Freight volumes fell faster in July while expenditures stepped slightly higher on a year-over-year comparison. Choppiness in demand created by an uncertain trade landscape continues to overhang the industry, according to a Thursday report from Cass Information Systems.

Shipments on the multimodal index slid 1.8% from June (down 1.7% seasonally adjusted) and were down 6.9% y/y. This was the largest y/y decline in the dataset since January. Volumes have fallen sequentially in three straight months.

“Tariffs hit shipments harder in the most recent data, as paybacks began from demand pull-forwards earlier in the year, though goods prices are still relatively steady,” the report said.

The index is expected to be down 8% y/y in August, assuming normal season trends. However, the report said a recent rise in imports may mute some of the expected decline.

| July 2025 | y/y | 2-year | m/m | m/m (SA) |

| Shipments | -6.9% | -7.9% | -1.8% | -1.7% |

| Expenditures | 0.4% | -5.8% | -1.5% | -0.6% |

| TL Linehaul Index | 2.4% | -0.8% | -0.6% | NM |

Cass’ freight expenditures index, which measures total freight spend including fuel, declined 1.5% from June (0.6% lower seasonally adjusted) but was up 0.4% y/y. (Retail diesel fuel prices in July were up 5% sequentially but 1% lower y/y.)

The expenditures dataset was positive (y/y) for a fourth straight month in July following over two years of declines. On a two-year-stacked comparison, the declines narrowed again in the month to 5.8%.

Netting the decline in shipments from the increase in expenditures shows actual freight rates were up nearly 8% y/y in July. A mix shift to truckload from less-than-truckload again drove the change to the inferred rate index, the report said.

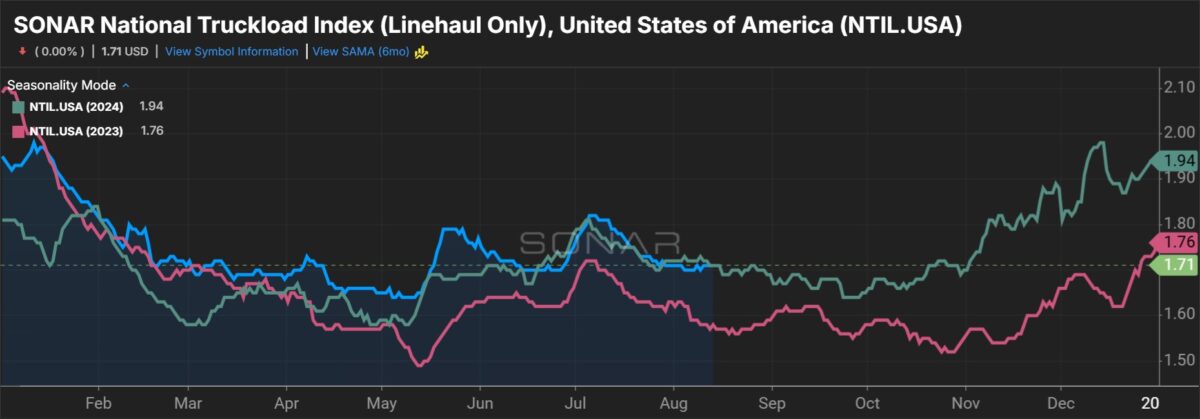

Cass’ TL linehaul index, which tracks rates excluding fuel and accessorial surcharges, dipped 0.6% sequentially but was 2.4% higher y/y. The dataset has been up on a y/y comparison in every month this year. This was the largest y/y gain since September 2022.

The index is “on track for a small increase in 2025.”

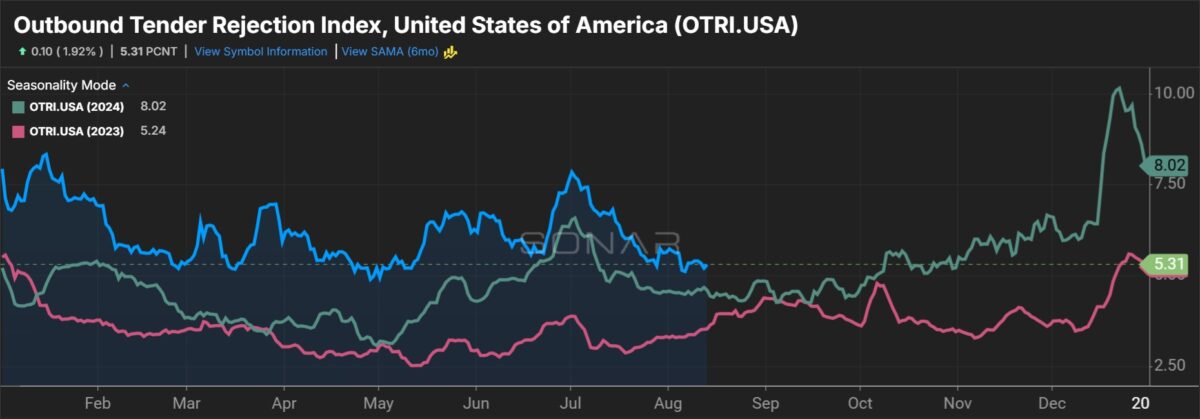

“As the economy is likely to absorb the effects of tariffs over the next several months, our freight demand outlook remains cautious,” the report said. “But the silver lining of lower [commercial] vehicle production and lost manufacturing jobs is that tighter capacity will likely drive freight back to the for-hire market next year.”

Data used in the indexes comes from freight bills paid by Cass (NASDAQ: CASS), a provider of payment management solutions. Cass processes $36 billion in freight payables annually on behalf of customers.

More FreightWaves articles by Todd Maiden:

- Landstar says $3.4M jury verdict, other charges to weigh on Q3

- Forward Air posts Q2 EBITDA beat; investors waiting to see if company will be sold

- GXO encouraged by pre-peak season activity, well positioned for 2026

The post Freight shipment decline streak extends to 30 months, Cass says appeared first on FreightWaves.