Container market performance this week reflects the ongoing volatility in global trade, with shipping companies experiencing a mix of gains and losses. While some carriers managed to post positive returns, others struggled with sharp declines, impacted by fluctuating demand, geopolitical factors and external economic pressures. The latest data provides a comprehensive view of how major players navigated these challenges, highlighting key trends and shifts in the industry.

The following graphs illustrate these movements, offering valuable insights into the sector’s current state.

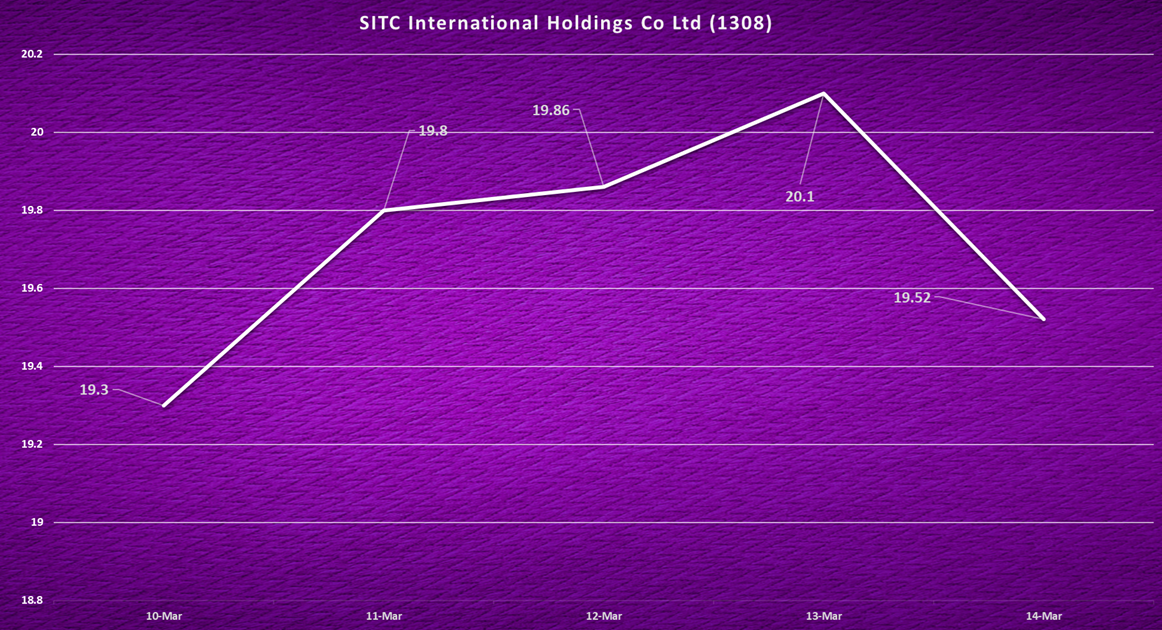

- SITC International Holdings Co Ltd (1308) – HK$

SITC displayed notable fluctuations this week, reaching a peak of HK$20.1 before retracting to HK$19.52. The initial upward momentum suggested bullish sentiment, possibly driven by improved regional trade activity or favorable freight rates. However, the subsequent decline indicates profit-taking or macroeconomic uncertainties impacting investor confidence. Despite the dip, SITC remains resilient, reflecting overall strength in intra-Asia trade lanes. Investors will be monitoring volume trends and operational efficiency closely in the coming sessions.

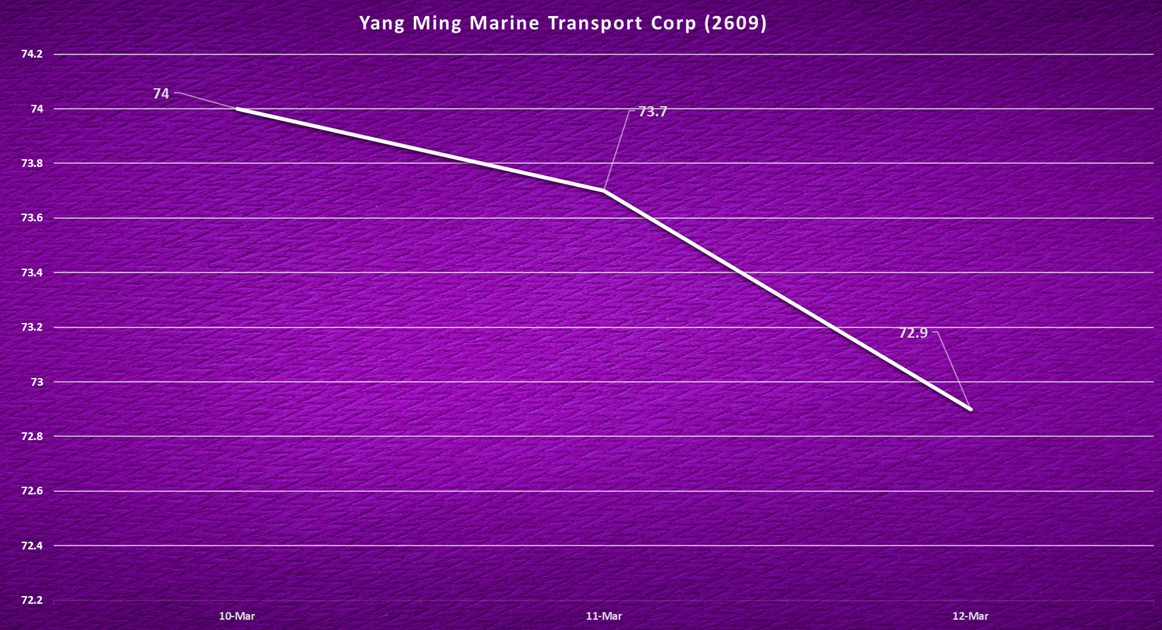

- Yang Ming Marine Transport Corp (2609) – NT$

Yang Ming saw a gradual downturn from NT$74 to NT$72.9, suggesting market hesitation amid concerns about global shipping demand. While the company benefits from solid trans-Pacific routes, recent softness in freight rates may have pressured the stock. Investors are weighing the potential of capacity adjustments and operational cost optimizations. A recovery in spot rates or stronger forward bookings could be necessary catalysts for reversing this short-term slide.

