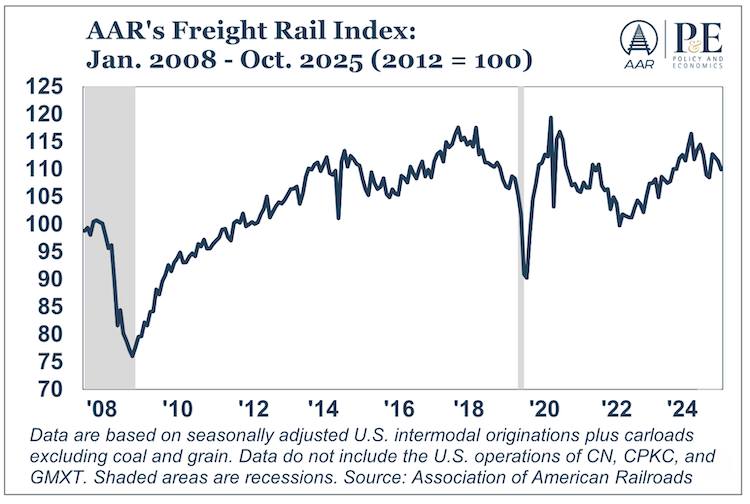

The November outlook for rail freight is parallelling a sawtooth grade profile in concert with the broader economy, with some gains set against declines amid a mix of external pressures.

While there are sectors within the rail industry that show signs of growth and resilience, others are experiencing noticeable declines, writes Rand Ghayad, chief economist at the Association of American Railroads, in a monthly analysis.

Key industrial commodities such as nonmetallic minerals, chemicals, and iron and steel scrap have seen year-over-year carload gains. Chemicals, an indicator for industrial activity, rose 1.8% in October, continuing a 24-month trend of increases.

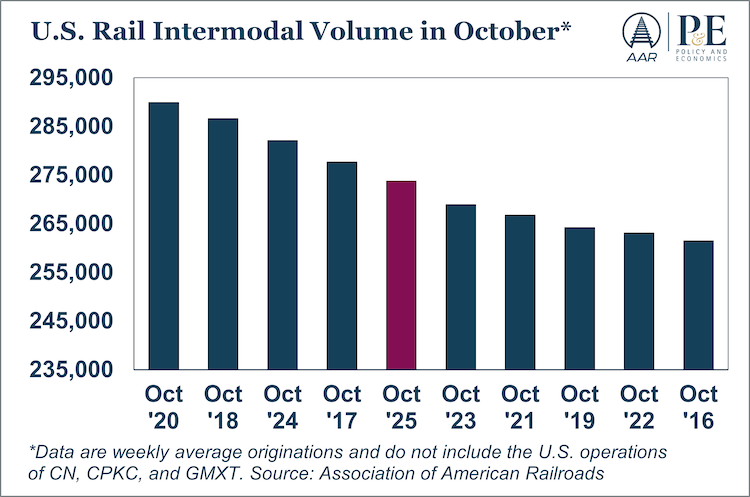

Conversely, intermodal rail shipments, a crucial component of rail freight traffic, declined. October 2025 saw a 3% reduction compared to the same month in the previous year, marking the third decline in five months. Normally a peak month for intermodal traffic, October underperformed, failing to rank among the top for average weekly volume. Contributing factors include a manufacturing slowdown, consumer spending shifts towards services, and alterations in ocean shipping patterns that hinder the typical seasonal growth. The pause in the tariff war fueled an early peak season as importers rushed to frontload goods from Asia, leading to weaker demand after the summer.

Ghayad addressed the persistently uneven footing of the U.S. economy. Record highs in equity markets, driven by robust tech earnings and recent interest rate cuts by the Federal Reserve, contrast with waning consumer confidence and stagnating manufacturing output. The Manufacturing Purchasing Managers Index (PMI) has remained below the growth threshold for 34 out of the last 36 months, symptomatic of the sluggishness in traditional sectors like automotive and construction though burgeoning areas such as AI and data centers provide some counterbalance.

Further emphasizing current economic complexities, Ghayad points to the mixed performance of carload categories. While coal shipments have fallen following previous increases, highlighting the impact of lower natural gas prices on coal-fired power generation, the industrial products category has posted a continuous increase, driven largely by chemicals and crushed stone.

Steel, closely tied to the fortunes of rail, has also demonstrated robust growth. The American Iron and Steel Institute reports a rise in steel shipments, aligning with an increase in rail carloads of iron and steel scrap, up 13.5% in October alone. This increase signals a rebound, on eight consecutive months of rising carloads.

Economic uncertainty clouds these developments, compounded by the effects of the government shutdown that disrupted access to critical economic data. Labor market dynamics add another complication, as slower job creation rates and rising unemployment pressure the Fed, which has responded by cutting interest rates. The impact on consumer spending and business investment, Ghayad wrote, remains to be fully realized.

Subscribe to FreightWaves’ Rail e-newsletter and get the latest insights on rail freight right in your inbox.

Find more articles by Stuart Chirls here.

Related coverage:

STB nominees promise fair rail merger evaluation

Rail intermodal down 6.4% in latest week

Why TRAC’s Florida East Coast Rwy. chassis deal matters for intermodal transport

Florida East Coast boosts Grupo Mexico’s earnings

The post Rail freight faces a mixed economic signal appeared first on FreightWaves.