Chicago-based Echo Global Logistics announced that it has signed a definitive agreement to acquire Reno, Nevada-headquartered ITS Logistics, one of North America’s fastest-growing third-party logistics (3PL) providers. The deal, announced Wednesday, will create a combined entity with pro forma 2025 revenue of approximately $5.4 billion, expanding Echo’s scale while integrating ITS’s specialized solutions with Echo’s advanced technology platform.

Founded in 1999 with just two tractors, two drivers, and 40,000 square feet of warehouse space, ITS has evolved into a multifaceted 3PL powerhouse. By 2013, it spun up its asset-light brokerage division, which crossed the $1 billion revenue mark in 2022.

Exceeding $1.3 billion in revenue for 2025, ITS’s headcount tops 1,200 nationwide, with 550 employees at its Reno headquarters. Its portfolio includes North America’s No. 18 ranked asset-light freight brokerage and No. 12 ranked drayage and intermodal solutions, alongside an asset-based dedicated fleet, port and rail drayage, truckload (TL), less-than-truckload (LTL), small parcel, direct-to-consumer, and direct-to-retail delivery covering over 95% of the U.S. in under two days. Standout offerings like its DropFleet drop trailer and trailer pool program, freight security, omnichannel fulfillment, and sustainability-focused strategies have earned it a reputation for tackling complex supply chain challenges.

“This acquisition represents a meaningful strategic opportunity for Echo and our customers,” said Doug Waggoner, Chief Executive Officer at Echo, in a statement. “ITS has built a highly differentiated set of solutions, including drop trailer and trailer pool capabilities, backed by best-in-class execution that delivers reliability and flexibility across complex networks. By applying Echo’s proprietary technology, advanced analytics, and growing AI capabilities to the ITS solution set, we will strengthen our value proposition for a broader range of customers.”

The move aligns with Echo’s history of growth through acquisitions, a strategy that has transformed the company from a non-asset-based truckload brokerage into a diversified logistics leader. Since its founding in 2005, Echo has completed at least 23 acquisitions, including tuck-ins like the 2012 purchase of Purple Plum Logistics for truckload brokerage, the 2015 acquisition of Xpress Solutions for LTL and TL expansion, and larger plays such as the $420 million buyout of Command Transportation in 2015. More recently, Echo expanded its service offerings with the 2022 acquisition of Roadtex Transportation for expedited LTL and temperature-controlled warehousing, Fastmore Logistics for global freight forwarding, and the August 2025 purchase of FreightSaver for managed transportation. Echo itself went private in 2021 via a $1.3 billion acquisition by The Jordan Company.

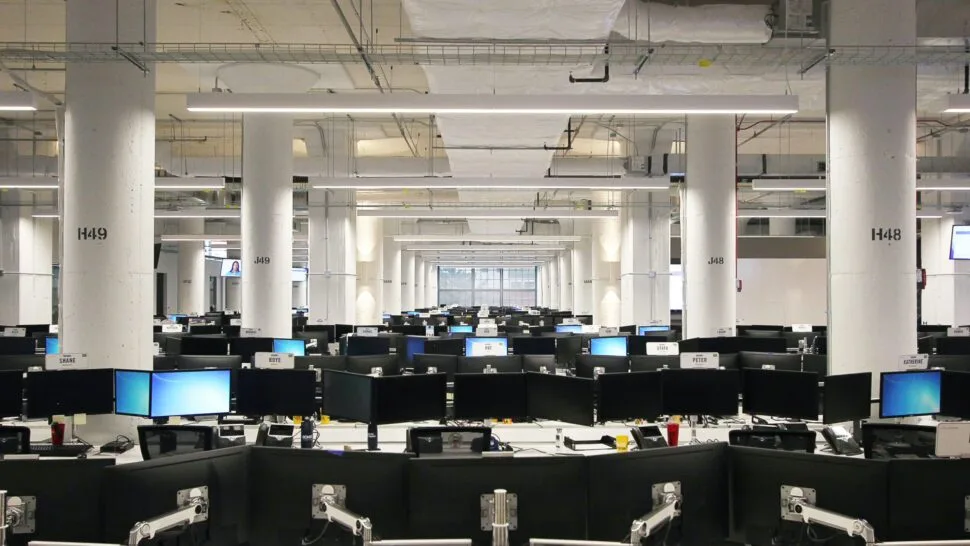

Historically focused on non-asset truckload brokerage, Echo has leveraged its low-capital model—requiring minimal capex and generating $40-60 million in annual free cash flow—to build a tech-centric operation. Its proprietary transportation management system, developed in-house since inception, incorporates automation, machine learning, and AI for pricing, capacity sourcing, shipment execution, and exception management. Innovations like the EchoShip platform for partial truckload shipping and AI-driven fraud prevention have positioned Echo as a leader in data science and tech integration. In temperature-controlled logistics, for instance, the Roadtex integration enhanced Echo’s reefer fleet and warehousing, enabling precise 45-60 degree Fahrenheit control for perishables.

The ITS deal accelerates this evolution by blending Echo’s tech prowess with ITS’s asset-light and asset-based strengths. ITS will retain its leadership, including CEO Scott Pruneau, and customer-facing structure, while gaining access to Echo’s carrier network, cross-border expertise, and multimodal offerings.

“Joining forces with Echo marks an exciting new chapter for ITS Logistics,” said Pruneau. “Echo’s truckload brokerage scale, managed transportation platform, strong cross-border capabilities, and broad multimodal offering — combined with its technology platform and AI-driven innovation — will enable us to elevate our service offerings and provide enhanced value to our customers. Together, we will be well equipped to help customers navigate the increasing complexity of today’s supply chain, offering smarter, more connected execution and powerful solutions that drive results.”

The combined platform is poised to address more of customers’ end-to-end needs, from network optimization and real-time insights to sophisticated value-added services like AI-enhanced trailer pooling and sustainable transportation. ITS’s proprietary tools, such as ITS Drive TMS for truckload and drayage, and ITS Engage AI suite for supply chain management, will integrate with Echo’s ecosystem, fostering innovation.

With over 60 locations across North America, Echo’s expanded footprint—now including ITS’s 4 million square feet of warehouse space—positions the company to capitalize on a fragmented market. The transaction, advised by Goldman Sachs & Co. LLC and UBS for Echo, and J.P. Morgan and Jefferies for ITS, is expected to close in the first half of 2026, pending regulatory approvals.

This brokerage mega-merger underscores a broader industry trend toward consolidation, where tech-enabled scale allows companies to bid aggressively for target companies. For shippers, the Echo – ITS acquisition presents a comprehensive freight logistics partner with formidable new capabilities.

The post Echo Global Logistics acquires ITS Logistics to create $5.4 billion combined entity appeared first on FreightWaves.