REPOWR, the startup company that is attempting to inject short-term leasing capability into the trailer market, is putting some numbers on what’s going on in its business.

In a report recently released by the company, and in an interview with FreightWaves, statistics from that market are coming into focus.

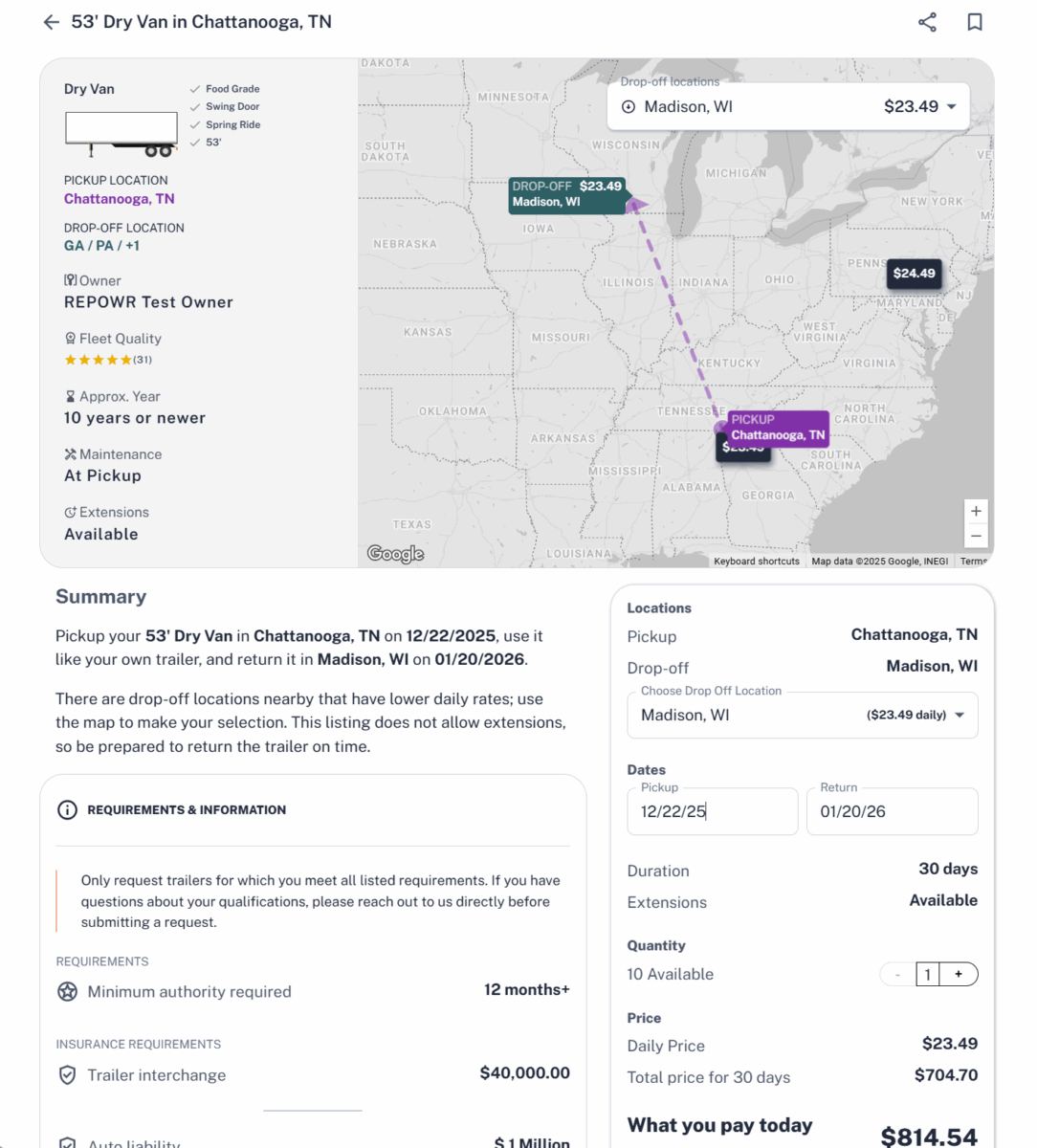

The white paper issued by REPOWR said its average daily rate to lease a dry van rose to $19.42 in 2025, which was notably higher than $16.93 in 2024. The increase came although most market observers would say the trucking industry in 2025 was worse than it was in the prior year.

The 2025 number was more than it was in 2023 as well, when it stood at $18.88, according to REPOWR data.

The average number of days leased by a REPOWR dry van customer in both 2024 and 2025 was 45 days, down from 51 days in 2023.

How dry van rates managed to rise this year in such a weak market was the result in part of actions taken by REPOWR, according to Chris Hines, the company’s CEO..

In 2023 and 2024, “there were a lot of new carriers in the market,” Hines said in an interview with FreightWaves. But they weren’t all solidly based.

