Tariffs have been a major focus of recent installments of FreightWaves’ monthly State of Freight webinar, held in conjunction with SONAR, but they took a back seat this month to various data points.

What those data points are saying–whether they are about company finances or numbers on demand and capacity–was the focus of the July webinar with FreightWaves and SONAR CEO Craig Fuller and Zach Strickland, SONAR’s director of freight market intelligence. Here are five takeaways from Thursday’s session.

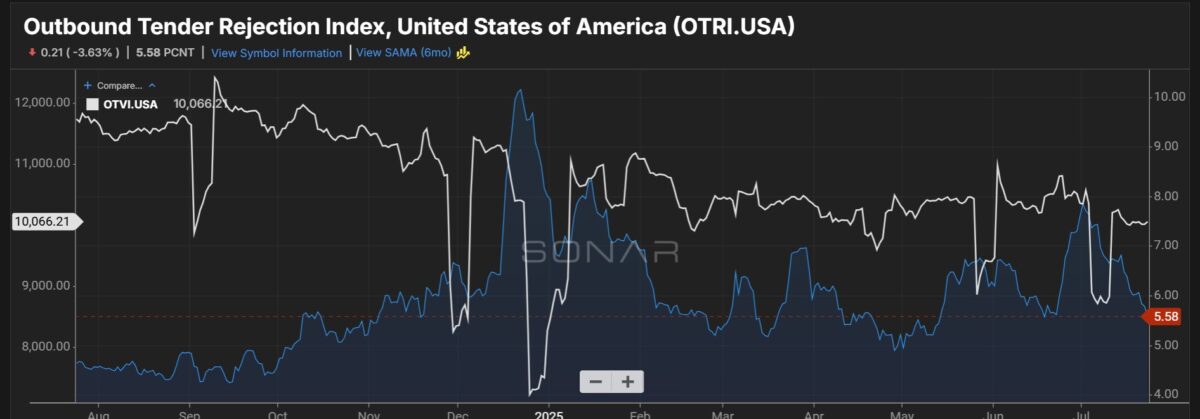

One index rising, the other falling

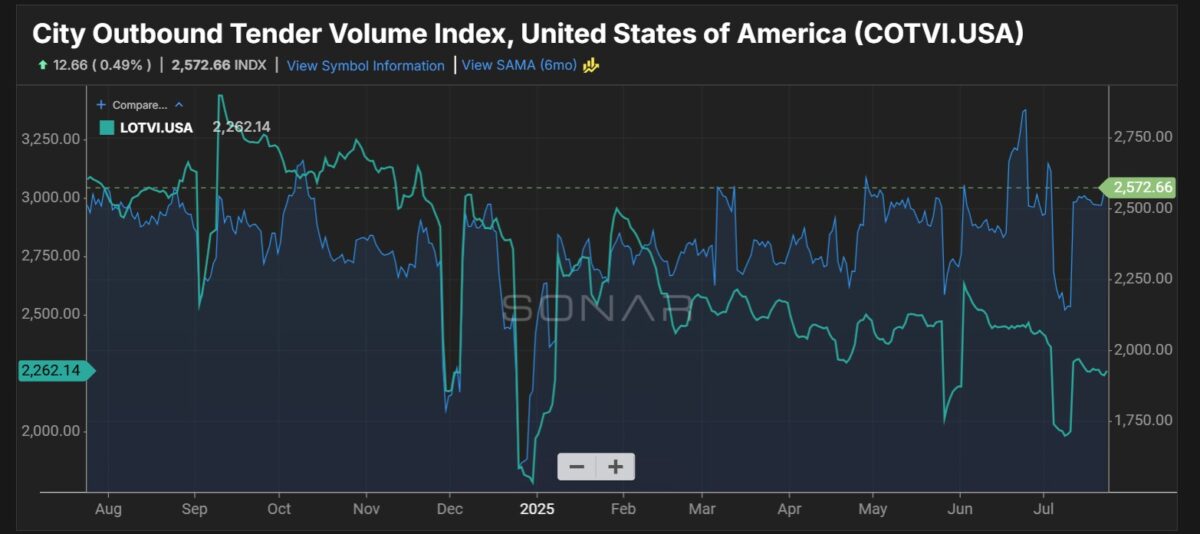

Two trends are showing up in SONAR data that at times can reflect a degree of correlation but isn’t doing so now: the outbound tender rejection index (OTRI) is rising, while the outbound tender volume index (OTVI) is falling.

The OTVI is reflecting what might be expected given that everybody in the sector still sees the freight market in some degree of a recession. But the OTRI is rising, a sign of tightening capacity as independent owner operators take their trucks off the road and fleets continue to disappear, not able to survive current conditions.

Fuller said capacity had been on an upswing for several years, “with a flood of new participants, companies and truck drivers.”

