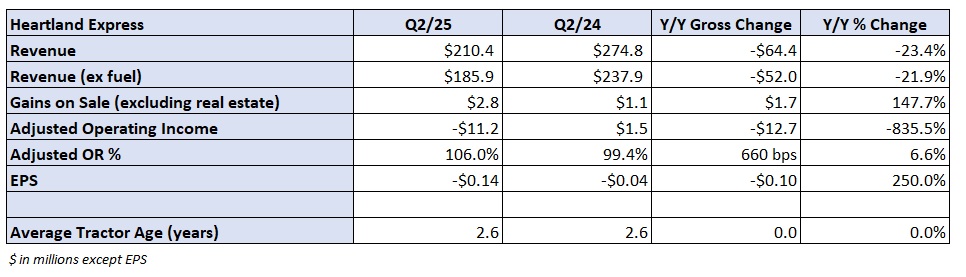

Truckload carrier Heartland Express reported an eighth consecutive net loss (excluding one-time real estate gains) during the second quarter. The North Liberty, Iowa-based company noted some sequential improvement from the first quarter but said market conditions remain unfavorable.

Heartland’s (NASDAQ: HTLD) $10.9 million net loss, or 14 cents per share, was worse than analysts’ expectations for a 7-cent-per-share loss. The result was also 10 cents worse than the year-ago loss. A $1.7 million year-over-year increase in gains on equipment sales provided a 2-cent tailwind (at a normalized tax rate) to the period.

Revenue fell 23% y/y to $210 million, which was $20 million shy of consensus. Excluding fuel surcharges, revenue was down 22% y/y. Like other TL carriers, Heartland has been culling its fleet count and walking away from some unprofitable freight. However, the latest downturn has been protracted and Heartland has been unable to orchestrate a turnaround at some of its previously acquired brands.

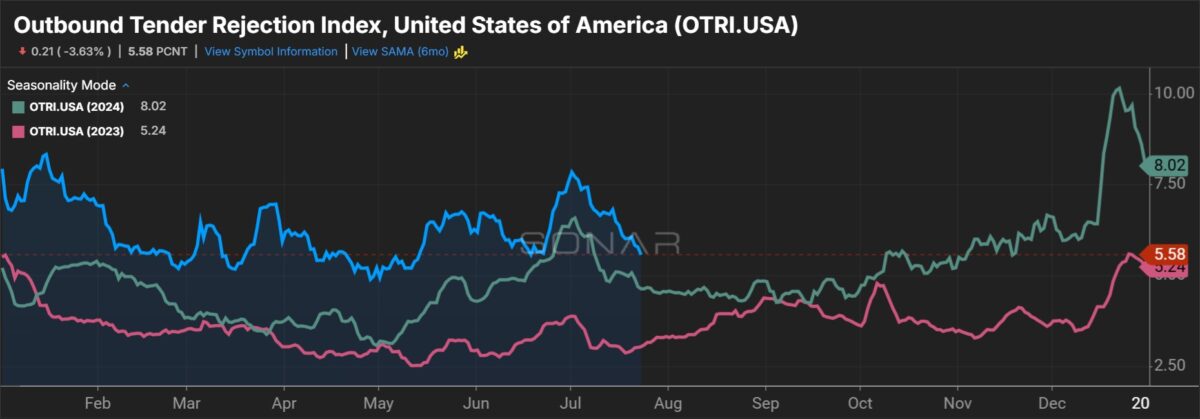

Citing an “operating environment where current capacity outpaces weak freight demand,” Heartland CEO Mike Gerdin noted that TL fundamentals remain untenable.

“These dynamics coupled with what we perceive as unsustainable pricing in many markets and rising operating costs, continue to be a significant headwind for us and all of those operating in our industry,” Gerdin said in a Thursday news release.

(Heartland does not provide operating metrics for utilization and pricing.)

The company reported a 106% adjusted operating ratio (inverse of operating margin), 660 basis points worse y/y, but 110 bps better than the first quarter. An $11.2 million adjusted operating loss was nearly a $13 million swing from the prior-year quarter.

Salaries, wages and benefits expenses as a percentage of revenue were up 140 bps y/y. Depreciation and amortization expenses (up 290 bps), operations and maintenance (up 220 bps) and insurance and claims (up 200 bps) were also detractors.

The carrier continued to reduce rents and purchased transportation expenses, which were down 160 bps in the period.

Heartland’s legacy fleet remained profitable in the quarter and its Millis Transfer fleet returned to profitability. Both brands saw 400 bps of sequential OR improvement from the first quarter.

However, Smith Transport and Contract Freighters Inc. (CFI), both of which were acquired in the summer of 2022, shortly after the onset of the freight recession, were unprofitable again. Sequential results worsened at CFI as that fleet is in the process of converting to a new TMS.

All four fleets are expected to be operating on the same TMS by the end of the year, however, it could be a while before Heartland returns to profitability.

“While we have begun to see some encouraging signs within current freight demand and customer pricing, we do not expect material improvements until later in 2025 and a resulting positive impact to future financial results and an improved freight outlook in 2026,” Gerdin said.

The company continues to deleverage the balance sheet following the acquisitions.

Operating cash flows totaled $47 million in the first half of the year. Heartland reduced net debt (inclusive of financing lease obligations) by nearly $5 million in the quarter. It has reduced debt obligations by $300 million over the last three years.

Heartland ended the quarter with $88 million available on an untapped revolving credit facility.

The average tractor age remained elevated by Heartland’s historical standards at 2.6 years.

Shares of HTLD were down 1.4% at 11:00 EDT on Thursday compared to the S&P 500, which was up 0.3%.

More FreightWaves articles by Todd Maiden:

- Knight-Swift’s belt tightening offsets soft demand

- FedEx Freight gives shippers ‘more time’ to adjust to new LTL class rules

- New LTL freight class rules take effect on Saturday

The post Heartland Express books another loss in Q2 appeared first on FreightWaves.