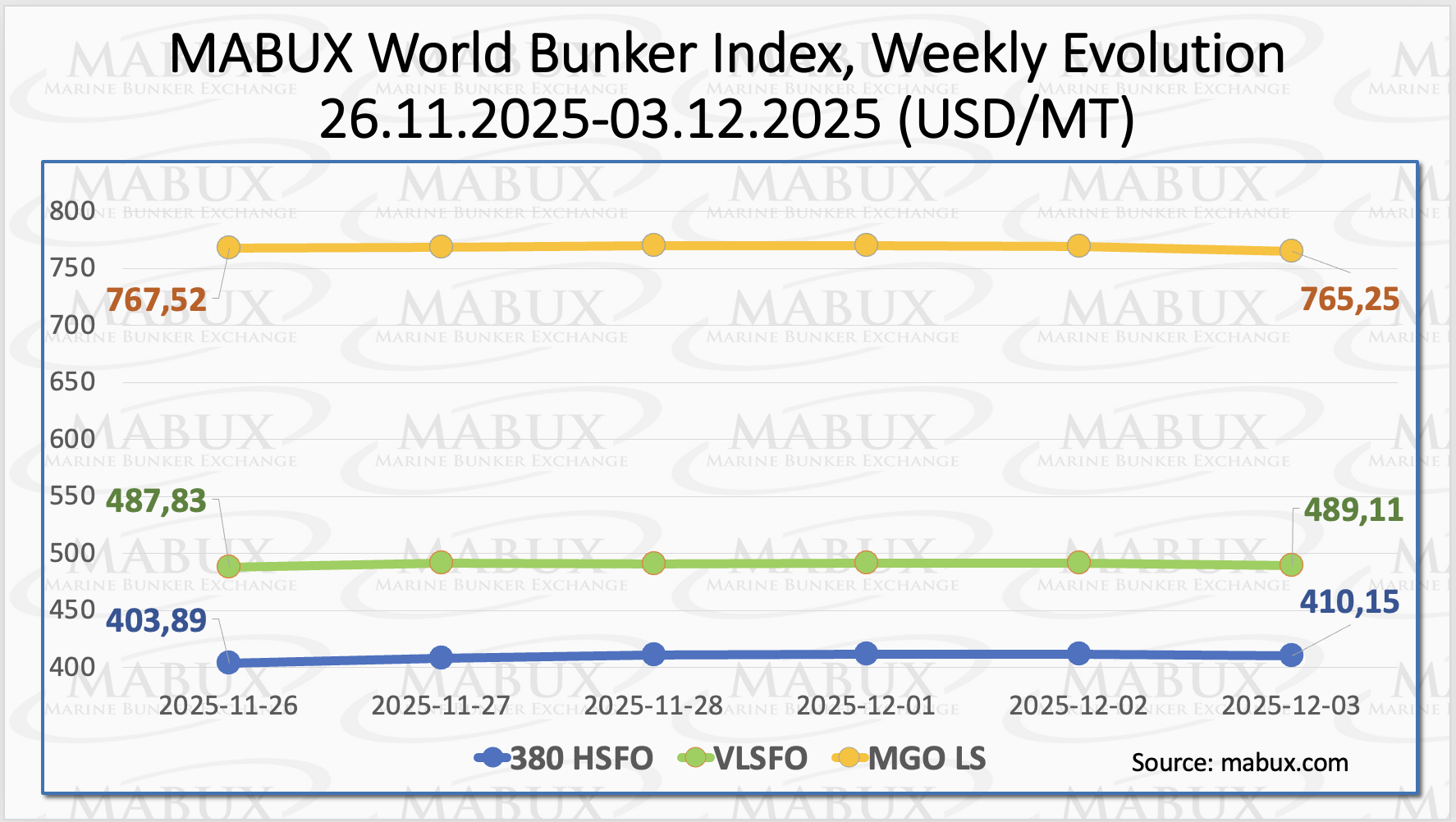

At the close of Week 49, the global MABUX bunker indices moved in mixed directions, with no distinct trend emerging. The 380 HSFO index rose by US$6.26 to US$410.15/MT. The VLSFO index edged up by US$1.28 to US$489.11/MT, while still remaining below the US$500/MT threshold. In contrast, the MGO LS index declined by US$2.27 to US$765.25/MT. At the time of writing, global bunker fuel prices continued to show no clear directional momentum.