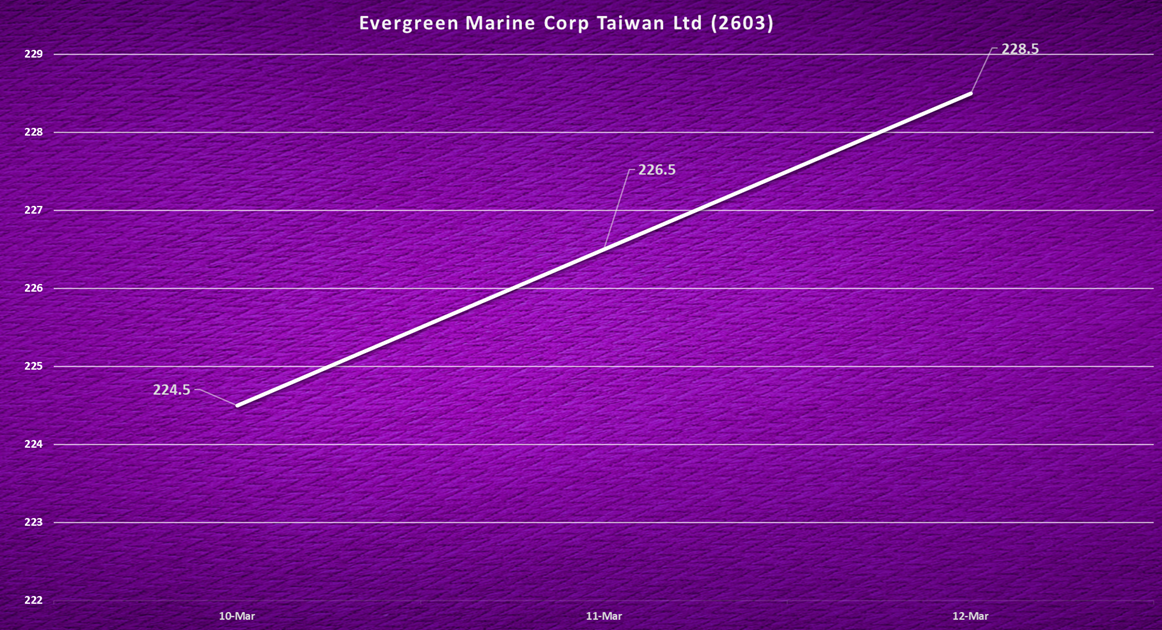

- Evergreen Marine Corp Taiwan Ltd (2603) – NT$

Evergreen posted a strong performance this week, advancing from NT$224.5 to NT$228.5. The consistent uptrend reflects robust demand and possibly improved rate conditions in key trade lanes. As a leading carrier, Evergreen’s ability to optimize fleet utilization and manage costs efficiently continues to support its valuation. Investors will be watching for any capacity adjustments or industry-wide rate shifts that could impact forward momentum.

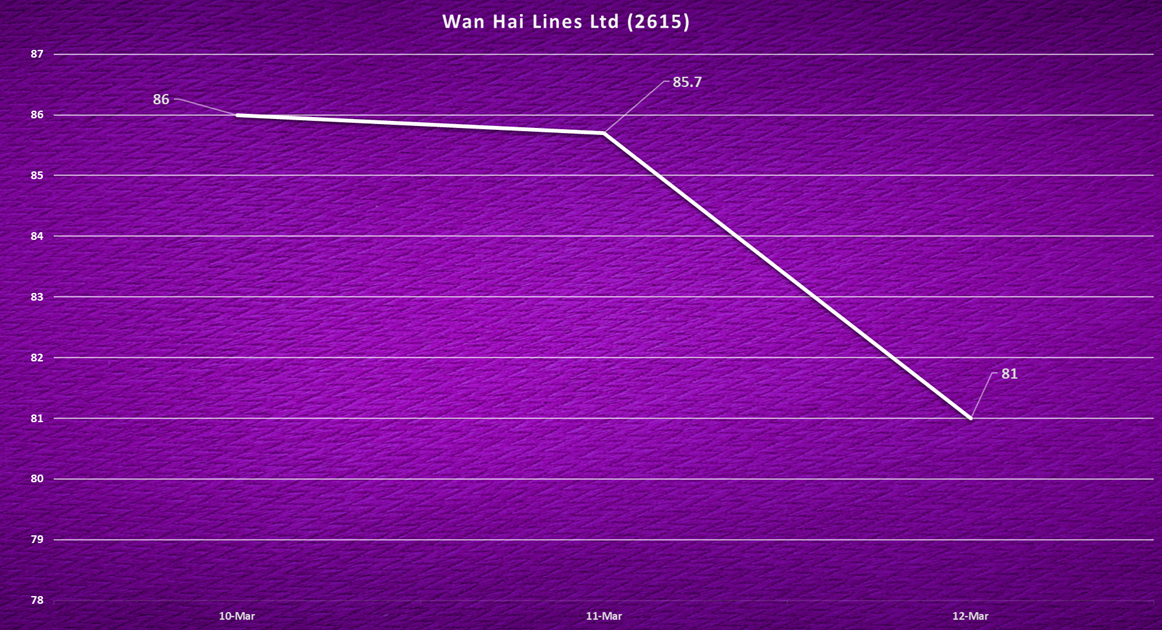

- Wan Hai Lines Ltd (2615) – NT$

Wan Hai encountered a more pronounced decline, dropping from NT$86 to NT$81 by week’s end. This signals investor caution, likely driven by market-wide concerns about overcapacity and fluctuating regional trade volumes. Despite strong intra-Asia operations, the company may face margin pressure if rate volatility persists. Rebounding from this level could depend on operational adjustments or broader improvements in container demand.

- COSCO SHIPPING Holdings Co Ltd ADR (CICOY) – US$

COSCO demonstrated some strength early in the week, climbing to US$7.72, but later retreated to US$7.55. This suggests a mix of optimism and market resistance, possibly due to macroeconomic uncertainty or concerns over geopolitical disruptions affecting global trade. COSCO’s diversified exposure across multiple trade lanes provides a level of resilience, but investors remain cautious about the overall outlook for Chinese exports.

