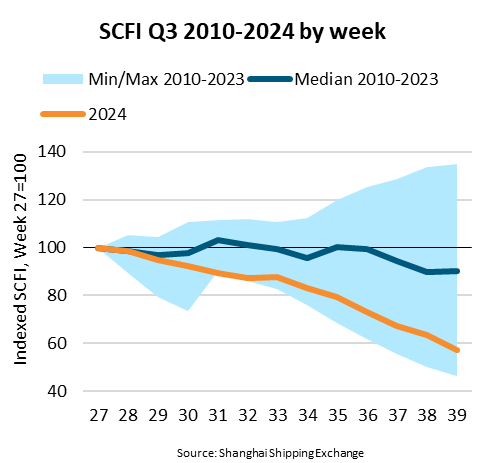

“The Shanghai Containerized Freight Index (SCFI) fell another 10% in week 39. In total, the SCFI has dropped 43% during the third quarter, the largest Q3 drop in a year not affected by the COVID pandemic (2020-2023) since the SCFI was launched in October 2009,” stated Niels Rasmussen, Chief Shipping Analyst at BIMCO.

The only third quarter to see a bigger decline in spot rates was in 2022 when a 24-month boom in cargo volumes and high consumer spending during the pandemic was replaced by a quick drop in volumes and spot rates.

The SCFI measures spot container rates for container loading in Shanghai. It gives a strong indication of the market’s supply/demand balance. Carriers quickly adjust spot rates up or down in response to high or low capacity utilisation, whereas contract rates are often slower to respond to changes in market conditions.

“The China Containerized Freight Index (CCFI) that measures average freight rates for containers loading in China has fallen 19% during the third quarter and has equally seen the worst third quarter development in a non-COVID year since 2009,” added Rasmussen.

Freight rates to key trades into Europe, the Mediterranean, the US West Coast and the US East Coast have been among those declining the most. Spot rates in Europe and the Mediterranean have dropped nearly 55% whereas average rates are down about 20%. The US West Coast and US East Coast markets have seen spot rates fall about 40% and average freight rates nearly 20%.

Time charter rates and freight rates have historically moved together. However, in the third quarter, average time charter rates remained stable. The limited availability of ships has supported rates, and the Red Sea rerouting continues to underpin demand. At the same time, the upcoming changes to global alliance structures may also add demand as carriers look for the ships required in the new service plans.

An earlier-than-normal peak in volumes along with lower bunker prices may help explain the adverse development in third quarter rates. In the short-term, the strike in US East Coast and Gulf Coast ports may temporarily help lift rates to those markets as well as the overall indices.

“Despite the SCFI and CCFI remaining 140% and 90% higher than last year, the medium- to long-term freight rate development must be a concern for carriers, especially if ships can return to the Red Sea. The 10% of the fleet that has been absorbed by the rerouting will at some point be released and add to supply growth along with any fleet growth (nearly 7% in 2025). It therefore appears unlikely that demand will be able to keep pace,” stated Rasmussen.

This article was written by Niels Rasmussen, Chief Shipping Analyst at BIMCO