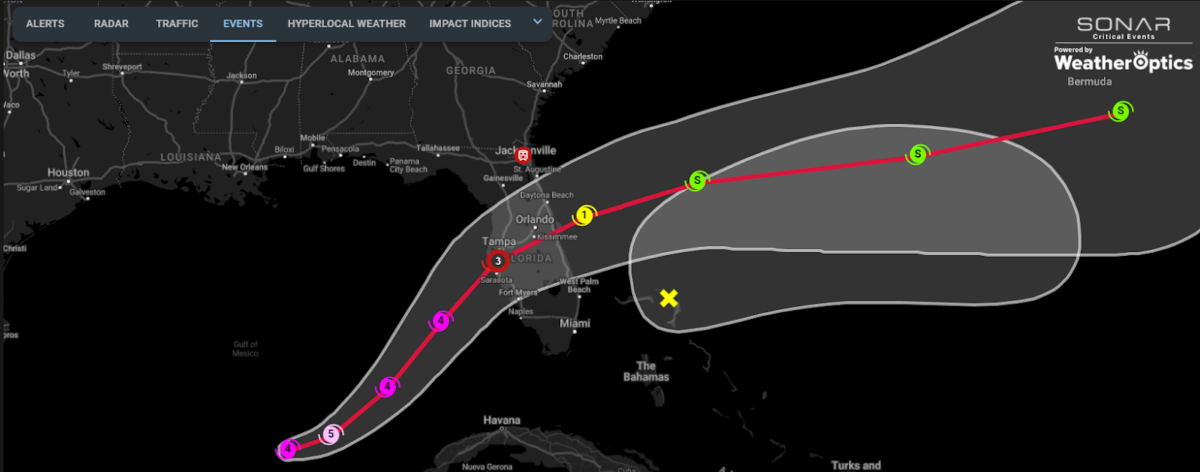

The impacts of Hurricane Milton are already appearing in freight markets in Florida. The storm is currently forecast to make landfall just south of Tampa as a Category 3 with sustained winds of 127 mph and gusts upwards of 155 mph.

The freight markets in Florida are prototypical backhaul markets, but Milton is set to be one of the most disruptive events in the area in quite some time. Based on the forecast track as of 8 a.m. EDT, the Lakeland market, home to both Tampa and Orlando, the 16th- and 21st-largest metro areas in the country, respectively, will bear the brunt of Milton’s strength.

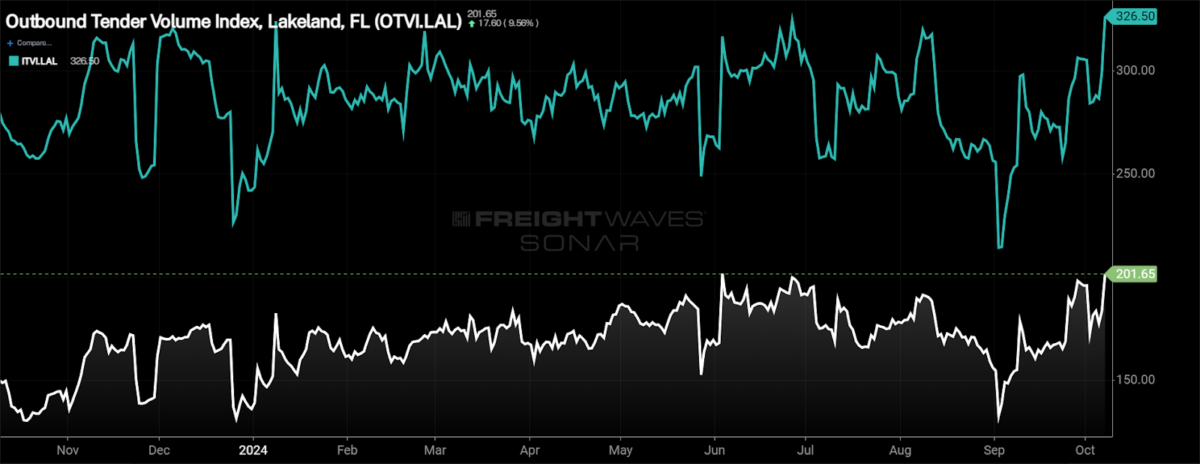

For perspective on the size of the Lakeland market, the Outbound Tender Volume Index sits at 201.65, the 16th largest freight market of the 135 markets tracked within FreightWaves SONAR, representing 1.693% of total outbound freight in the U.S. On the inbound side, the Inbound Tender Volume Index sits at 326.5, making it the sixth-largest inbound freight market of the 135 markets, currently slightly larger than the Dallas freight market. The Lakeland market is the destination for 2.726% of total freight.

The Inbound Tender Volume Index, a measure of the number of shippers’ requests for truckload capacity into a given market, for Lakeland is surging to new heights not seen in well over a year. This is a signal that shippers are trying to get goods into position ahead of the storm or as soon as the storm passes.

The Outbound Tender Volume Index, a measure of shippers’ requests for truckload capacity to move freight out of a given market, also gained momentum over the past week. The increase in outbound freight is likely a function of shippers’ trying to make a last-second push to get freight out of the market.