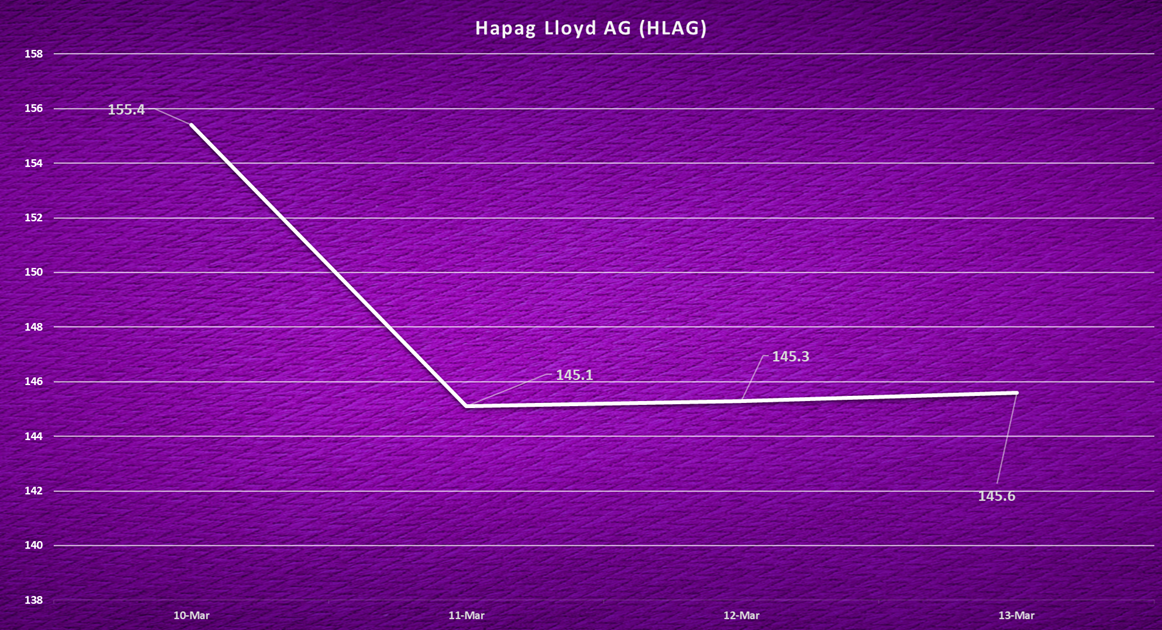

- Hapag-Lloyd AG (HLAG) – €

Hapag-Lloyd experienced a significant pullback from €155.4 to €145.1 before stabilizing slightly. The drop reflects market sentiment surrounding declining freight rates and potential demand slowdowns. The company’s cost-control strategies and long-term contracts may offer some stability, but near-term fluctuations in spot pricing remain a key factor influencing investor confidence.

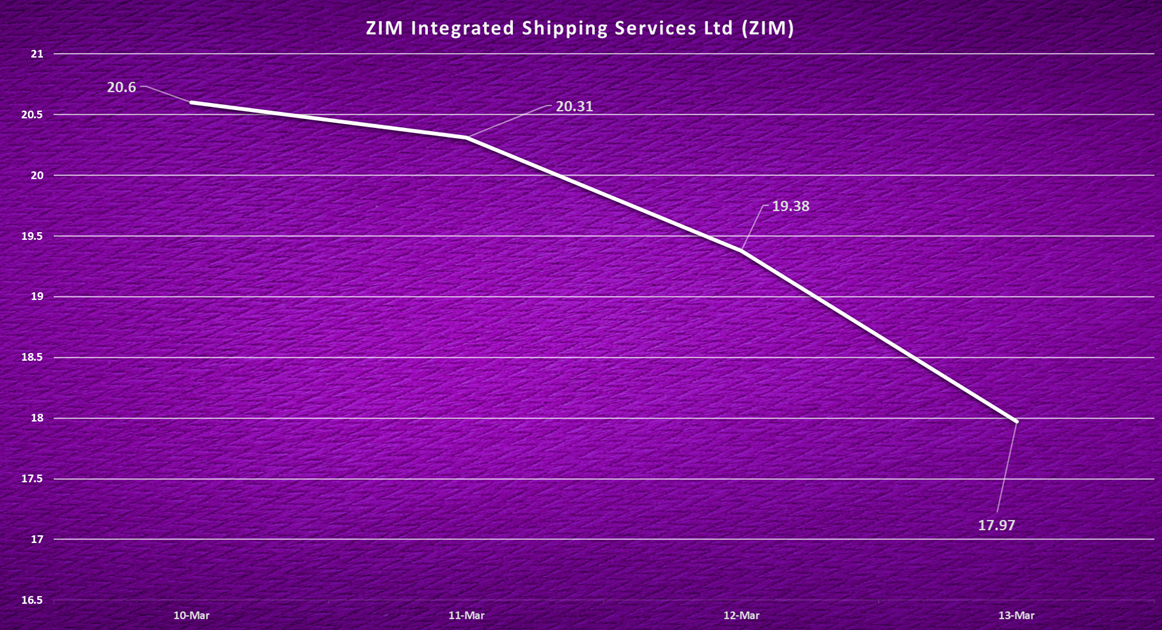

- ZIM Integrated Shipping Services Ltd (ZIM) – US$

ZIM suffered a notable decline from US$20.6 to US$17.97, marking one of the steeper losses among major carriers this week. The company has been under pressure due to softening spot rates, uncertainty around long-term contract renewals, and overall volatility in the container shipping market. Investors remain cautious about the company’s outlook, particularly given its higher exposure to fluctuating rate environments.

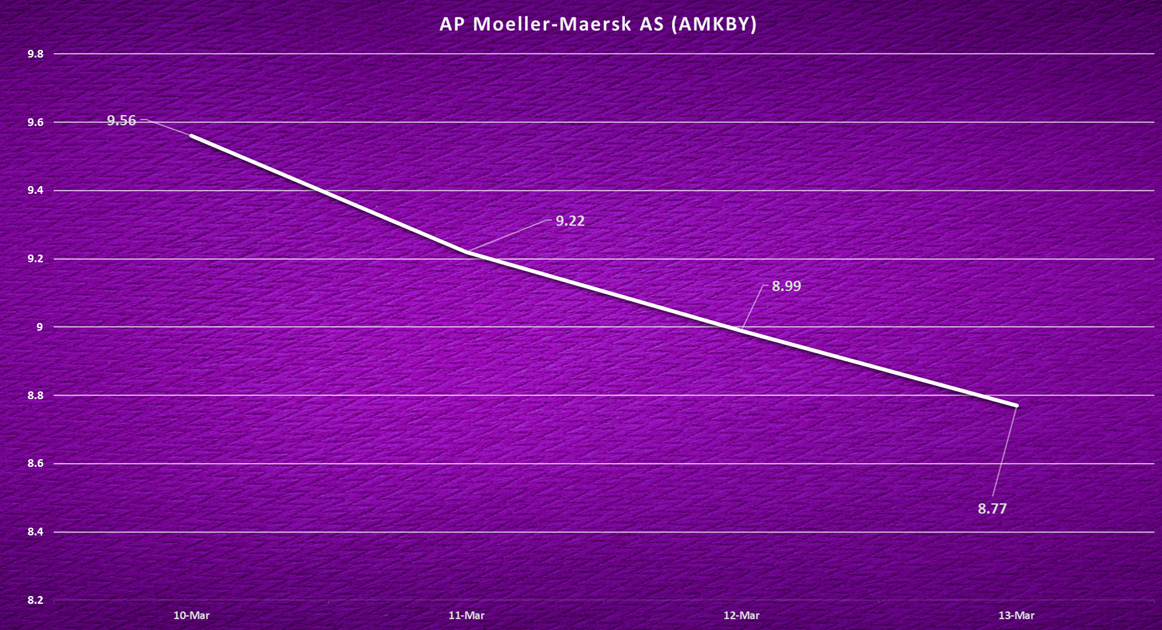

- AP Moeller-Maersk AS (AMKBY) – US$

Maersk continued its downward trajectory, slipping from US$9.56 to US$8.77. As one of the largest shipping conglomerates, Maersk’s performance is often viewed as a bellwether for the broader industry. Weaker demand forecasts and cost concerns may be weighing on the stock. However, Maersk’s strong contract coverage and strategic investments in logistics services offer long-term stability despite short-term pressures.

