Great expectations or paper rates?

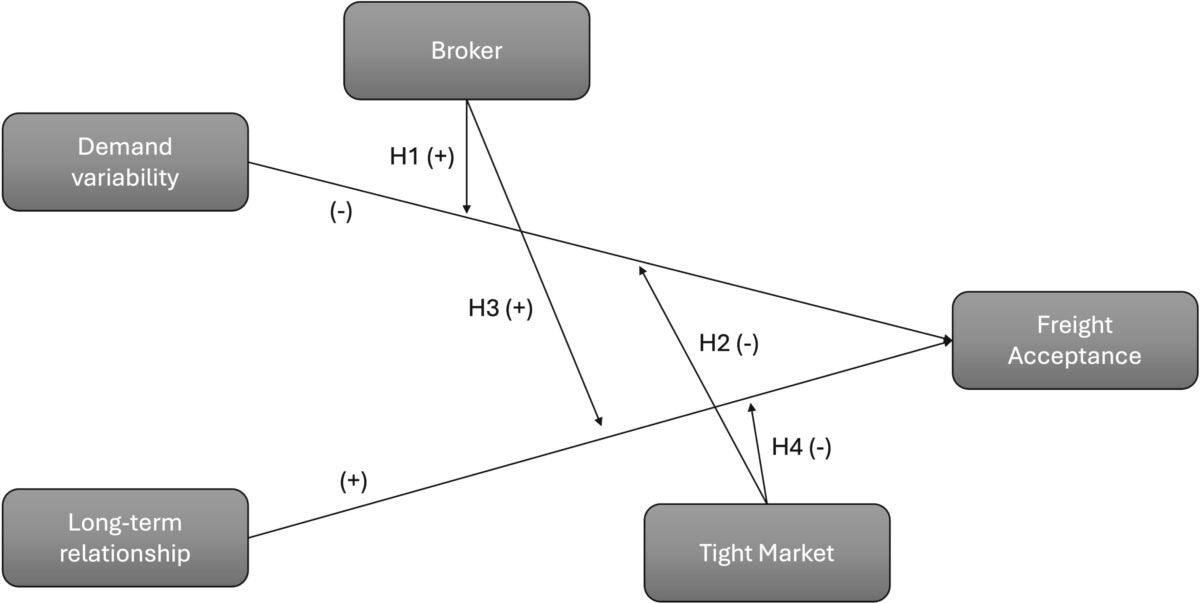

The term “paper rates” is getting a fresh look with recent research by researchers from the MIT Center for Transportation & Logistics. Angela Acocella, Chris Caplice and Yossi Sheffi divided into how shippers, carriers and market dynamics play into freight contract performance. The recently released paper defines this relationship interplay as a buyer-supplier relationship. To translate this into trucking terms, the buyer refers to a shipper who is buying transportation capacity from a seller, which is either an asset-based carrier or a third-party brokerage that buys capacity from other asset-based carriers.

Current research on shipper-carrier relationships shows that more frequent interactions, longer relationships, and consistency in either sending agreed upon volumes or accepting those tender volumes predict better service. What the report notes and examines is what happens to those relationships when market characteristics change, and if external factors can change those relationships. The report notes that this is new territory, as little research exists on impacts from the latter.

The for-hire truckload space is unique, as nonbinding, relational contracts between shippers and carriers dominate the industry, yet “Incomplete and relational contracts are the norm.” For the study, researchers examined a large transactional dataset from major transportation buyers in the U.S. truckload sector over five years, including the supplier’s decision to accept or reject the load, prices involved for each contracted load, and information about the shipper in the market. Spot market data was also examined to determine which loads were exchanged on the spot market compared to the contract space.

One big takeaway from the research was that 3PLs were better able to handle operationally difficult transportation demand than asset-based providers. Part of this came from the dataset, which included the pandemic-inspired freight demand spike. That datasheet showed that despite carriers and shippers having a long relationship, “we do find that market condition impacts relational factors: during a tightly constrained market when the outside financial option is high, suppliers are pulled from customers with which they have long-term relationships.” To put it more simply, market forces like short-term demand surges in the spot market that spike rates there can pull a carrier away from contracted relationships, making the rate “worth less than the paper it’s printed on” to steal Chicago commodities trader parlance.

For asset-based carriers, constrained by the number of trucks they have, this research helps explain why non-asset-based freight brokerages were able to grow their market share during and following the pandemic. From being a backup service provider with a reputation of overcharging, the brokerage space has exploded in growth and now competes with asset-based carriers on network capability and service.

At the end of the day, the price to move a load remains king. The research adds, “The impact of market conditions on relationship duration and supplier acceptance suggests buyers should not expect to rely solely on long relationships during tight markets. Instead, they should emphasize keeping contract prices competitive.”

Walmart becomes largest private fleet in North America

When looking at reasons behind the ongoing freight market doldrums impacting the for-hire truckload space, private fleet growth and its ramifications require additional attention. Large truckload carriers service large Fortune 100 shippers, which appear to increasingly look inward for their own transportation needs.

According to Transport Topics, Walmart is now the largest private motor carrier in North America after increasing its fleet to 12,633 power units, up 1,300 units from last year. This growth appears to be in part from the successes tied to its associate-to-driver training program, which launched in January 2023. This is a continuation of its private fleet development program launched in 2022.

