Shipping lines are extending their direct call services in an effort to absorb excess capacity and maintain schedules as port congestion in both Asia and Europe takes hold following the Houthi attacks on shipping.

Consultancy MDS Transmodal has conducted an analysis of vessel deployment and new services which reveals that carriers are deploying vessels in direct services with fewer port calls in an effort to avoid delays through congestion, helping them to maintain schedules better.

Analyst Antonella Teodoro said: “The data from the past year indicates a trend towards direct services in deepsea shipping, with a notable ‘pause’ on the hub-and-spoke model. The resilience of smaller vessels and the strategic deployment of capacity towards non-hub ports highlights the industry’s adaptive strategies in response to evolving market demands in the context of the ongoing Red Sea crisis.”

Lengthening journey times, mainly caused by re-routing via the Cape of Good Hope away from the Bab al-Mandeb Strait, along with a reduction in the number of ports in service rotations supports the view that carriers have made a limited, but significant shift away from hub and spoke strategies.

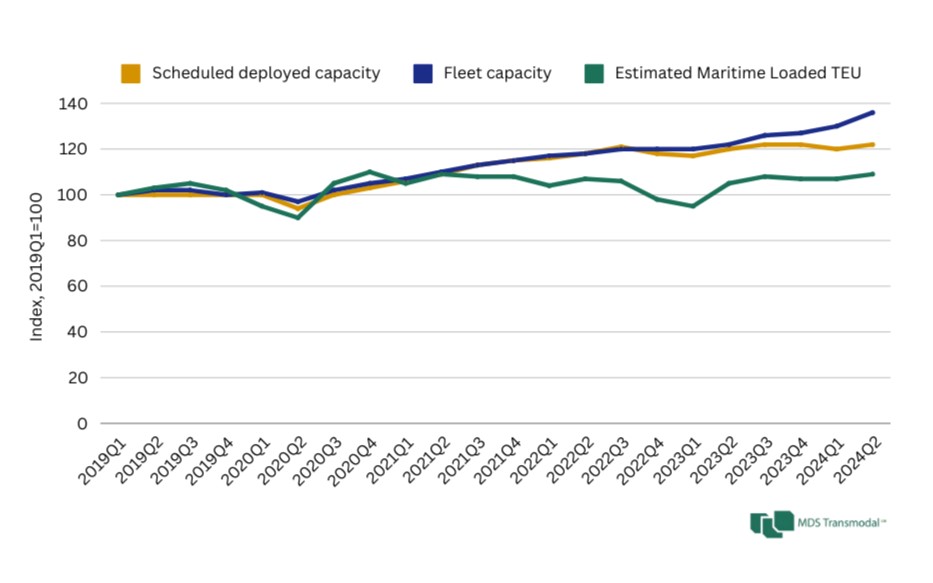

As shown in the following graph, fleet capacity has been continually growing faster than scheduled deployed capacity since around 2022Q4, with the gap between the two enlarging.

Figure 1: Scheduled deployed capacity, fleet capacity and trade flows, Index 2019Q1=100 (Deepsea routes only)

Teodoro added that this shift raises the question: “Is this due to a preference for a hub-and-spoke model or a pivot towards more direct services?”