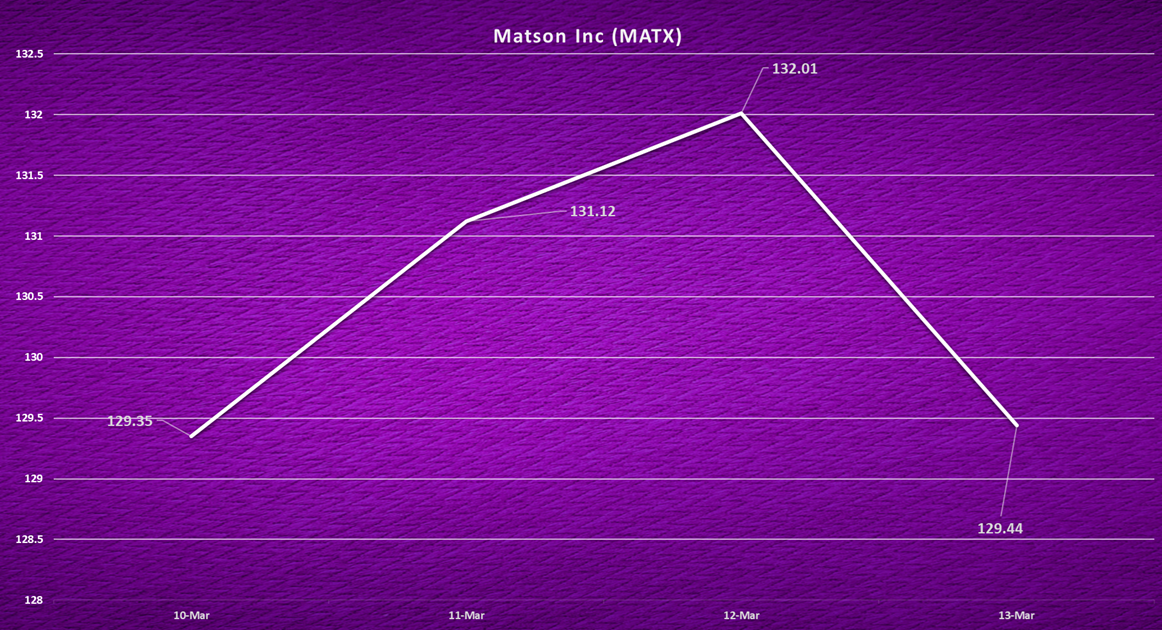

- Matson Inc (MATX) – US$

Matson exhibited relative stability, trading in a tight range between US$129.35 and US$132.01 before closing near US$129.44. While not experiencing sharp volatility, the company’s performance suggests a wait-and-see approach among investors. Matson’s strength in Pacific trade routes offers a buffer against broader industry fluctuations, but investors are closely monitoring rate movements and macroeconomic developments.

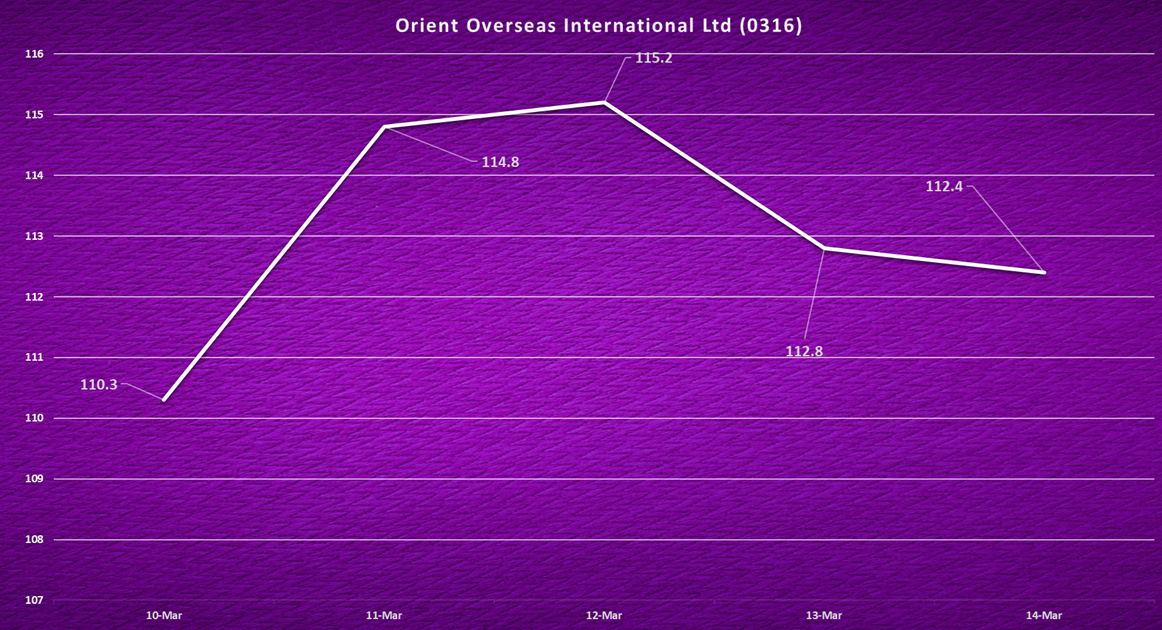

- Orient Overseas International Ltd (0316) – HK$

OOIL started strong, rising from HK$110.3 to a weekly high of HK$115.2 before settling at HK$112.4. The upward momentum in the first half of the week suggests positive investor sentiment, potentially driven by improving freight conditions or operational efficiencies. However, the slight retracement at the end hints at market caution or profit-taking. As one of the key players in trans-Pacific and intra-Asia routes, OOIL remains well-positioned, but broader economic factors will determine its next move.

