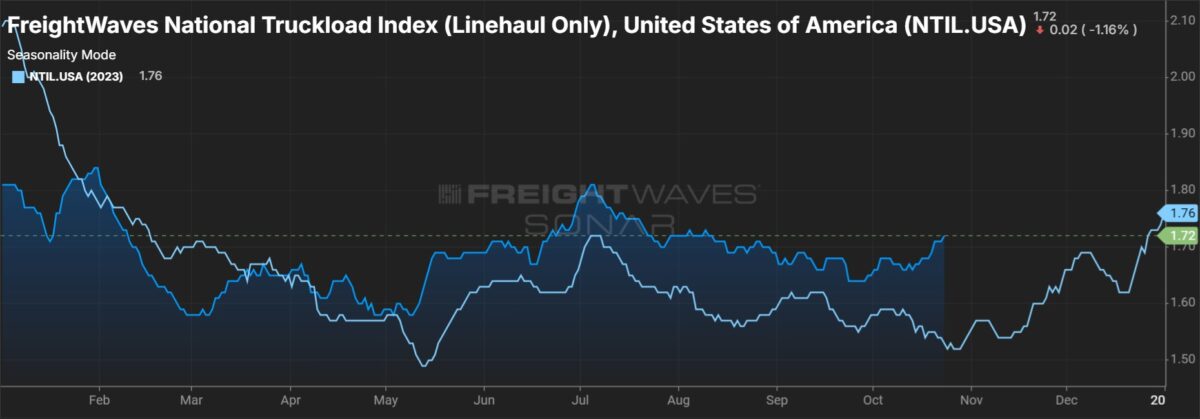

Knight-Swift Transportation said it is seeing normal seasonal demand trends and that it is capturing rate increases in its truckload business. It tempered the update by saying what happens to demand after Thanksgiving is an unknown that will ultimately impact at least the beginning of next year’s bid season.

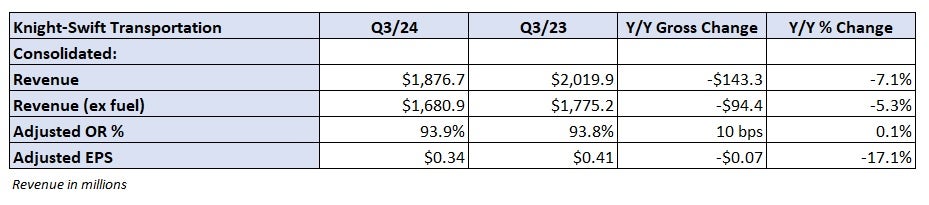

Knight-Swift (NYSE: KNX) reported third-quarter adjusted earnings per share of 34 cents Wednesday after the market closed. The result was at the top end of management’s guidance range (31 to 35 cents), beating the consensus estimate by 2 cents, but lagging the year-ago result by 7 cents.

Knight-Swift reiterated fourth-quarter adjusted EPS guidance of 32 to 36 cents, which was in line with the 34-cent consensus estimate at the time of the print. It introduced first-quarter guidance of 29 to 33 cents, which was lower than the 36-cent consensus estimate. The company’s outlook assumes normal seasonal trends and does not include a positive inflection in the freight market.

Still right-sizing the TL unit

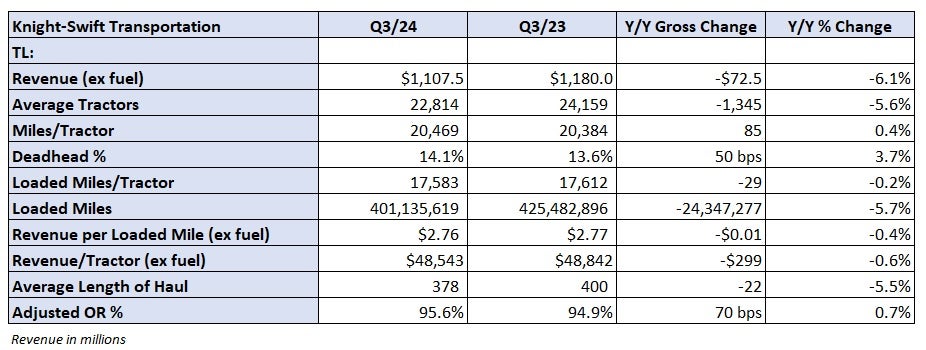

Knight-Swift said it will again rationalize both tractors and trailers across its TL unit during the fourth and first quarters following a prolonged period of depressed demand. The company continues to right size the fleet since closing on the July 2023 acquisition of U.S. Xpress, which operated more than 7,000 tractors at the time. The goal is to improve asset utilization in the segment, ultimately driving rates higher.

Truckload revenue fell 6.1% y/y in the third quarter to $1.1 billion. The bulk of the decline stemmed from a 5.6% decline in average tractors in service. Utilization metrics like loaded miles per tractor (down 0.2% y/y) and revenue per tractor (down 0.6% y/y) were largely unchanged. However, management said there was some noise in the mileage metric as it has moved some of U.S. Xpress’ equipment to cover more higher-priced, regional loads as opposed to the lower-priced, longer-haul shipments it was carrying.

Knight-Swift will look to cut a “few hundred” tractors over the next two quarters but said better routing and load selection will free up incremental capacity across the remaining fleet, allowing it to take advantage of spot market opportunities. Knight-Swift said it has seen rate increases on recent bid awards and that its spot rates are still higher than contractual rates. However, it said both spot and contract rates remain at “unsustainable levels.”