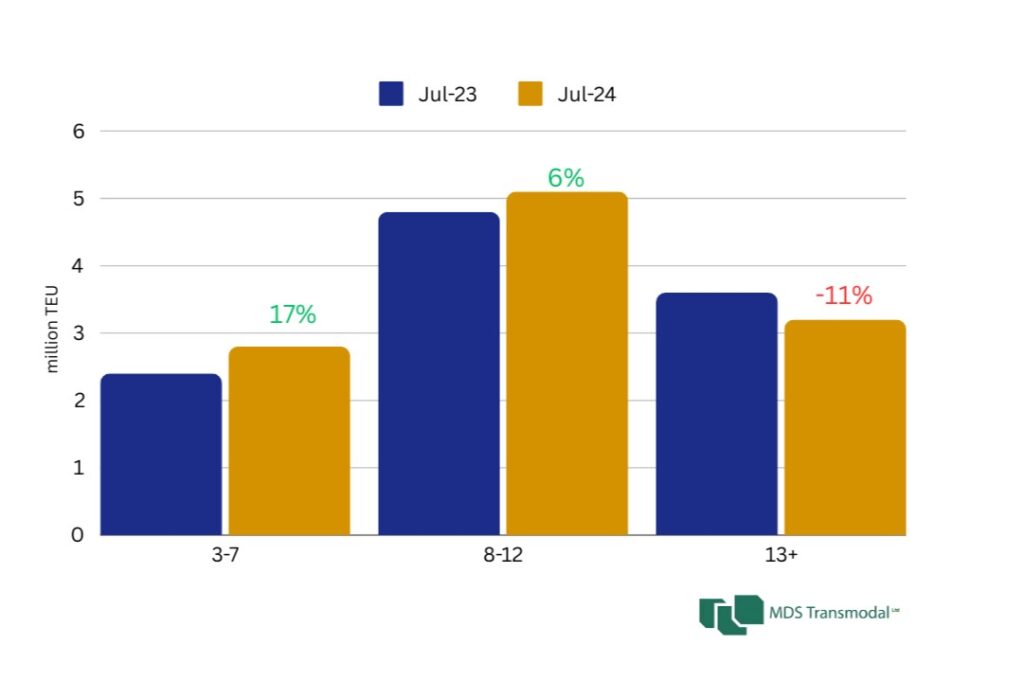

Figure 2: Scheduled deployed capacity (million TEU) on deepsea routes calling at 3+ ports

According to MDS Transmodal analysis, seen in Figure 2, the capacity deployed and the number of ports in rotation seen this year reveals some critical changes from July 2023.

The chart shows an increase of 17% in capacity calling at just three to seven ports, a 400,000 teu increase to 2.8 million teu, now accounting for 25% of total capacity (up from 22%); while rotations involving eight-12 ports saw a 6% capacity increase in capacity, of 300,000 teu to 5.1m teu, accounting for 46% of total capacity, up from 44%.

However, service loops of 13 or more ports experienced an 11% decrease in capacity, declining by 400,000 TEUs, to 3.2 million TEUs, now accounting for 29% of total capacity, down from 33%.

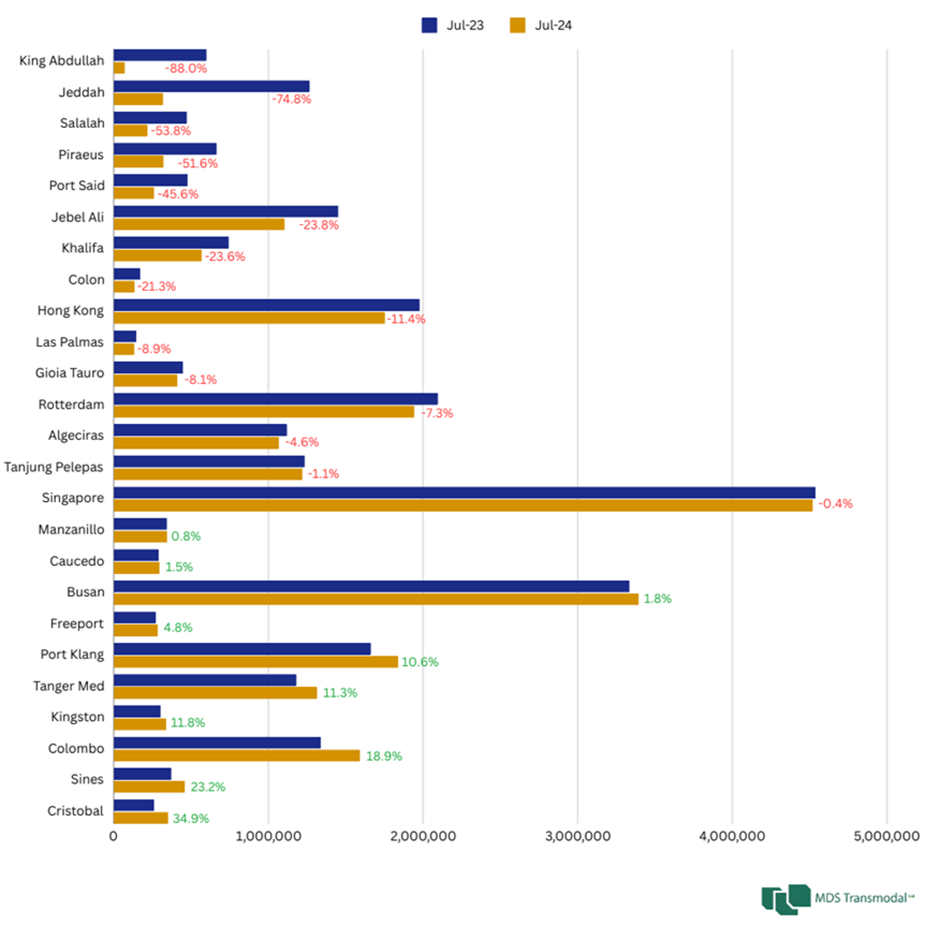

“Drilling down into the analysis to the port level, the capacity deployed on 25 key global hubs, mainly transhipment ports, reveals that the number of hubs experiencing an increase in standing capacity is lower than the number of hubs seeing a decline in the annual capacity offered by each service,” explained Teodoro.

