Ryder System managed to make more money than a year ago even after a revenue performance that was essentially flat from the third quarter of 2024.

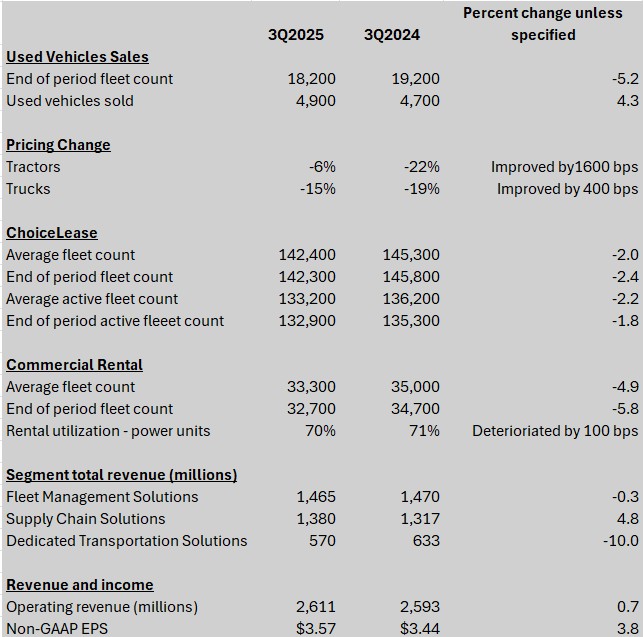

Total revenue at Ryder (NYSE: R) was $3.17 billion, up a minuscule amount from $3.168 billion a year earlier. But non-GAAP earnings per share were $3.57, compared to $3.44 a year ago.

Dedicated Transportation Solutions, the Ryder segment that has been targeted as a key growth engine, reflected the weakness of the trucking market by seeing a 10% decline in revenue to $570 million. DTS has grown sharply in recent years as a result of the Ryder acquisition of Cardinal Logistics.

But the fact that DTS is essentially a trucking company is hitting its revenue in the ongoing freight recession. The $570 million in revenue was down sequentially from $606 million in the second quarter. And that $606 million was down from $635 million in the second quarter of 2024, the first full three-month period that reflected the Cardinal acquisition.

In brief comments released with the earnings, prior to an earnings call with analysts, Ryder CEO Robert Sanchez said “benefits in DTS from strong operating performance and acquisition synergies were offset by fleet reductions reflecting weaker freight market conditions.”

Despite the drop in revenue, earnings before taxes at DTS were $36 million, unchanged from a year earlier. They were down just $1 million sequentially from the second quarter.

The core leasing business at Ryder, Fleet Management Solutions, saw a minor drop of $5 million in revenue from a year earlier. But earnings before taxes were $146 million, up 11% from $132 million a year earlier.

Supply Chain Solutions, the contract logistics segment of Ryder, had the best revenue growth of the three divisions. Its revenue rose 5% year-on-year to $1.38 billion, but earnings before taxes dropped 8% to $86 million.

Fleet Management Solutions is where used vehicle sales hits the company’s earnings. Ryder reported that used vehicle pricing was down 6% and 15%, respectively, for tractor and truck sales compared to the second quarter of 2024. But sequentially from the second quarter, tractor pricing was unchanged and truck pricing was up 7%, “reflecting a higher retail mix,” Ryder said.

Fuel was a definite tailwind for Ryder in the quarter. A year ago, the company spent $116 million on fuel services. That dropped to $94 million in the second quarter of 2025.

Ryder made minor adjustments in its forecast. It now expects fiscal non-GAAP EPS of $12.85-$13.05, down from $12.85-$13.30. Most other forecast numbers were unchanged.

Ryder stock was hit hard in early trading. At approximately 10:15 a.m., Ryder was down $13.25 to $169.56, a decline of 7.25%. This was despite the fact that according to SeekingAlpha, reported revenue was better than consensus forecasts by $10 million, and the non-GAAP EPS also was higher than consensus by 3 cts/share. Ryder stock has been strong for most of the last year, up just under 19% for the 52 weeks. But it has struggled recently. Its 52-week high of $195.48 was set just a few weeks ago on October 6.

More articles by John Kingston

China expert Miller: why supply chain ‘choke points’ matter most

Trailer manufacturer Wabash’s nuclear verdict lawsuit settled

Factoring companies squeezed by slowing shipper payments: Alsobrooks

The post First look: Ryder’s earnings eke out a gain, revenue stagnant appeared first on FreightWaves.