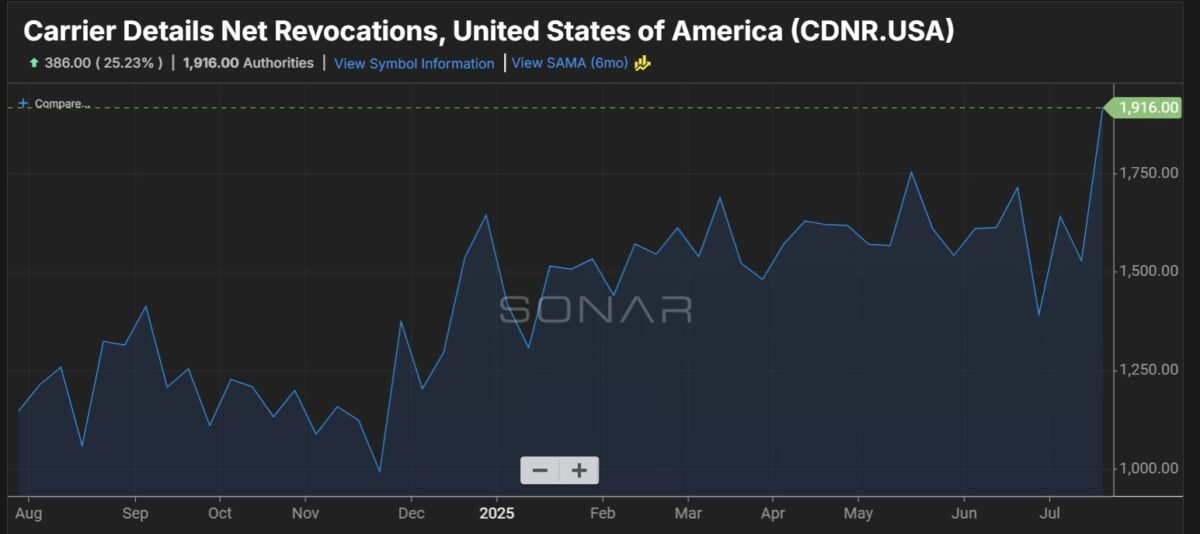

But Strickland showed a chart showing recent increases in net revocations of motor carrier authorities granted by the Federal Motor Carrier Safety Administration (FMCSA).

Fuller said he believed enforcement of the English-language only was having just a “fractional” impact on capacity. But it could become a significant issue if there is a rebound in the housing market that leads to more trucking demand.

Strickland and Fuller discussed possible other reasons for the rise in revocations, including impacts from the Drug & Alcohol Clearinghouse. “This is an ongoing thing that we really need to pay attention to,” Strickland said.

Earnings season and what it is saying

The July State of Freight webinar occurred in the middle of numerous transportation companies releasing their quarterly reports. The performance of a few companies came in for discussion, including Heartland Express (NASDAQ: HTLD), which posted yet another quarterly loss Thursday.

Fuller noted that Heartland’s acquisitions over the years have been in the commodity truckload business, “based on a 1990’s long haul business that is no longer there.”

He also spoke from personal experience as a member of the family that founded U.S. Xpress, whose profile and financial troubles were similar to what Heartland Express is going through. U.S. Xpress eventually was purchased by Knight Swift.

“The long haul business is dead for those truckload operators,” Fuller said. “Unfortuantely, Heartland just can’t seem to get a handle on that.”

U.S. Xpress is now a division of Knight Swift (NYSE: KNX). In Knight Swift’s second quarter earnings report, the company said U.S. Xpress had seen its operating margin improve by 300 basis points over the last year. “Knight Swift has really proven that it can bring U.S. Xpress back to some level of sustainability,” Fuller said, noting the contrast with Heartland’s struggles.

Short haul ascendant

The discussion about Heartland’s ties to long haul truckload activity led Strickland to pull up a chart from SONAR showing its index for short haul versus long haul activity. Generally, long haul runs at a higher index, but that has flipped in recent months.

The data comes from tenders. Long haul business is anything over 800 miles, Strickland said.

Fuller said he believes the shift is part of a longer term trend. But he also said he believes the sort of reindustrialization of the U.S. economy being pursued by the Trump administration could reverse that change.

But there’s a risk for trucking, he said. As the long haul sector of the freight market becomes more dependent on import activity, “then a lot of that is going to be containerized and going to go on the railroads.”

Across the country on one company’s set of tracks

With negotiations ongoing between Norfolk Southern (NYSE: NSC) and Union Pacific (NYSE: UNP) that would create the country’s first true transcontinental railroad, the impact on the transportation sector became a topic of discussion.

Describing railroads as a “dream business,” Fuller noted that Union Pacific profitability has exceeded that of Microsoft at times.

“The consolidation ends up making them that much more profitable,” he said. As to the question of who else might benefit from a consolidation besides the railroads, Fuller said “I would argue that rarely does a real merger benefit the shippers.”

However, a consolidation between the two railroads, UP in the west and NSC in the east, would likely aid large shippers like Amazon. .

Owner operators and brokers would likely lose, he said, but he added that large intermodal carriers such as J.B. Hunt (NASDAQ: JBHT) or HubGroup (NASDAQ: HUBG) would benefit. “I think the traditional railroad shippers, the big commodity players like coal or grains, they probably lose because the service quality will likely deteriorate for them. But it should improve for intermodal.”

A revival of freight tech

Fuller said that “one of the most exciting things happening at freight now” is a revived interest in freight technology.

Prior to the pandemic, Fuller said there were a slew of technology vendors offering new products, backed by venture capital.

In his discussion, he only mentioned one specific company that has been active: Triumph Financial (NASDAQ: TFIN), which bought Greenscreens AI earlier this year and is looking to expand its Intelligence division.

But beyond that, he said, “there’s just a lot of deal flow happening.” He described much of the activity as being around “next generation” technology, like freight tech powered by AI.

More articles by John Kingston

Yet another broker liability case, this time in the Fifth Circuit, adds to the growing mix

Much happened at Triumph Financial during the quarter; USPS dispute settled

Supply chain software provider Manhattan Associates soars after strong revenue growth

The post Five takeaways from the State of Freight for July: What earnings and the indices are saying about the market appeared first on FreightWaves.