Figure 3: Scheduled deployed capacity and fleet capacity on deepsea routes calling at 3+ ports – predominately hub ports (TEU)

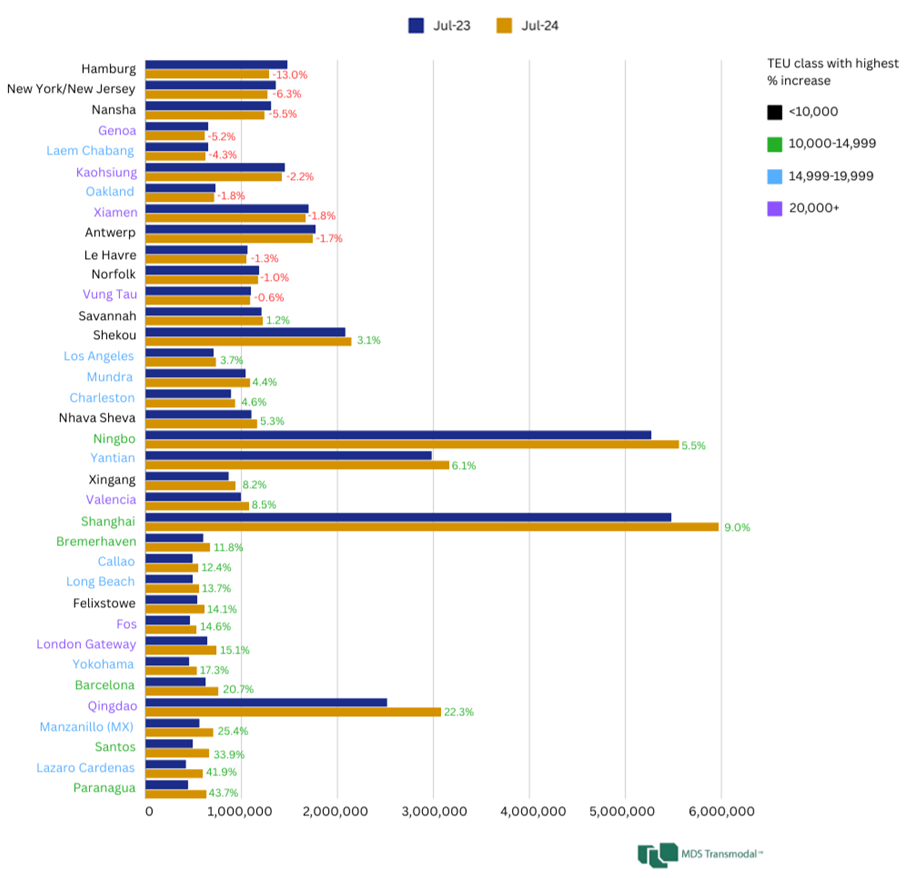

However, the analyst goes further: “Extending the analysis to predominately gateway ports and focusing on ports with a capacity of over 500,000 TEUs, in July 2024, our data suggests that hub-and-spoke models are not prevailing; instead, there is a shift towards direct services, as they often utilise smaller vessels offering a more resilient option compared to the larger vessels typically associated with hub-and-spoke networks.”

MDS Transmodal believes that confirmation that the hub-and-spoke model has been “paused” can be found in the vessel deployment trends.

Figure 4: Scheduled deployed capacity and fleet capacity on deepsea routes calling at 3+ ports – predominately hub and gateway ports with over 0.5million TEU scheduled capacity in Jul24 (TEU)

Ships under 15,000 TEUs are increasingly accounting for a larger proportion of capacity in shorter rotations compared to larger vessels.

