While European ports scramble to retain relevance, Morocco is executing a calculated infrastructure offensive that could fundamentally redraw the Mediterranean’s maritime power map.

The kingdom is deploying over US$7 billion across four deepwater ports in a coordinated expansion designed to capture container flows, energy transitions, and African trade corridors simultaneously transforming temporary crisis into permanent competitive advantage.

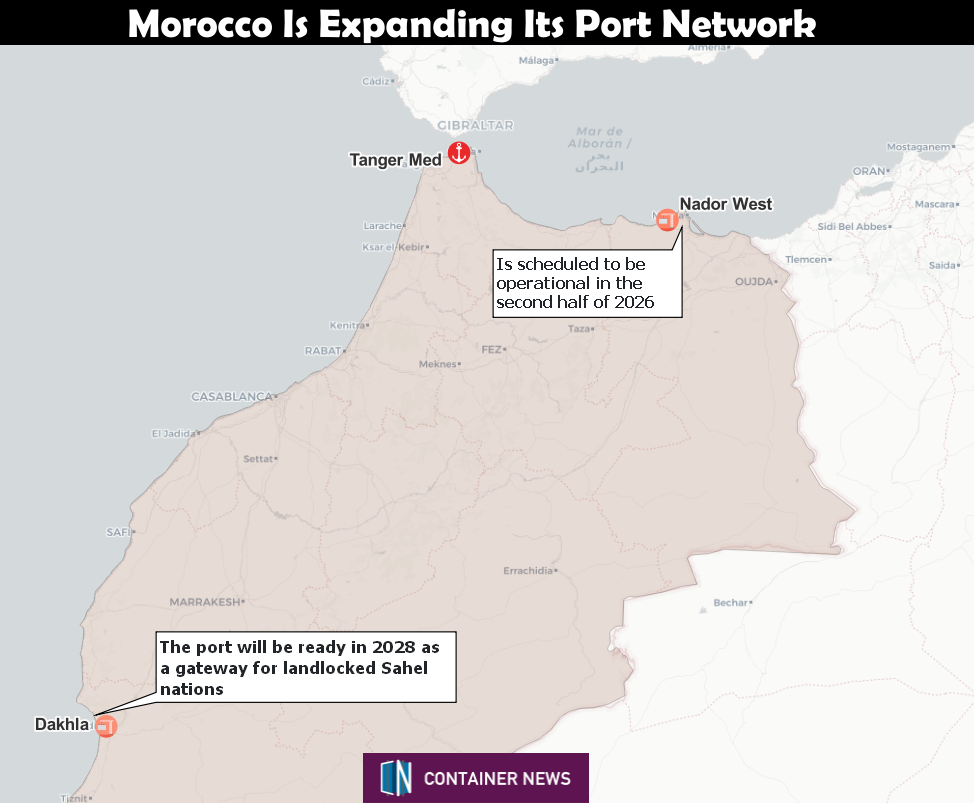

The strategy centers on synchronized commissioning of two massive facilities: Nador West Med on the Mediterranean coast, scheduled for late 2026, and a $1 billion Atlantic port in Dakhla by 2028.

Combined with the already dominant Tanger Med handling 11.33 million containers annually at 91% capacity Morocco will command over 15 million TEUs of annual throughput by decade’s end, positioning the kingdom to control 35-40% of Western Mediterranean transshipment.

Since Houthi attacks forced 70-80% of Asia-Europe container traffic around the Cape of Good Hope in late 2023, adding weeks to voyage times, carriers have sought Mediterranean alternatives to traditional European hubs.

Morocco’s geographic position at the Mediterranean-Atlantic junction provides the optimal solution closer to rerouted vessels while maintaining European market access without Suez Canal dependency.

Morocco engineered this infrastructure before the demand fully materialized, creating a self-fulfilling prophecy where their hub availability enables the diversification that validates their investments.

The strategic depth extends beyond containers. Nador will host Morocco’s first liquefied natural gas terminal a floating regasification unit pipeline-connected to northwestern industrial hubs reducing coal dependence while positioning the kingdom as a Mediterranean energy node.

More tellingly, both Nador and Dakhla include dedicated quays for green hydrogen exports before production even exists, anticipating European Union mandates and IMO 2030 decarbonization requirements that will obsolete conventional bunkering infrastructure.

European competitors face mounting pressure. Spain’s Algeciras has declined from 558 to 518 connectivity index points since mid-2025, while Barcelona has shed 47 points over six quarters.

France’s Marseille announced a defensive EUR€1.3 billion investment explicitly timed to Nador’s commissioning acknowledging permanent structural disadvantage rather than competing on equal terms.

Dakhla’s development carries additional geopolitical weight. Located in disputed Western Sahara territory, the Atlantic facility is explicitly marketed as a “gateway for landlocked Sahel nations” challenging French-influenced West African port networks while asserting Moroccan sovereignty through infrastructure development.

With security deterioration forcing major carriers to suspend Mali operations via traditional Abidjan and Dakar routes, Dakhla offers political diversification wrapped in commercial logistics.

Morocco isn’t simply adding capacity it’s engineering network effects where port infrastructure enables manufacturing nearshoring, which generates cargo volumes justifying further expansion, which attracts alliance commitments that lock in hub centrality.

The critical test arrives in the 2025-2027 window as Nador activates and carriers finalize Mediterranean network configurations.

If Morocco successfully captures Ocean Alliance’s transshipment concentration while Dakhla establishes Sahel corridor credibility, European ports face relegation from gateway hubs to continental feeders a reversal of Mediterranean maritime hierarchy unthinkable a decade ago.

What distinguishes Morocco’s approach is the exploitation of chronic volatility rather than waiting for stability restoration.

By providing superior infrastructure during the decisive decision period when companies commit to permanent supply chain restructuring, the kingdom converts temporary disruptions into enduring strategic position.

The outcome will determine whether the Mediterranean’s center of gravity shifts permanently southward with Morocco commanding trade flows through infrastructure provision rather than naval projection.

The post Morocco sees rerouting and trade shifts as strategic enablers appeared first on Container News.