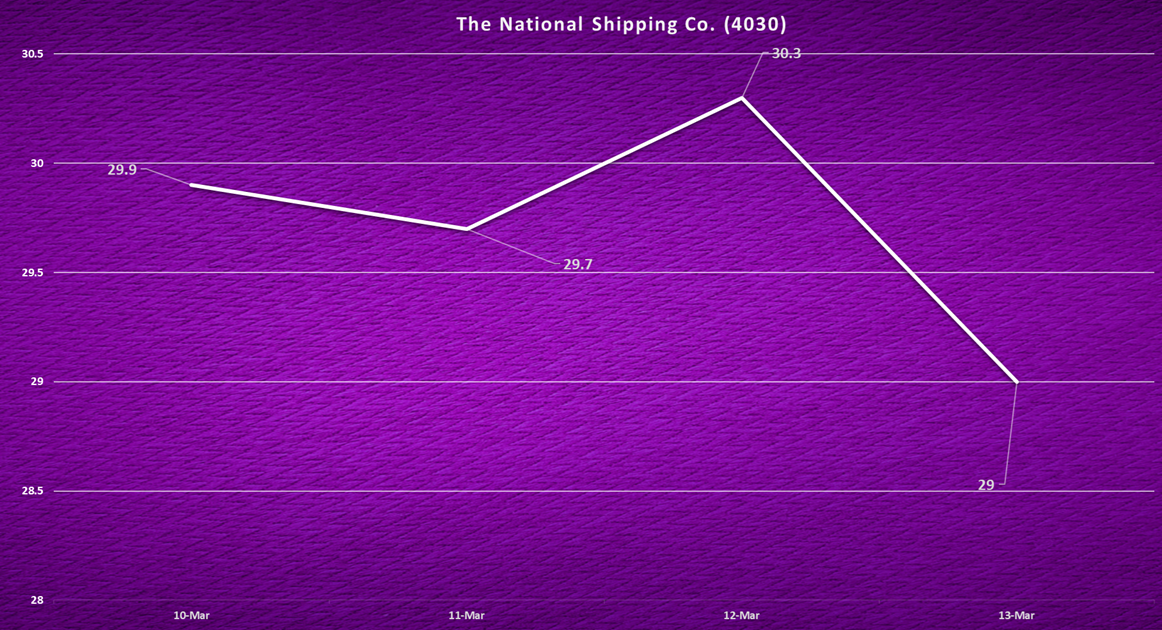

- National Shipping Co. (4030) – SAR

Bahri exhibited moderate volatility, peaking at SAR 30.3 before ending the week at SAR 29. As a leading tanker operator, the company’s performance is often influenced by oil transportation demand. The fluctuations indicate mixed market sentiment, likely due to varying oil price trends and demand outlooks. With the global energy market remaining uncertain, Bahri’s near-term movements will depend on crude shipping rates and geopolitical factors.

- Mitsui O.S.K. Lines, Ltd. (9104) – ¥

Mitsui O.S.K. saw fluctuations but remained largely stable, closing at ¥5,486 after reaching a midweek low of ¥5,440. This indicates resilience despite external market pressures. The company’s diversified portfolio, including bulk carriers, LNG transport, and container operations, helps cushion against volatility. Investors will be monitoring its contract negotiations and fleet efficiency for further direction.

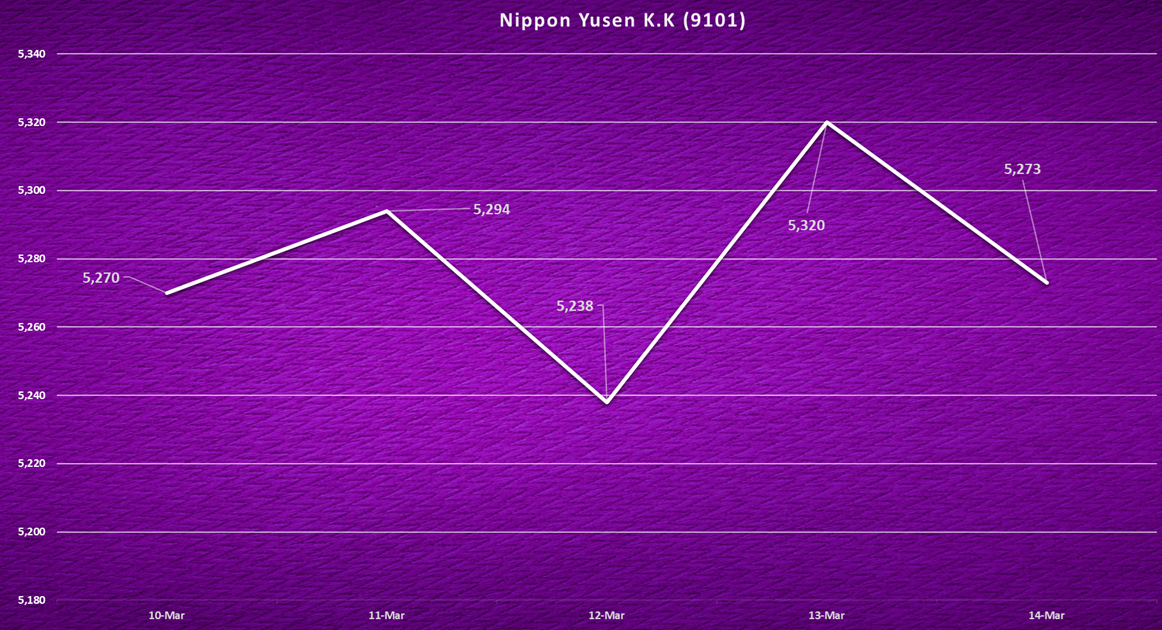

- Nippon Yusen K.K (9101) – ¥

NYK demonstrated relative stability, moving within a narrow band before ending at ¥5,273. The fluctuations suggest market indecision, possibly due to mixed signals from the broader shipping sector. NYK’s exposure to car carriers, bulk shipping, and container operations provides a diversified revenue stream, but market participants remain cautious given the overall rate environment.