The nuances of the Lakeland market are interesting, though. While it is a proverbial backhaul market in which there is more inbound volume than outbound volume, the market effectively services all of central and southern Florida, including the Miami market, home to the ninth-largest metro area in the country.

Shippers that have locations in the Lakeland market include household names, such as Amazon, Walmart, Best Buy, Rooms to Go, Purina, Land O’Lakes and PepsiCo. Regional grocers Publix and Winn-Dixie also have distribution centers in the area, including multiple temperature-controlled facilities.

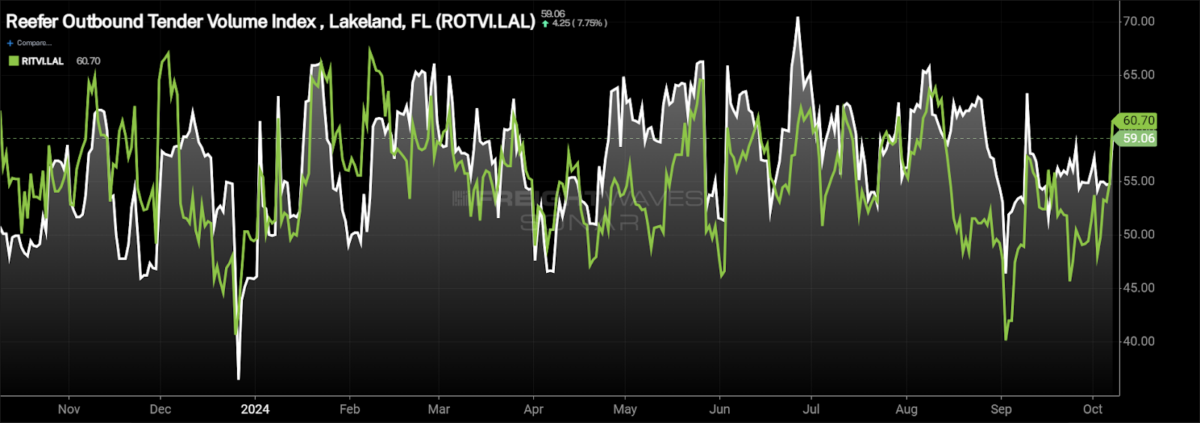

While the Lakeland market is a backhaul market in nature, it is far more balanced when it comes to temperature-controlled freight, so the potential for disruption appears more likely.

The Lakeland market is the third-largest inbound and outbound reefer market in the country, according to FreightWaves SONAR. Inbound and outbound reefer tender volumes are effectively level.

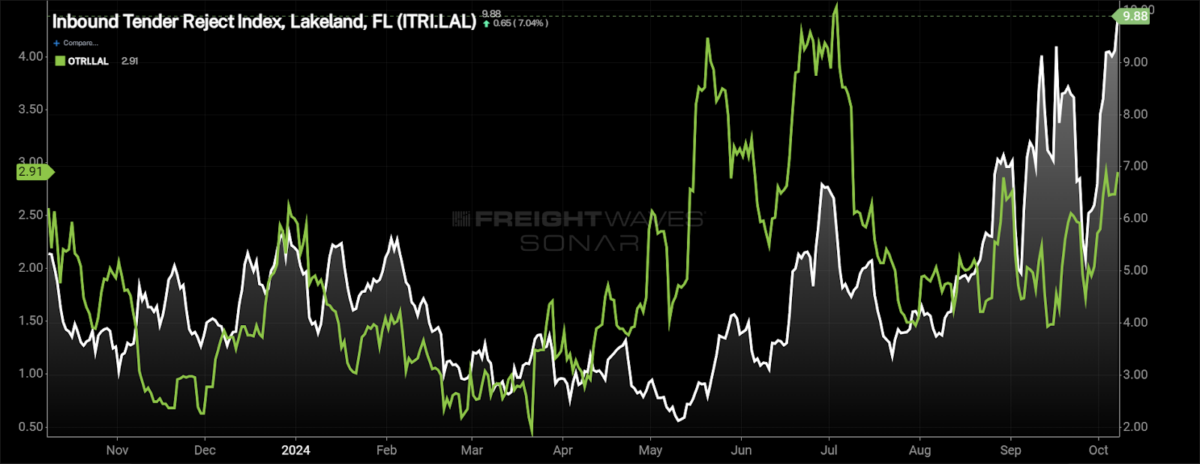

The challenges that shippers will face apart from potential damage to facilities and the need to move goods into areas of need is that transportation networks will become imbalanced. While the overall market remains challenging for carriers, they will continue to avoid the region.

The evidence of carriers wanting to avoid the Lakeland market is already appearing.

The Inbound Tender Reject Index, which is the percentage of tenders that are being rejected by carriers into a given market, is thought to be a gauge of carriers’ willingness to enter a given market. Inbound tender rejection rates in the Lakeland market are soaring, rapidly approaching 10%. That means 1 in 10 tenders destined for Lakeland is being rejected by carriers.

