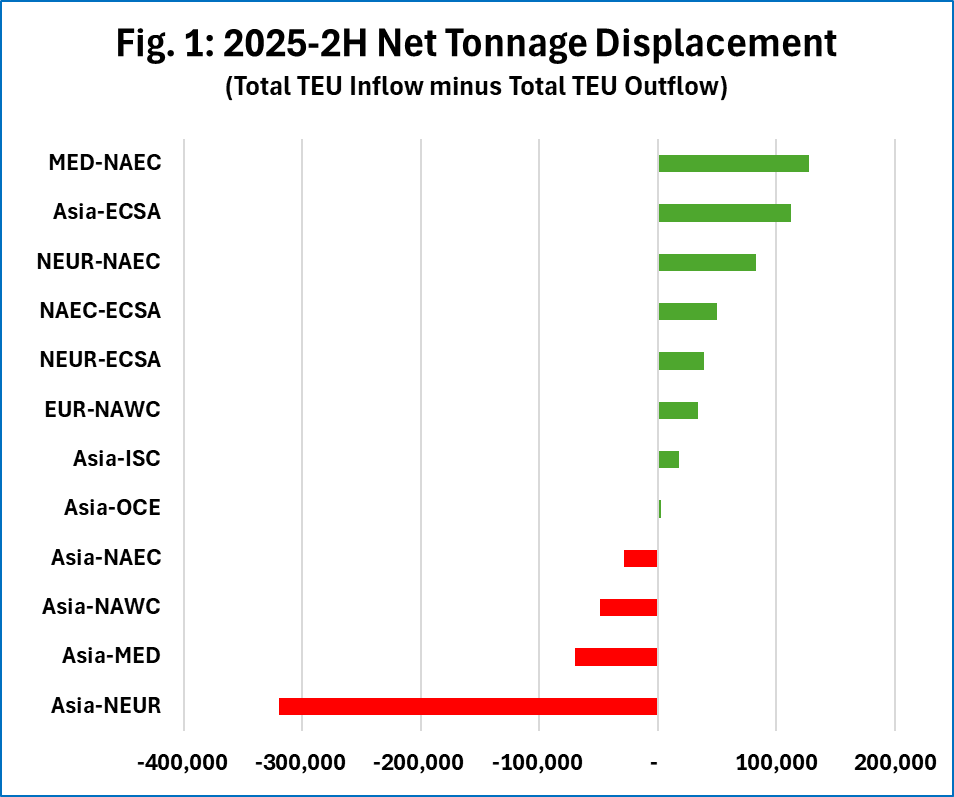

In issue 744, Sunday Spotlight, Sea-Intelligence analysed the displacement of global vessel capacity, tracking over 16,000 vessel transfers across 2024 and 2025. The data indicates that the “Cascading Effect” – where tonnage shifts from primary to secondary trade lanes – has entered a distinct new phase in 2025-2H.

While 2024 was characterized by an injection of capacity into Asia-Europe to manage the Red Sea crisis, current data shows that these trades have reached saturation, pushing excess tonnage into secondary trade lanes.

The data highlights a structural shift in the Asia-Mediterranean trade lane. Previously a primary absorber of displaced Asia-North Europe capacity in 2024, this trade lane is now actively cascading tonnage out to other lanes.

The Mediterranean-North America East Coast trade lane emerged as the top net gainer in 2025-2H, absorbing a net +127,686 TEU of cascaded capacity. This number was driven by +178,189 TEU of cascaded capacity from Asia-Mediterranean, with a transfer of 11 vessels of 14,000-15,000 TEU.

Similarly, the Asia-East Coast South America trade lane became the second-largest net gainer of cascaded capacity, absorbing a net +112,998 TEU, primarily consisting of mid-sized vessels of 8,000-14,000 TEU, that have been cycled out of the main East-West trade lanes.

The data shows this as a permanent structural change, as 97% of the vessels cascaded to Asia-East Coast South America in this period did not redeploy back to their previous trade lanes. This indicates that the capacity surplus originally triggered by the Red Sea crisis is now effectively saturating the peripheral trades of the global network.

The post Sea-Intelligence: Cascaded capacity reaches secondary trades in 2025 appeared first on Container News.