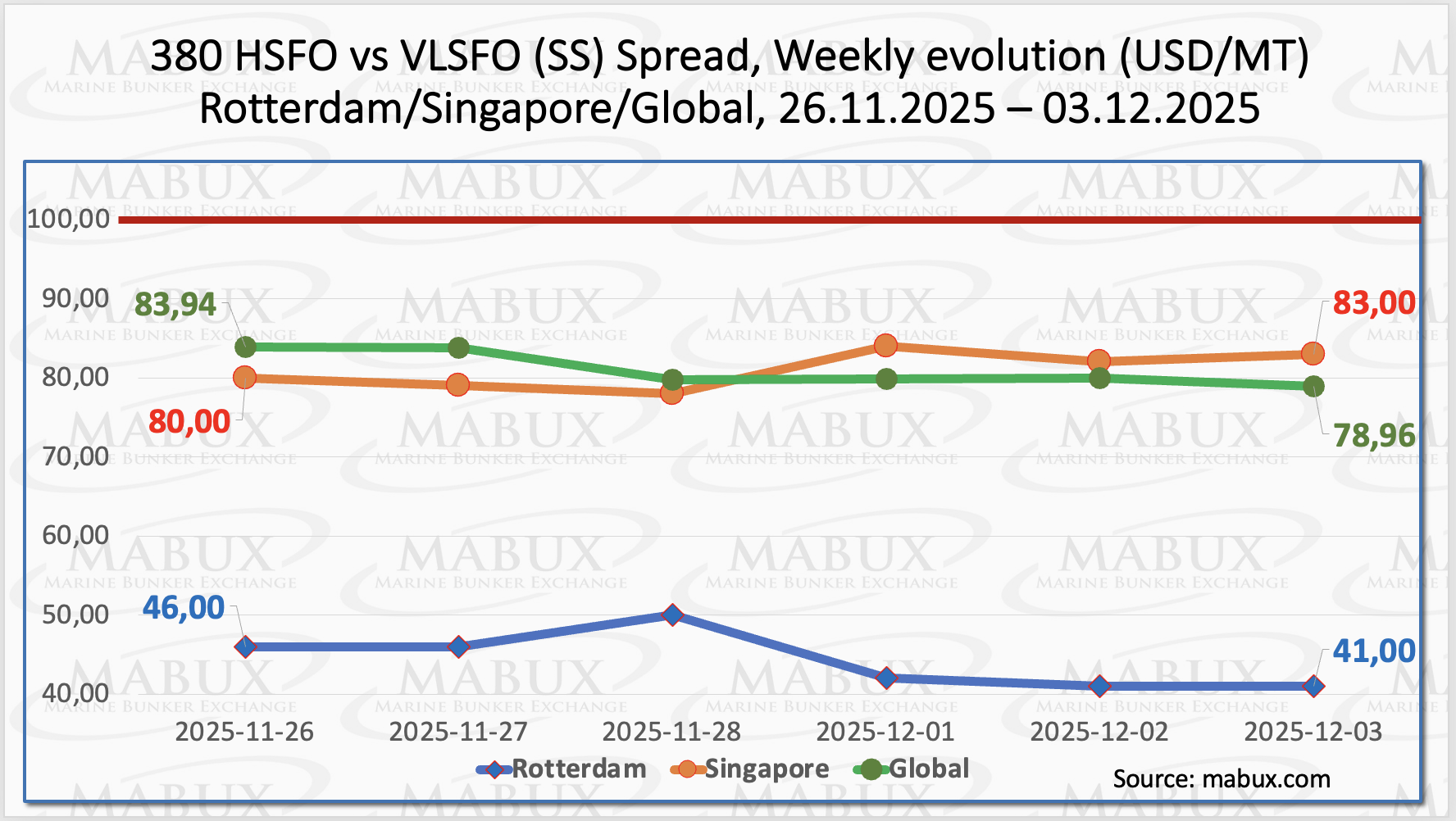

At the close of Week 49, the MABUX Global Scrubber Spread (SS)—the price differential between 380 HSFO and VLSFO—declined by US$4.98, from US$83.94 last week to US$78.96, once again falling below the US$80.00 level. The spread also remained firmly under the psychological US$100.00 threshold (SS breakeven). The weekly average value of the index decreased by US$3.77.

In Rotterdam, the SS spread narrowed by US$5.00 to US$41.00, compared to US$46.00 last week. The port’s weekly average SS value also decreased by US$3.67. In Singapore, by contrast, the 380 HSFO/VLSFO spread widened by US$3.00, from US$80.00 last week to US$83.00. However, the weekly average SS value in the port declined by US$6.00.

Overall, the SS spread has exhibited no material recovery, with values remaining well below US$100.00, thereby sustaining the stronger relative economics of conventional VLSFO versus the 380 HSFO + scrubber configuration. We expect the SS spread to retain its current trajectory into next week.

