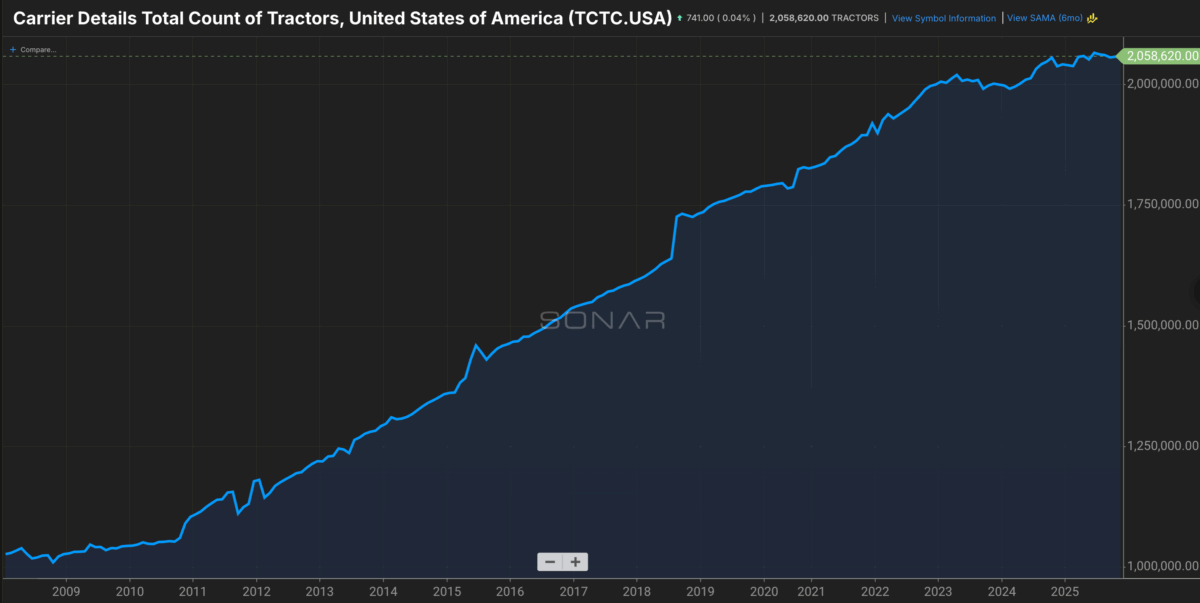

Over the past few months, I’ve spoken with hundreds of senior executives at America’s largest trucking companies. Nearly all say they only recently discovered the massive influx of foreign drivers and motor carriers. Most assumed the trend was gradual; none realized it was exponential.

Few had ever heard the term “non-domiciled CDL” until this summer or understood how many drivers with little or no real training have flooded the industry. They failed to understand that despite their own investments in upgraded training and compliance efforts in recent years, that the smallest operators had been handed a massive gift: the ability to “train” their own truck drivers, with little to no oversight from Federal regulators.

These changes were driven by a long-standing belief—pushed hard by the American Trucking Associations (ATA)—that the U.S. faces a permanent truck-driver shortage. The ATA’s solution was to lobby Congress and FMCSA to lower every barrier to entry, convinced that new drivers would flow to large ATA-member fleets rather than small operators.

That assumption was rooted in an old reality: twenty years ago, only the biggest carriers offered real-time tracking, electronic tendering, and direct shipper relationships. Small carriers and brokers were stuck with phone, fax, and leftover freight.

That world no longer exists.

Fueled by billions in venture capital and private equity, freight brokers have not only caught up on technology—they’ve leapfrogged the large fleets. They offer single-source routing guides, superior automation, and, crucially, no obligation to enforce hours-of-service, speed limiters, or driver-qualification standards. Brokers simply buy the cheapest capacity available.

When the ATA successfully lobbied to dismantle entry barriers, it inadvertently handed the industry to those brokers and to the least-compliant segment of the market.

Key regulatory changes that removed barriers and gutted safety enforcement:

- 2016 – DOT stops enforcing English-proficiency requirements for CDLs

- 2018 – ELD mandate implemented; self-certified devices with intentional back doors allow unlimited editing of driving hours

- 2019 – Non-domiciled CDLs introduced, permitting foreign nationals to obtain U.S. commercial licenses

- 2022 – Entry-Level Driver Training rule triggers explosion of unaccredited “CDL mills” selling licenses for $500–$1,000 in days with virtually no training

These minimally trained foreign drivers cannot pass the vetting of large, compliant carriers (no work authorization, poor English, zero experience). They end up at small, often foreign-owned fleets that pay 40% below market and routinely run 14–20-hour days using tampered ELDs.

Three additional accelerants turned a bad situation into a catastrophe:

- Freight brokers now control ≈⅓ of all loads and almost exclusively award them to the lowest bidder, pushing spot rates below the cost of legal operation.

- The Biden-era immigration surge delivered millions of new arrivals seeking work; foreign-owned fleets recruited aggressively—higher pay than at home, no experience needed, free “housing” in the sleeper berth.

- During the COVID freight boom, carriers and brokers offshored hundreds of thousands of dispatch and brokerage jobs. When the Great Freight Recession hit and those positions were eliminated, many laid-off overseas workers used their newfound industry knowledge to orchestrate cargo theft from jurisdictions beyond U.S. law-enforcement reach.

The results are undeniable:

- Legitimate carriers and drivers can barely break even; trucking has become an economic backwater motor carriers that follow the rules

- Cargo theft is now an industrial-scale national-security crisis coordinated by foreign dispatchers and brokers working in concert with foreign-born drivers inside the United States.

- Despite billions spent on safety technology, fatal truck-involved crashes are up ≈40% since 2014—almost entirely because of untrained, overworked, and inexperienced drivers now operating 80,000-pound rigs.

In short, a well-intentioned but catastrophically naive campaign to “fix the driver shortage” combined with regulatory loopholes, unchecked immigration, technology back doors, and offshoring has fundamentally broken America’s trucking industry in less than a decade—and virtually no one in Washington or in corporate corner offices saw it coming.

The post How America’s trucking industry became a hellscape appeared first on FreightWaves.