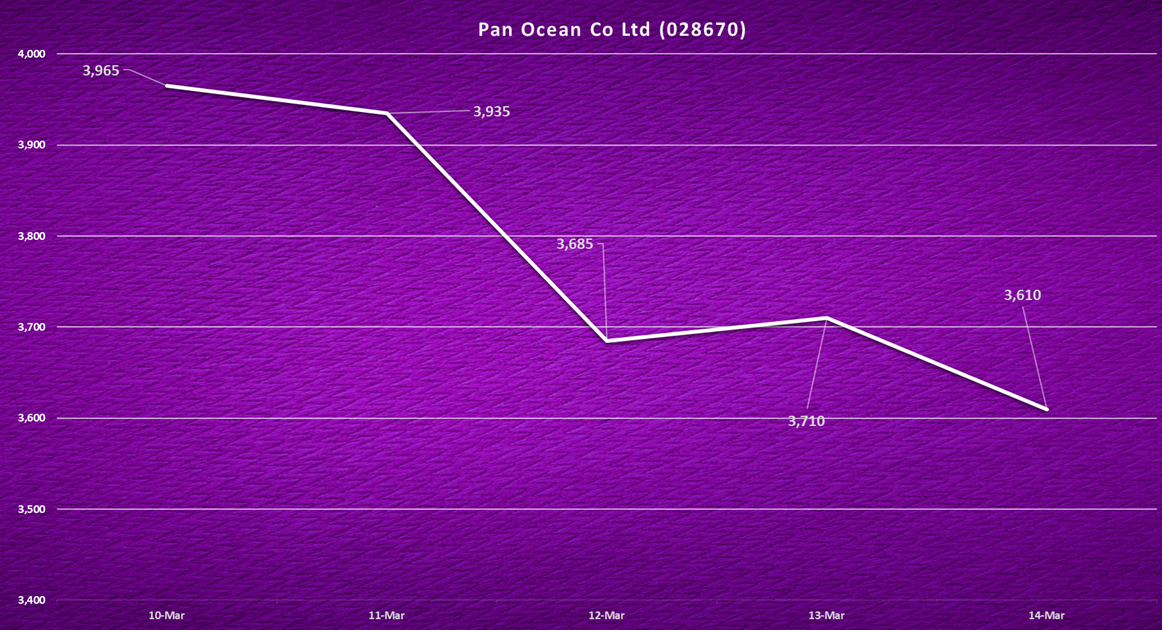

- Pan Ocean Co Ltd (028670) – ₩

Pan Ocean saw a consistent downtrend, falling from ₩3,965 to ₩3,610. This suggests investor concerns over the bulk shipping sector, potentially due to weakening demand in dry bulk commodities. While Pan Ocean has strong regional positioning, fluctuating freight rates and global economic uncertainties are likely weighing on its stock. A turnaround will depend on improved demand for iron ore, coal, and agricultural commodities.

- Ningbo Ocean Shipping Co Ltd (601022) – ¥

Ningbo Ocean Shipping had a strong performance, climbing steadily from ¥7.88 to ¥8.71 by week’s end. The uptrend signals investor confidence, likely driven by improving regional shipping demand and stable freight rates. As a key player in China’s maritime sector, Ningbo Ocean Shipping benefits from strong trade flows, and its upward movement suggests positive sentiment around future growth.

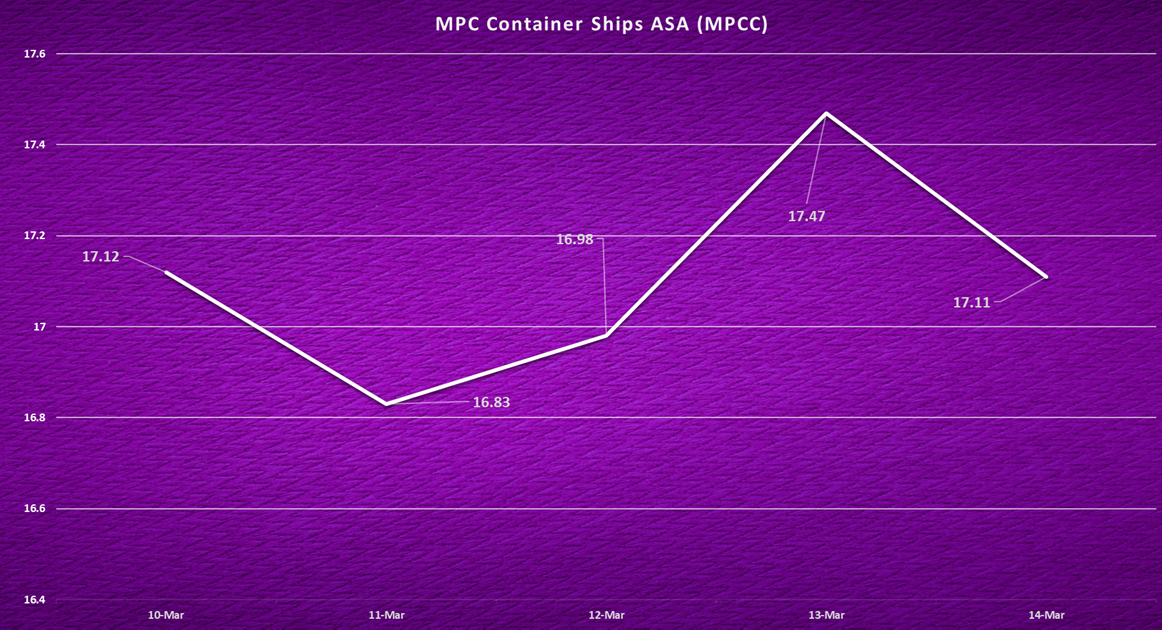

- MPC Container Ships ASA (MPCC) – NOK

MPC displayed moderate volatility but managed to end the week near NOK 17.11, indicating resilience in a fluctuating market. The stock dipped midweek but recovered, suggesting underlying investor confidence. The company’s focus on feeder and regional container shipping provides some insulation from broader industry fluctuations, but freight rates will remain a key driver.

- SFL Corporation Ltd (SFL) – US$

SFL trended downward throughout the week, declining from US$8.74 to US$8.11. This suggests investor caution, possibly due to concerns over shipping rate stability or operational challenges. However, as a diversified maritime leasing firm, SFL’s long-term contracts could provide some buffer against short-term market swings.