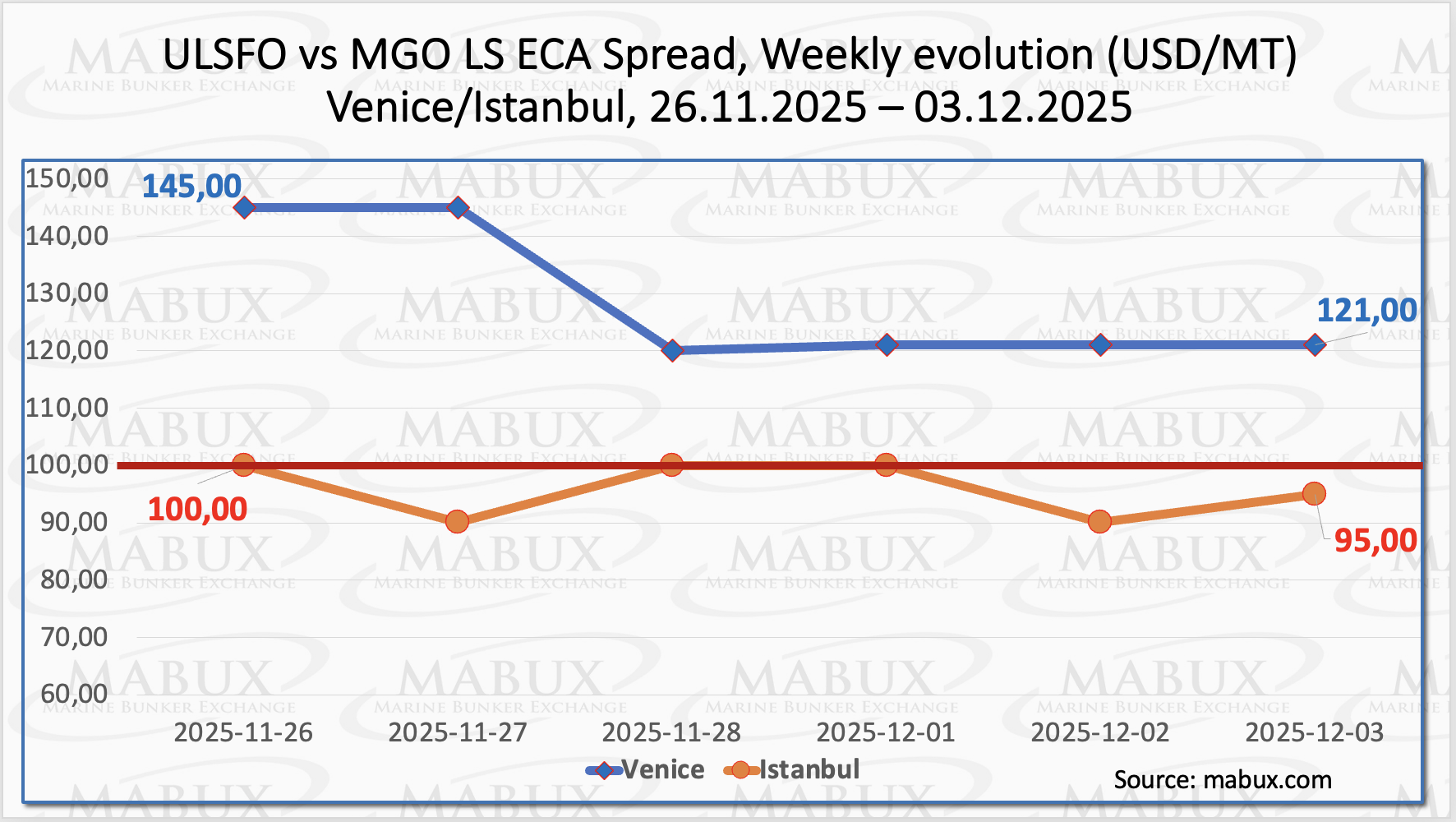

As new emission control areas (ECAs) continue to emerge worldwide—most recently the Mediterranean ECA, which entered into force on May 1, 2025—it has become increasingly important to compare pricing for the zone’s conventional compliant fuel, ULSFO (0.10% sulfur), against the traditional and currently most expensive grade, MGO LS.

This comparison is essential for assessing the outlook for the development of regional ECA bunker markets. In this context, we are launching publication of the ECA Spread for the MedECA zone. By the end of the week, the Istanbul ECA Spread decreased by $5.00 ($95.00 versus $100.00 last week), while in Venice the ECA Spread dropped by $24.00.

Nevertheless, ECA Spread values remain at or near the psychological $100.00 level, supporting a comfortable price differential in favor of ULSFO. This continues to stimulate demand for ULSFO and creates the conditions for further expansion of this segment within the MedECA bunker market.

According to Kpler, U.S. liquefied natural gas (LNG) exports recorded a 40% year-on-year increase in November, reaching an estimated 10.7 million tons. This surge made the United States the first country to export more than 10 million tons of LNG in a single month. The ample supply has already exerted