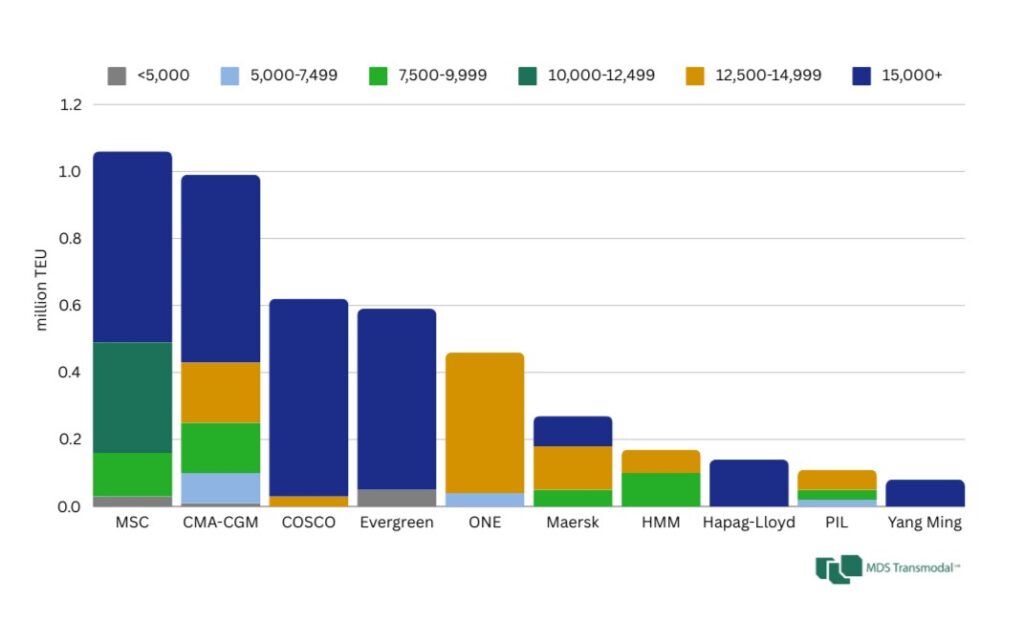

Figure 5: Orderbook for the top 10 shipping lines and by size of ship (based on June 2024 data) – fleet capacity (millions TEU)

“This trend underscores the industry’s shift towards servicing non-hub ports more frequently, enhancing the efficiency and directness of their operations,” explained Teodoro.

Moreover, Teodoro believes that direct services will likely remain a focal point for shipping companies worldwide as the industry continues to navigate the need to find the balance between efficiency and frequency.

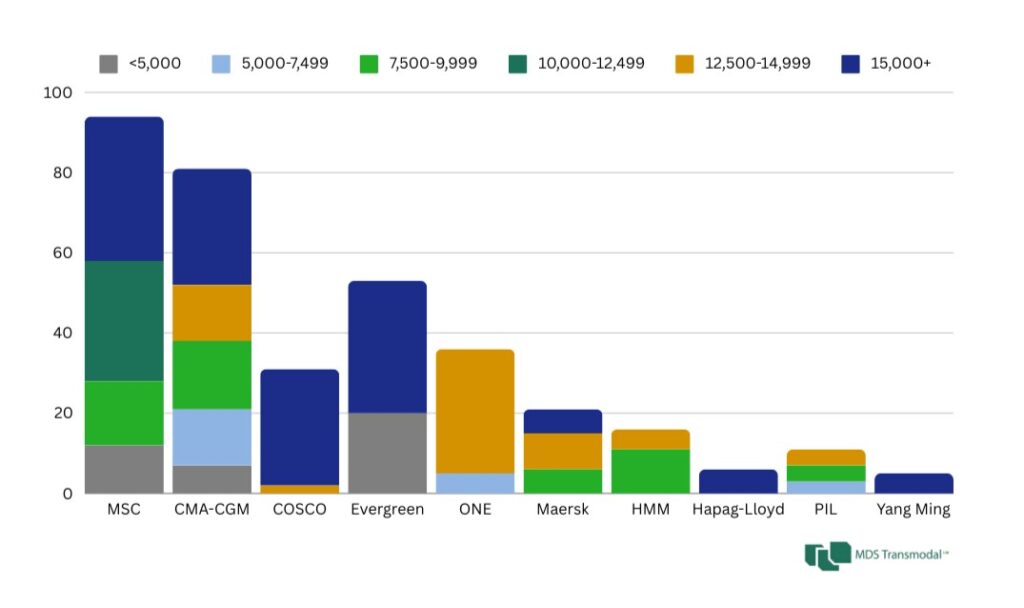

Figure 6: Orderbook for the top 10 shipping lines and by size of ship (based on June 2024 data) – number of ships

[script]>

jQuery(document).ready(function(){

jQuery(‘#dd_562660dc777dffe696f315892e482c40’).on(‘change’, function() {

jQuery(‘#amount_562660dc777dffe696f315892e482c40’).val(this.value);

});

});