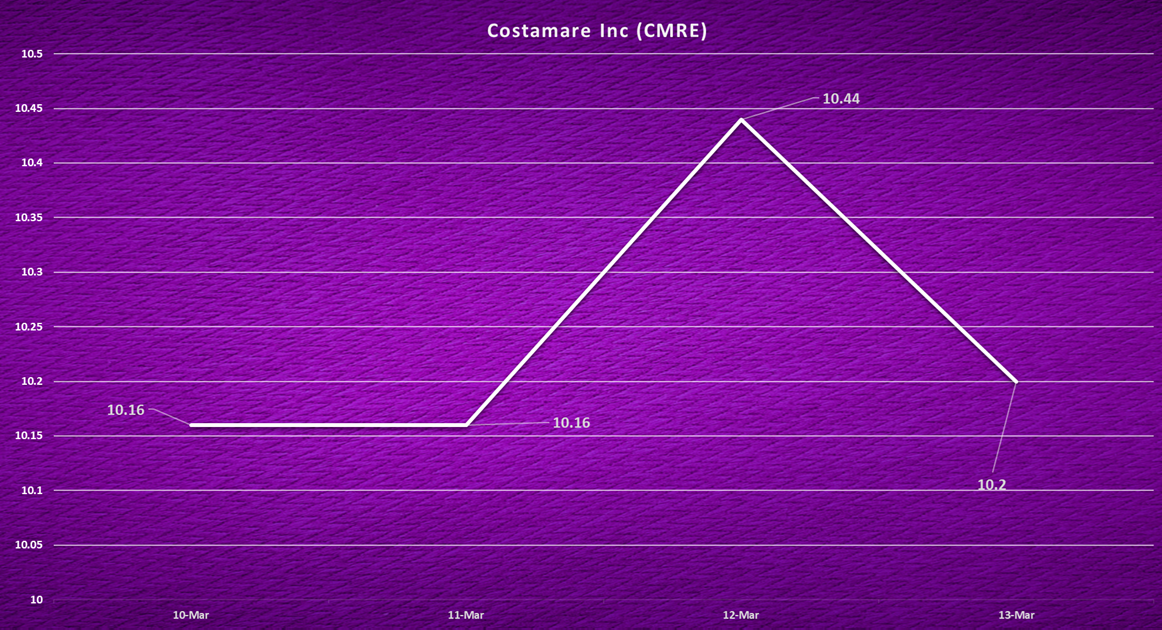

- Costamare Inc (CMRE) – US$

Costamare saw slight gains, reaching US$10.44 before settling at US$10.2. The stock’s stability indicates continued investor confidence, likely driven by the company’s strong charter coverage. As a leading container ship lessor, Costamare capitalizes on long-term contracts, shielding itself from the volatility of short-term freight rate fluctuations.

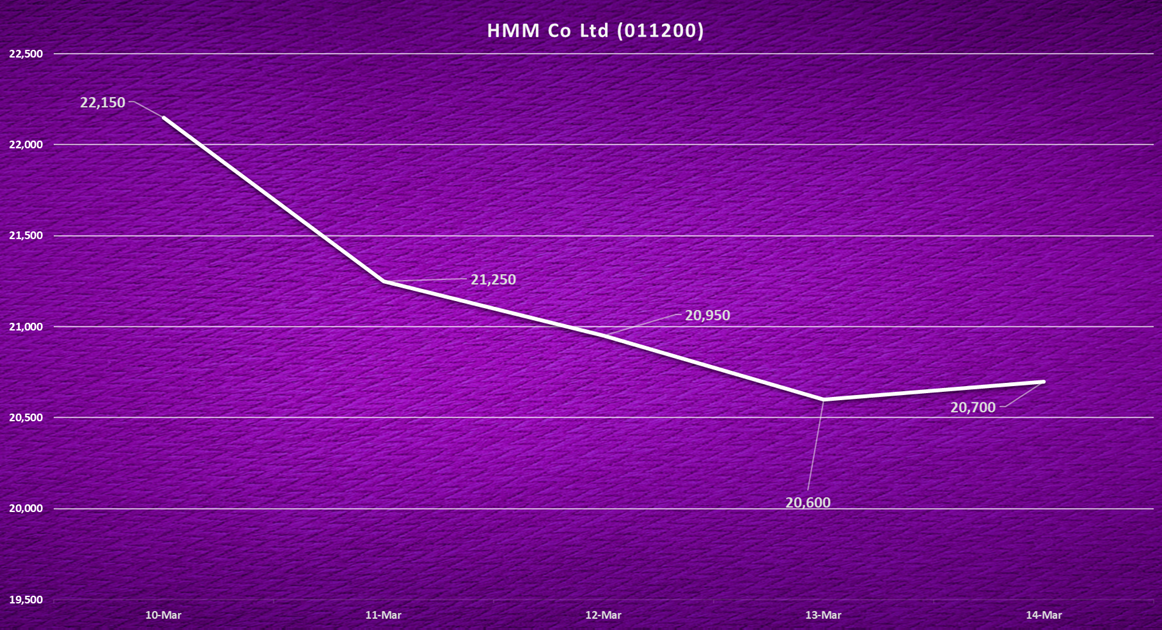

- HMM Co Ltd (011200) – ₩

HMM experienced a significant decline, dropping from ₩22,150 to a low of ₩20,600 before recovering slightly to ₩20,700. The sharp drop suggests pressure from weakening freight rates or profit-taking after previous gains. As South Korea’s largest shipping line, HMM remains a critical industry player, but investor confidence will depend on its ability to maintain profitability amid shifting rate conditions.

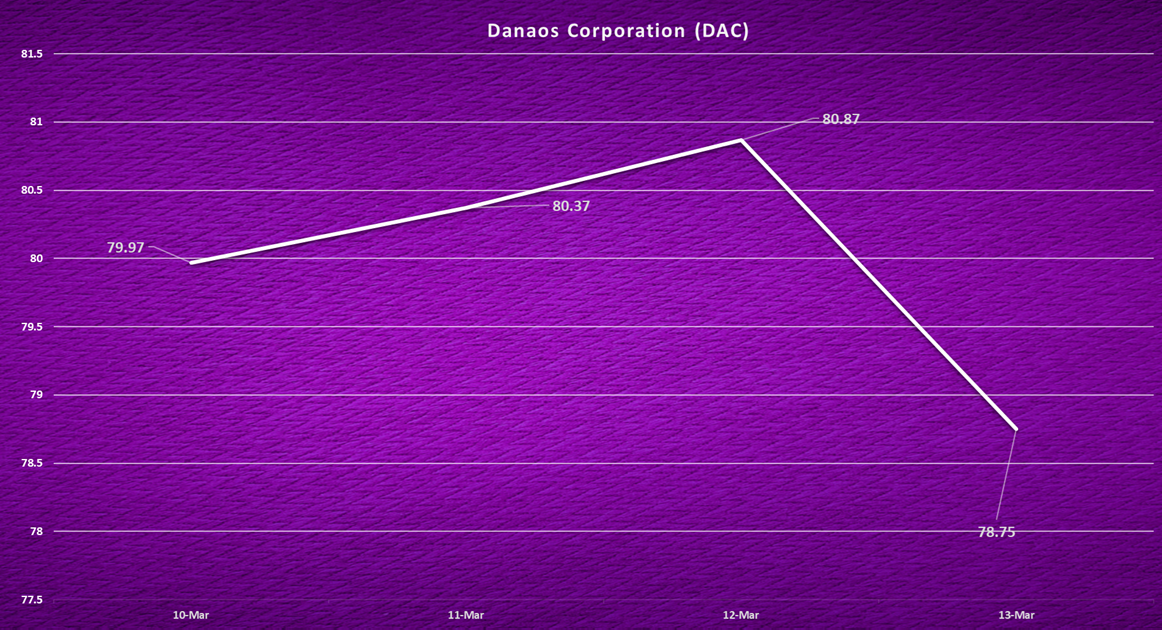

- Danaos Corporation (DAC) – US$

Danaos moved within a relatively tight range, hitting a high of US$80.87 before declining to US$78.75. The company’s exposure to long-term charters provides stability, but market fluctuations in container shipping influence investor sentiment. Analysts will be looking at forward bookings and fleet utilization for further direction.