downward pressure on European natural gas prices, which have fallen to their lowest levels in more than a year despite the onset of colder winter weather. Market forecasts suggest that prices could decline further in the coming months, even though winter traditionally represents the peak demand period.

As of Dec. 02, European regional gas storage sites were filled to 74.95% (down 2.64% from the previous week), while gas withdrawal rates increased sharply over the week. Current storage levels are close to the early-2025 benchmark of 71.33% and exceed it by only 3.62%. Although European gas reserves continue to decline and remain below last year’s level for the same period, increasing LNG inflows are helping to ease concerns over a potential supply shortfall. By the end of Week 49, the European gas benchmark TTF extended its moderate decline, falling by 1.897 euros/MWh to 28.050 euros/MWh, compared with 29.747 euros/MWh last week.

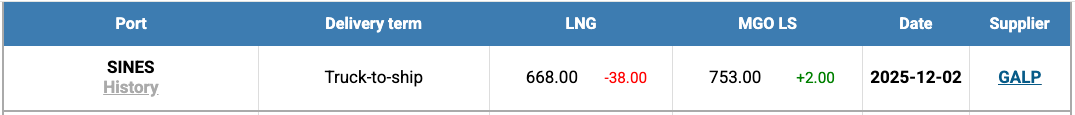

The price of LNG as bunker fuel at the port of Sines (Portugal) fell by a further US$36.00 this week, to US$668/MT from US$706/MT the previous week. The price differential between LNG and conventional fuel remained in LNG’s favor, narrowing to US$85 from US$122 a week earlier: MGO LS was quoted at US$753/MT in Sines on the same day.