“So we did a lot of pruning and getting our carrier base a lot smaller to weed out the fraud,” he said. “Once we had a more concentrated carrier base, we saw prices start to increase from suppliers, doing a little bit of protection themselves. They’re getting focused on using us as a way to increase revenue and they’re trying to get their prices up as much as possible.”

Numbers for reefers and flatbeds

As to be expected, there is a significant difference between dry van rates and those for reefers and flatbeds.

Flatbed rates have stayed relatively steady: a low of $37.10 in 2024 and a high of $39.81 this year with 2023 at $38.31. What fluctuated is the length of the reservation, which was 132 days in 2023, 91 days last year and 115 days this year.

Reefer prices have come down. They were $48.68 with an average reservation length of 112 days in 2023. Last year that dropped to $36.65 and 53 days, and this year was $39.61 and 59 days.

Hines said the big drop in reefer prices was more a function of them being elevated in 2023 rather than particular weakness in the past year. At current levels, he said, “there’s still substantial profitability in reefer moves.”

None of those trailers that were leased out were owned by REPOWR. At its most basic, REPOWR is a technology company that uses its programming to match carriers that need trailer capacity on a short-term basis, free of a long-term lease, with owners of trailers able to offer out a portion of their capacity specific durations far shorter than a full lease.

Hines told FreightWaves that trailers “spend about 40% of their life sitting empty somewhere.”

“So this optimization of underutilized trailers and trailer moves is the exact thing we are trying to solve for here,” he said.

The REPOWR report also lists other data coming from its own operations. It says its rental range for a dry van is between $530-$610 per month. Same-day availability is 72%. The average earnings per listed trailer are $900.38 per booking for the company supplying the equipment.

“With fleet capacity contracted by 2.2% in 2024 and the drivers-per-truck ratio declined to

0.93, equipment imbalance and underutilization risk are at critical levels,” the report said in what amounts to a numerical declaration of REPOWR’s “value prop.” “Trailer-sharing monetizes this idle capacity precisely where the market needs it most.”

Of its rentals, REPOWR said 83% of them are transported to a different market and returned there, with the balance originating and ending in the same place. “This demonstrates that the vast majority of trailer usage is tied to freight that moves directionally, not in closed loops,” the REPOWR report said.

Long list of considerations

The decision to lease out a trailer on a short-term basis through a platform like REPOWR or to obtain a trailer through that method has an almost endless list of considerations. For a trailer supplier, what is the revenue to be derived from repositioning the trailers? What if an opportunity suddenly arises; will there be capacity to meet them if the carrier has leased out too many trailers?

For the companies that lease the trailers off the platform, would it be better to buy a trailer to pursue the work? What about a long-term lease? Is the trailer going into a headhaul market or a deadhead market?

Matt Harb, vice president of product and operations at REPOWR who was also interviewed by FreightWaves, said the company has a calculator that works with suppliers on many of those questions.

“It asks, how many trailers do you have?” Harb said. “What is your utilization?” Even with a trailer sitting empty, the costs of maintaining it “are always higher than what you think it actually is,” he said.

Much of the information needed to decide on a keep/lease strategy comes into the REPOWR system off telematics, Harb said. “So we’re looking for high idle times on their trailers, regardless of whether they are in a pool or they are dedicated,” he said “And then we’re able to use that to tell our suppliers here’s where we think you have the opportunities to move trailers.”

Harb said there has been a shift in what the platform is being used for. Early on, he said, the owners of trailers used it primarily as a way to reposition trailers for their own use. The need to move trailers, he said, comes from two primary developments. “I have to move trailers because I have a new contract or I have to move trailers because I lost the contract but potentially I have hot markets,” he said.

But now, Harb said, “they’ve become much more savvy about where to list those trailers and drop those trailers, and that achieves higher revenue because they share in the value that the equipment creates.”

Hines said the idea of trailer pools in the past was that “it was a technology brought to you by cheap trailers.” But it never led to high utilization rates, and the result was the 40% figure he estimated as the capacity sitting idle.

Numbers on the users

Harb and Hines said while about 10,000 carriers have signed up for the REPOWR platform, the number of active users is currently about 3,000. However, they added that the number of carriers that have used it at any one time is about 8,000.

A mad dash to increase those numbers is not a primary goal at REPOWR, Harb said.

“We have purposely skinnied that number down, because of the market conditions around chameleon carriers,” Harb said, a term used for perpetrators of different types of fraud. “We’ve actively built a lot of safety guardrails over the past year to ensure that we know who has the trailers and to protect the carrier from mischievous acts that are happening out there.”

The average carrier on the platform has done about five reservations, with a duration of anywhere from three to 90 days, Harb said. The “sweet spot” of companies supplying into the pool is a carrier with between 25 to 50 trailers.

More articles by John Kingston

New York City bill that targeted Amazon won’t get taken up in 2025

State of Freight: a depressed trucking market suddenly comes to life

Benesch panelists: Why 2026 could be a strong year for logistics M&A

The post REPOWR’s data shows it cost more in ‘25 for a short-term dry van rental appeared first on FreightWaves.