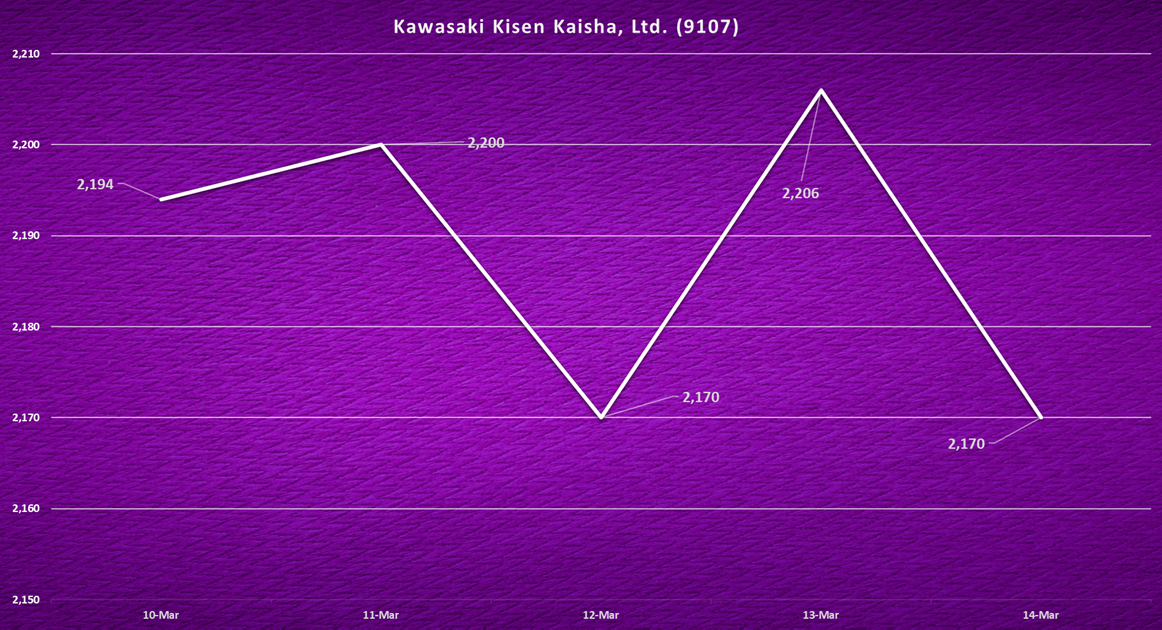

- Kawasaki Kisen Kaisha, Ltd. (K-Line) – ¥

K Line exhibited minor fluctuations, ending the week at ¥2,170 after reaching a midweek high of ¥2,206. This movement suggests a balanced market outlook, with investors monitoring operational performance and industry-wide trends. K Line’s exposure to bulk, car carriers, and LNG shipping offers diversification, but freight rate trends will remain a key factor in future movements.

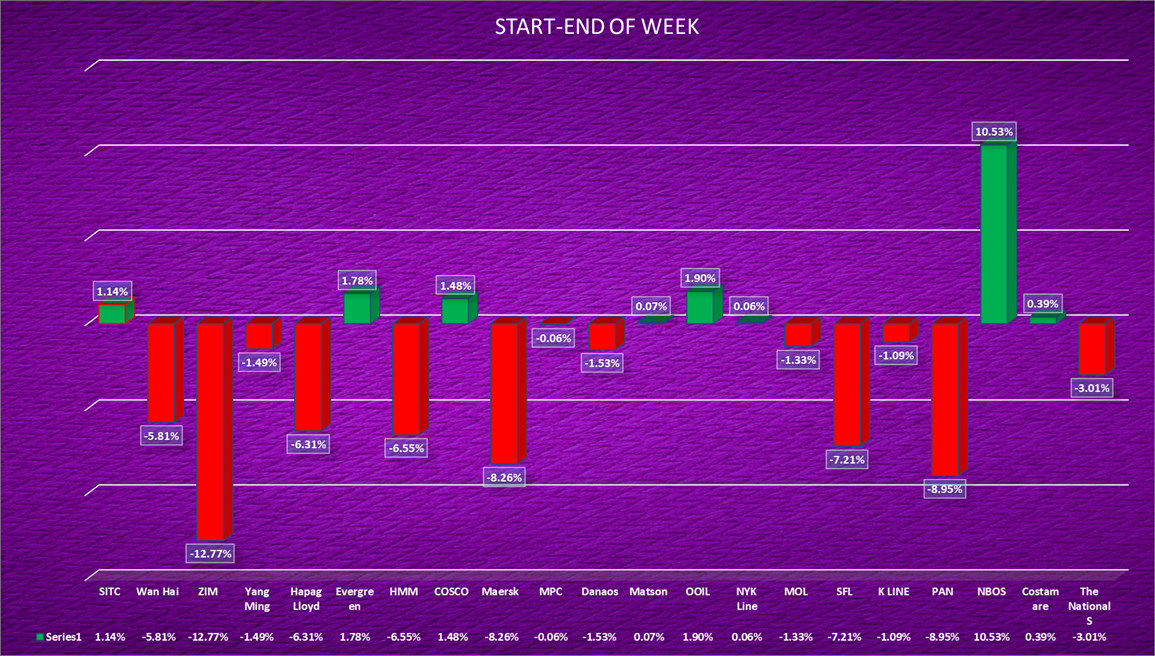

This week’s Container Market showcased significant volatility, with several companies experiencing sharp declines while a few stood out with notable gains. ZIM (-12.77%), Maersk (-8.26%), and Pan Ocean (-8.95%) were among the worst performers, indicating potential challenges in global trade flows and cost pressures.

On the other hand, Ningbo Ocean Shipping (+10.53%) emerged as the strongest gainer, signaling resilience in regional shipping demand. Evergreen (+1.78%), COSCO (+1.48%), and OOIL (+1.90%) also posted modest gains. The overall market sentiment appears bearish, with more companies in decline, reflecting a turbulent week for the industry. Moving forward, external factors like freight rates and demand fluctuations will be key in determining stability in the Container Market.