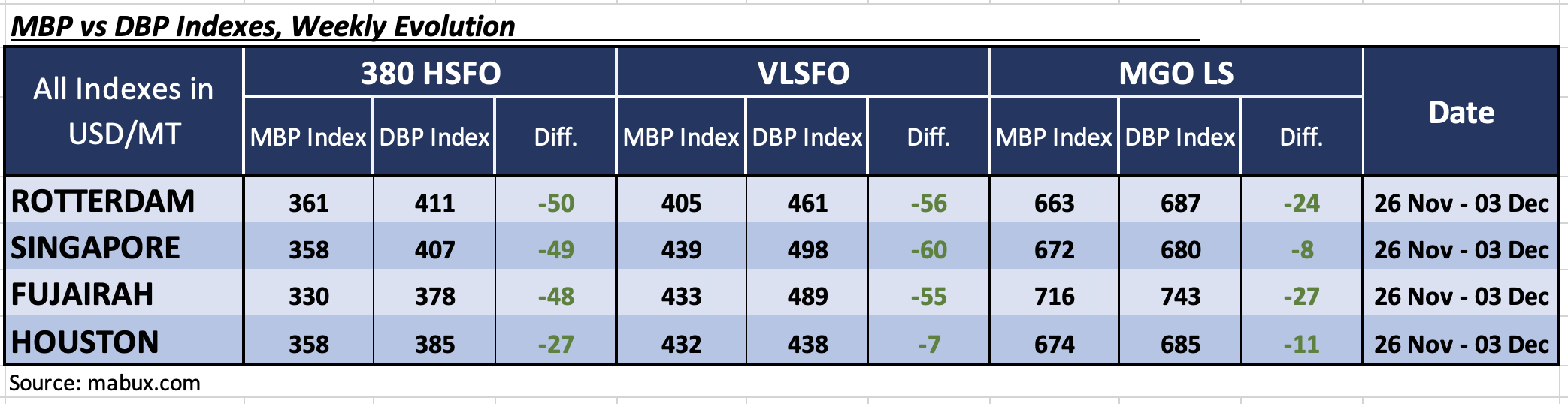

By the end of Week 49, the MABUX Market Differential Index (MDI)—reflecting the ratio of market bunker prices (MBP) to the MABUX Digital Bunker Benchmark (DBP)—continued to indicate a prevailing underpricing trend across all major fuel grades in the world’s key hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: Average weekly MDI values in Rotterdam remained unchanged, while the index increased by 2 points in Singapore, 1 point in Fujairah, and 5 points in Houston.

• VLSFO segment: MDI values rose across all hubs: by 2 points in Rotterdam, 9 points in Singapore, 7 points in Fujairah, and 2 points in Houston. Houston’s MDI remained close to 100% correlation between MBP and DBP.

• MGO LS segment: MDI underpricing levels narrowed substantially: by 12 points in Rotterdam, 11 points in Singapore, 35 points in Fujairah, and 23 points in Houston. Singapore’s MDI moved closer to 100% correlation.

”Overall, the balance of overvalued versus undervalued ports was unchanged from the previous week and remained firmly in the undervalued zone. We expect the underpricing trend to persist in the global bunker market next week”, commented Sergey Ivanov, Director, MABUX,

Lastly, Ivanoc added that the global bunker market continues to show a relatively stable pattern. We expect that next week global bunker indices will continue to fluctuate in mixed directions, with no clear or sustained momentum.

The post MABUX: Bunker indices mixed in week 49 appeared first on Container News.