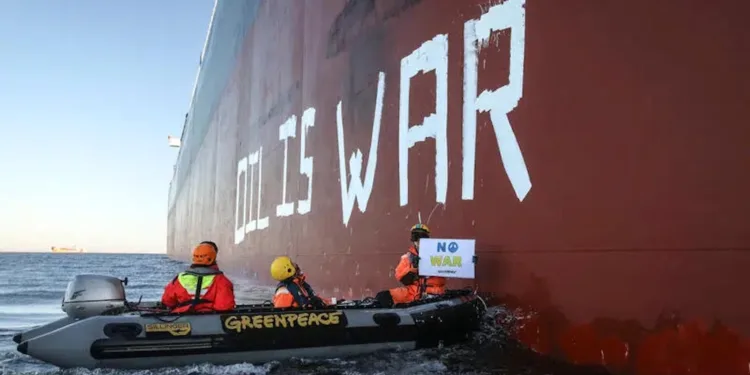

The oil markets are in flux today as tanker trades retrench and Russia’s two largest buyers of oil pause buying the fuel that has helped fund Moscow’s war in Ukraine for the past three and a half years.

News has emerged in the past 24 hours that, following Donald Trump’s sanctions this week on Rosneft and Lukoil, for the first time, major Chinese oil players, including Sinopec, CNOOC and PetroChina, have temporarily suspended seaborne purchases of Russian oil, not because of political alignment, but due to compliance calculus, likely a recognition that secondary sanctions exposure outweighs short-term gains.

Tanker tracking data in the coming days will reveal all

Splash reported yesterday how the American sanctions – designed to bring Russian president Vladimir Putin to the peace negotiating table – are already seeing India pull back from Russian oil imports.

China and India account for some three-quarters of all of Russia’s seaborne crude exports.

Rosneft and Lukoil are Russia’s two biggest oil producers, responsible for around half of Russia’s crude exports. With Gazprom Neft and Surgutneftegaz already sanctioned, virtually all Russian seaborne oil exporters are now under US sanctions.

Oil prices have risen since the news from Washington broke on Wednesday while tanker FFAs through to year-end have pushed up sharply.

Commenting on the sanctions, Jorge Leon, head of geopolitical analysis at Rystad Energy, said yesterday that combined with the recent wave of attacks on Russian oil infrastructure, there stands a real prospect of major disruptions to Russian crude production and exports, heightening the risk of forced production shut-ins.

According to Kuwait’s oil minister Tariq Al-Roumi, cited by Reuters on Thursday, OPEC is ready to counter any potential shortage in the oil market by reversing production cuts, as there are signs that demand is shifting towards the Gulf region and the Middle East.

Tanker tracking data in the coming days will reveal just how dramatically Trump’s first sanctions package against Russia since returning to office has reshaped global seaborne oil trade.

Russia’s seaborne exports have remained steady in the 3m to 3.5m barrels per day range since the start of the full-scale invasion of Ukraine in February 2022.

Estimates by Jefferies, an investment bank, suggest 30% to 40% of Russia’s seaborne crude exports are carried by compliant tankers, presumably under the G7 price cap, but the latest OFAC sanctions likely make this difficult. Market players would be liable for sanctions by supporting Rosneft and Lukoil exports, even if cargoes are acquired below the price cap, currently set at $47.60 per barrel. Overall, shipping experts at Jefferies, like many other tanker analysts, see Trump’s sanctions as positive for tankers as they create further disruption potential and stretch the compliant tanker fleet further.

Yesterday, the European Union ratified its long-awaited 19th Russia sanctions package, targeting a further 117 vessels and advancing a ban on Russian LNG imports by a year to 2027. The EU sanctions have specifically targeted Chinese importers, following the UK’s actions last week to sanction the Yulong Refinery in Shandong. The UK had already sanctioned Rosneft and Lukoil last week.