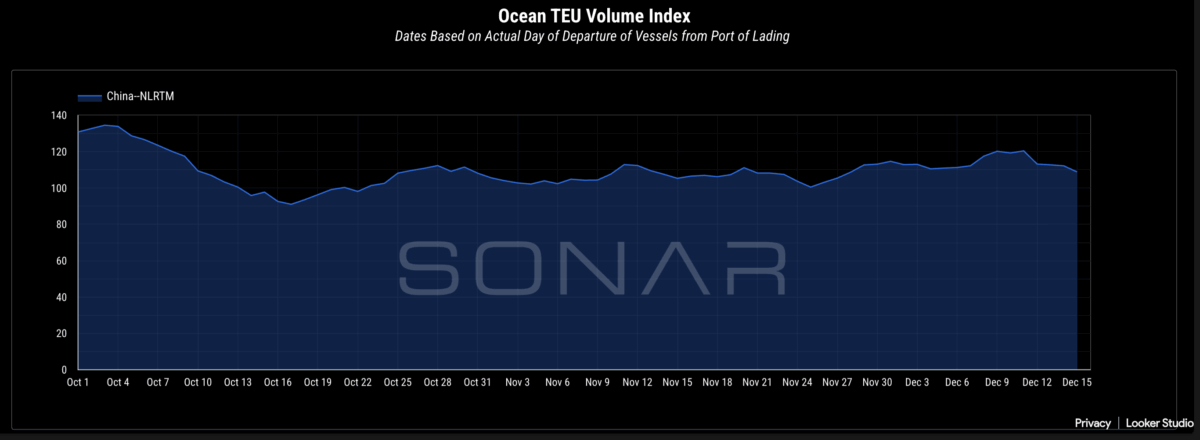

Deep in the heart of the slow shipping season and as they prepare for New Year contract negotiations, ocean container carriers have yet to find a good way to re-synch demand and capacity on the trans-Pacific.

Rates on the benchmark Asia-U.S. trade lane diverged in the latest week, according to analyst Freightos (NASDAQ: CRGO).

Capacity reductions and an array of announced blanked sailings on the trans-Pacific have so far failed to bolster recent general rate increases (GRIs).

“Last week West Coast rates retreated 6% from a start of the month GRI bump, to $1,963 per FEU (forty foot equivalent unit),” said Freightos Head of Research Judah Levine, in a note to clients. “Prices to the East Coast increased 8% to $3,150 per FEU this week, but are down 15% from a month ago.

Despite that sawtooth profile, “carriers have succeeded in keeping rates above October lows of $1,400 per FEU and $3,000 per FEU, respectively, likely with benefits of higher rates for short periods in between the dips.”

Carriers walk a fine line with GRIs, which can push some shippers to lower spot rates for their short-term needs. About 60% of cargo moves under contract, and 40% under spot rates although those figures can fluctuate when capacity is tight.

Concurrently, analysts say capacity issues are exacerbated by liners continuing to deploy new tonnage in a soft market.

“Slumping Q4 demand, in addition to growing fleets, is an important factor to rate levels,” Levine said, “making planned mid-month GRIs unlikely to hold and a more sustained rate rebound more likely only as we get closer to Lunar New Year.” That’s when shippers rush to move orders before Chinese factories close for two weeks.

A wildcard that’s clouding demand forecasts is a reported pause in imports by U.S. manufacturers, a percentage bet that duties will fall if the U.S. Supreme Court rules against President Donald Trump’s emergency tariffs. That decision isn’t expected until January at the earliest, and there is speculation that the administration will seek another avenue to restore those levies.

But Neale Mahoney, director of the Stanford Institute for Economic Policy Research, told a Freightos webinar that Trump could use the court’s decision as a tariff off-ramp as he faces increasing criticism over cost of living concerns.

The rate situation is different on Asia-Europe lanes, where prices have maintained their increases from recent GRIs, Levine said, despite overcapacity.

Rates on the Asia-Mediterranean lane were unchanged this past week at $3,342 per FEU after climbing 15% to start the month for its fourth consecutive successful GRI since mid-October, said Levine, following falling prices that dipped to a year-low of about $2,000 FEU.

“Asia-North Europe prices were stable last week at $2,449 per FEU, and level with rates set in early November, but still well above its mid-October nadir of $1,700 per FEU. For most of the last two months rates on these lanes have climbed bi-monthly via capacity reductions as demand eased. But carriers and forwarders are now reporting an uptick in demand as some shippers are getting an early start to pre-Lunar New Year ordering – a trend also seen in Asia-Europe rate behavior in 2023 and 2024 when December prices climbed sharply, possibly in response to Red Sea-driven longer lead times.”

To meet demand, carriers are increasing capacity with some planning mid-month Asia-Europe and Mediterranean GRIs to $4,200 per FEU and $4,750 per FEU, respectively. Asia-Europe volumes were up 8.6% year-to-date through October, per Container Trade Statistics. Asia-North Europe rates are off 54% from December 2024 as capacity growth pressures current price levels.

Levine said December demand is likely to grow from 2024 as carriers mull a return to the Red Sea and shippers reportedly build inventories ahead of expected disruptions. Attacks on shipping by Yemen-based Houthi rebels since late 2023 forced carriers to divert from the Red Sea-Suez Canal route and around the tip of Africa. The Houthis on Monday warned Israel against further ceasefire violations in Gaza, a reminder that the region remains far from stable.

Find more articles by Stuart Chirls here.

Related coverage:

Maersk, Hapag-Lloyd drop US East Coast city from trans-Atlantic services

Maersk tabs new CFO, North American chief in global leadership shakeup

Seamless integration behind DP World rebrand of ocean container line

Jaxport COO Bennett dies in car crash

The post Carriers look to higher rates, fewer sailings on key Asia-US route appeared first on FreightWaves.