With carriers opting to hold drivers outside of the Lakeland market, it will create an imbalance in capacity once the recovery begins and shippers restart trying to move inventory that they are holding in facilities in the market. Now, the imbalance may not be as evident as it would be in a headhaul market, where capacity is already naturally tighter, but it will create another wave of pressure on supply chains that have a presence in the region.

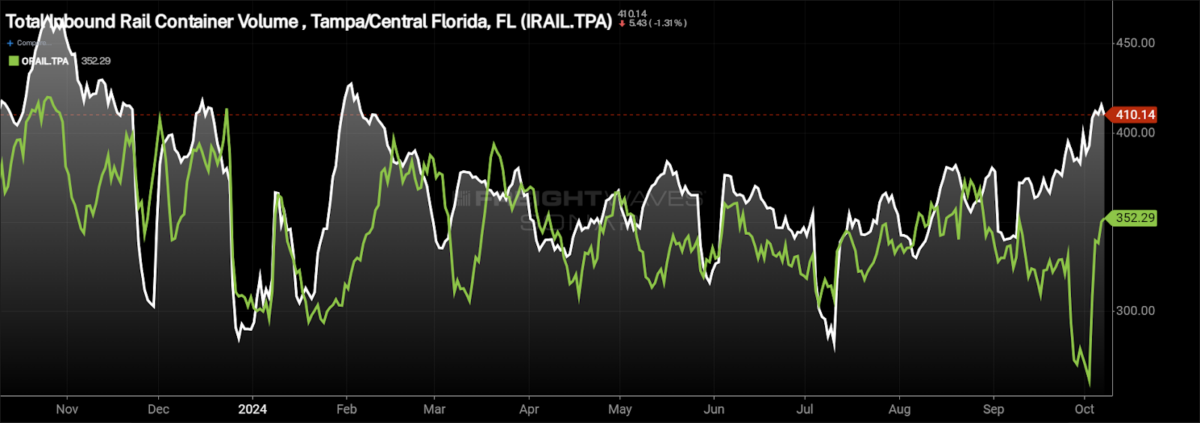

Florida – especially central and southern Florida – as a whole isn’t a major market when it comes to intermodal volume. For reference, total inbound intermodal container volumes into Tampa average about 410 containers per day, the 24th most inbound intermodal containers but 160 fewer containers per day than go into Jacksonville, the 17th-largest inbound container market.

But for those that utilize intermodal in the central and southern Florida region, expect there to be a sizable drop-off of outbound containers until the storm passes, similar to what happened with Hurricane Helene at the end of September. At the time of writing, both CSX and Norfolk Southern have released statements that there are no disruptions to their networks.

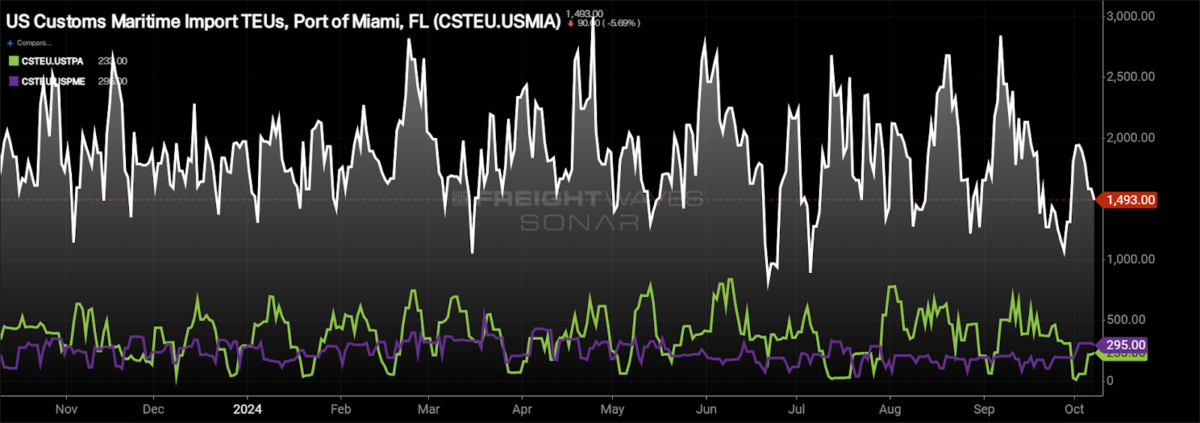

If there is a positive, it is that the ports of Manatee and Tampa, the ones likely to be the most disrupted by Hurricane Milton, are relatively small compared to other ports in the state like the Port of Miami. Compared to the Port of Miami, both Port Manatee and the Port of Tampa are about one-fifth the size in terms of the number of containers clearing U.S. customs.

While the Florida markets are not often talked about in great detail due to their backhaul nature, Hurricane Milton could have extreme impacts on supply chains in the region. Both shippers and carriers need to be prepared for potential delays once the recovery and rebuild get underway.

The post Hurricane Milton already impacting Florida freight markets appeared first on FreightWaves.