Another large shipper heavily tied into the for-hire truckload space that is expanding its private fleet is Home Depot, whose June acquisition of SRS Distribution put it at No. 50 of the largest 100 private fleets. SRS Distribution is a roofing material and building supply distributor that has a private fleet of around 4,000 tractors and 750 branches and warehouses. The reasoning appears to be growth-related. Don Davis of Distribution Strategy Group writes that as of mid-2023 half of Home Depot’s sales were to business buyers, with SRS’ $10 billion in annual sales being 53% business-to-business.

For Home Depot, Davis added that part of this strategy of in-house distribution comes from a more aggressive Federal Trade Commission, which has challenged several proposed mergers under FTC Chair Lina Khan. Ian Heller, co-founder and chief strategy officer of Distribution Strategy Group, said, “Home Depot can’t buy anybody in the home center industry because the FTC isn’t going to let it go through. If Home Depot or Lowe’s want to grow, it will be by going into the highly fragmented distribution industry.”

Another for-hire turning private shipper is Dollar General, which works with for-hire fleets for both over-the-road and dedicated distribution center management. It recently increased its fleet count to more than 2,000 tractors from 1,800 as it seeks to gain more control over costs and its internal supply chain. CEO Jeff Owen said on a Q2 earnings call that the company now handles nearly half of its own outbound transportation needs. Dollar General launched its private fleet back in 2016.

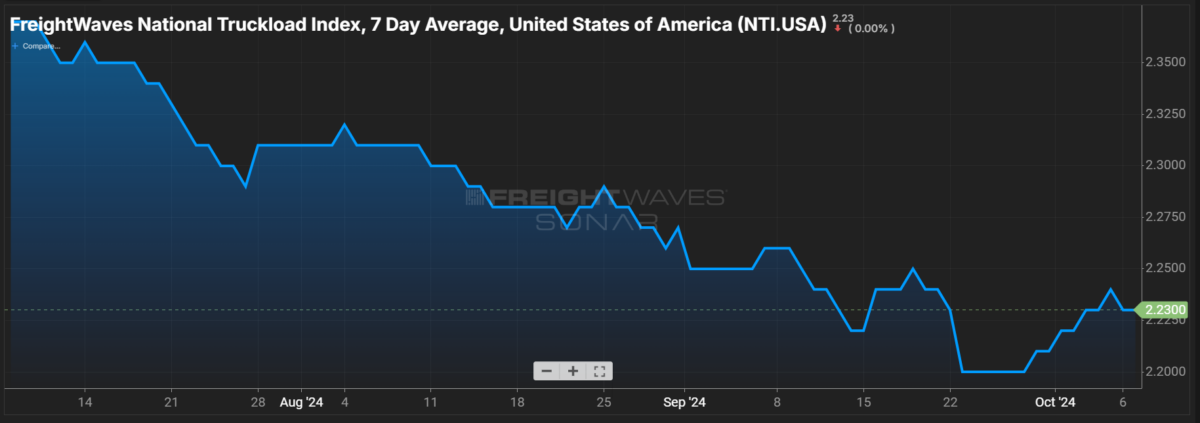

FreightWaves SONAR spotlight: Dry van spot rates see small upswing, reefer rates thaw

Summary: Dry van spot market rates finally saw a small positive upswing following a monthslong decline after the July Fourth weekend. In the past week, the FreightWaves National Truckload Index 7-Day Average rose 2 cents per mile all-in from $2.21 on Sept. 30 to $2.23. Dry van outbound tender rejection rates also saw an uptick in the past week, with VOTRI up 40 basis points w/w from 4.4% on Sept. 30 to 4.805%.

Compared to the dry van segment, reefer all-in spot market rates had a mild thaw over the past week. RTI fell 5 cents per mile w/w from $2.67 on Sept. 30 to $2.62. Compared to this time last year, RTI is down 11 cents per mile. Despite a softening in the spot market, reefer outbound tender rejection rates fared batter, increasing 169 bps w/w from 9.45% to 11.14%.

For a truckload space in search of an inflection point, the impacts following Hurricane Milton’s landfall in Tampa extending through central Florida will be the next test. Federal Emergency Management Agency and disaster relief shipments disproportionately impact contracted carriers and freight brokers as FEMA tenders loads to its approved transportation service providers.

Depending on the extent of the damage, an increase in nationwide outbound tender rejection rates may be likely, as contracted truckload capacity is rerouted for disaster relief shipments. For those unlucky shipments being rejected, a big question will be whether it filters down into the spot market or if shippers’ carrier routing guides hold fast. This behavior could be observed first by a spike in outbound tender rejection rates followed by a delayed rise in spot market all-in rates.

The Routing Guide: Links from around the web

Hurricane Milton slams into Florida, leaving trail of destruction (FreightWaves)

Disaster response: A day in the life of ALAN during a hurricane (FreightWaves)

J.B. Hunt buys another 20 Nikola Tre hydrogen fuel cell trucks (Trucking Dive)

FMCSA guidance on buying and selling MC numbers (OverDrive)

Trucking company shuts down, lays off 222 in Tampa, Jacksonville (Business Observer Florida)

Trucking industry reverses gains in new women drivers, survey finds (Trucking Dive)

Like the content? Subscribe to the newsletter here.

The post Great expectations or paper rates? appeared first on FreightWaves.