Revenue per loaded mile excluding fuel surcharges was flat at $2.76 in the quarter but 2 cents higher than the second quarter. Knight-Swift hopes to lower cost per mile in 2025, or at least keep it flat, which will allow anticipated rate increases to flow through the income statement without any offset.

Knight-Swift’s CEO Adam Miller said the company normally reallocates 25% to 30% of rate increases toward driver wage increases. However, the company needs to improve margins first coming out of an extended downturn, and see a tightening in the driver market before that will happen this time around.

“I think [in] 2025, we’re going to have to, as an industry, convert any rate improvement into margin improvement,” Miller told analysts on a Wednesday evening call. “Our focus will be, keep inflation to a minimum … continue to improve on a cost-per-mile basis while you’re getting yield to flow down to margin.”

The guidance calls for a slight increase in revenue from the third to fourth quarter, with a low- to mid-single-digit sequential decline expected in the first quarter. Changes to the unit’s operating margin is expected to see a similar cadence.

The TL unit reported a 95.6% adjusted operating ratio (inverse of operating margin), 70 basis points worse y/y but 160 bps better than the second quarter. Knight-Swift’s legacy operations saw a 250-bp sequential OR improvement while U.S. Xpress’ operations were a 220-bp drag during the quarter.

Miller’s current outlook on rates calls for a “slow, progressing” build through next year’s bid season with increases likely in the low- to mid-single-digit range (potentially up in the high-single-digits later in the bid season). He said current indications show solid demand up to Thanksgiving but what happens after the holiday will really be the tell for the 2025 bid season.

High-teens growth expected in LTL

Knight-Swift is on track to grow its LTL network by 1,500 doors this year, a 32% y/y increase. It has opened 34 terminals so far in 2024 and plans to add another four before the year ends. It acquired 25 locations (12 of which are leased) for $54 million from bankrupt Yellow Corp. (OTC: YELLQ). It also acquired Dependable Highway Express (DHE) and its 14 service centers in July. The expansion is expected to fuel a high-teens y/y percentage increase in revenue (excluding fuel surcharges) in the fourth and first quarters.

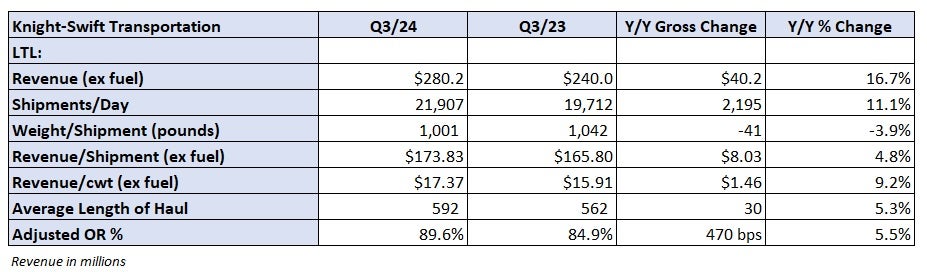

The LTL unit saw revenue (excluding fuel) increase 16.7% y/y to $280 million in the third quarter. Shipments increased 11.1% while revenue per shipment (excluding fuel) increased 4.8%. Revenue per hundredweight (excluding fuel) increased 9.2% y/y and was partially aided by a 3.9% decline in weight per shipment.

Management said LTL rate increases are moderating as the industrial economy remains stagnant and as the y/y comps get tougher. However, as more of its network comes on line and it transitions to a national carrier, it will see longer lengths of haul, which often include heavier shipments. Both changes will drive revenue per shipment and margins higher.

Revenue guidance for the segment calls for high-teens y/y growth in the fourth and first quarters.

The unit recorded an 89.6% adjusted OR in the third quarter, which was 470 bps worse y/y. Incremental costs associated with onboarding new locations were a headwind to margins. A high-80s OR is again expected in the near-term.

Other takeaways from Q3

The logistics unit reported a 9.5% y/y revenue decline as a 21.1% decline in loads was partially offset by a 13.6% increase in revenue per load. The unit reported a 94.5% adjusted OR, which was 120 bps worse y/y. Guidance calls for a similar OR in the first and fourth quarters.

The intermodal unit moved closer to break-even in the quarter. The segment recorded a 101.4% adjusted OR, a sixth consecutive operating loss, but a 310-bp y/y improvement. The unit is expected to see approximately break-even operating results over the next two quarters.

Knight-Swift cut its 2024 net capex guidance to a new range of $525 million to $575 million (down from $600 million to $650 million). It will continue to replace equipment and make investments in its terminals.

The third-quarter adjusted EPS number excluded acquisition-related expenses, noncash impairments on equipment and real estate, and a $12.1 million write-off (7 cents per share) of a minority investment in a freight-tech venture. Gains on equipment sales totaled $9.2 million in the quarter, a 1-cent headwind to the year-ago period (assuming a normalized tax rate). An increase in net interest expense was a 3-cent y/y headwind.

Shares of KNX were down 2.7% at 10:31 a.m. EDT on Thursday compared to the S&P 500, which was up 0.2%.

More FreightWaves articles by Todd Maiden

- Old Dominion points to October as ‘a sign of hope’

- Saia to open 3 terminals in October, pushing 2024’s count to more than 20

- Yellow’s bankruptcy plan would let former employees recoup PTO, commissions

The post Knight-Swift starting to see positive TL rate negotiations appeared first on FreightWaves.