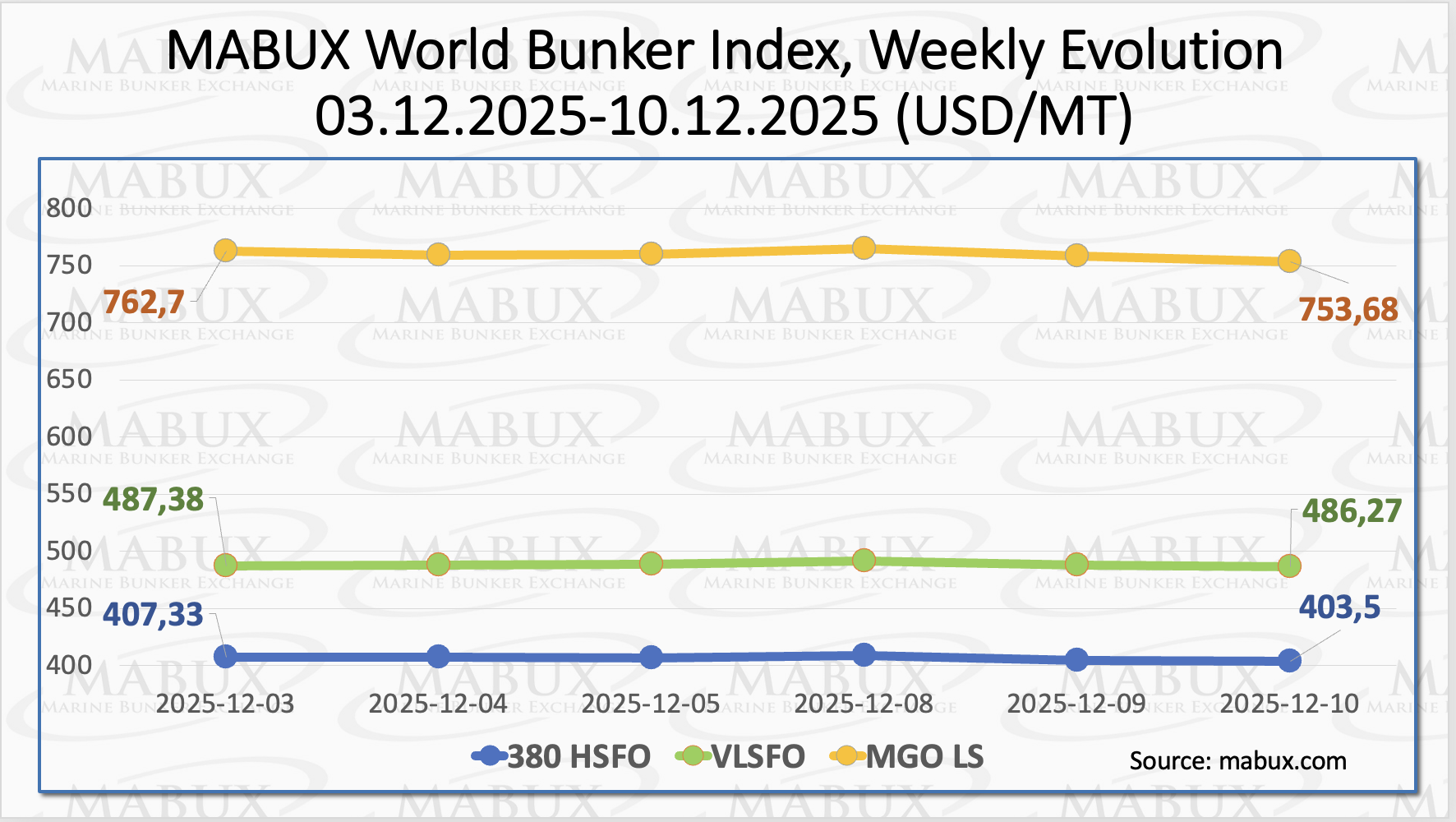

By the end of Week 50, the global MABUX bunker indices posted a moderate decline. The 380 HSFO index fell by US$3.83, to US$403.50/MT, moving closer to the US$400 level.

The VLSFO index edged down by US$1.11, to US$486.27/MT. The MGO LS index recorded the steepest drop, decreasing by US$9.02 to US$753.68/MT. At the time of writing, the global bunker market showed no pronounced price dynamics.

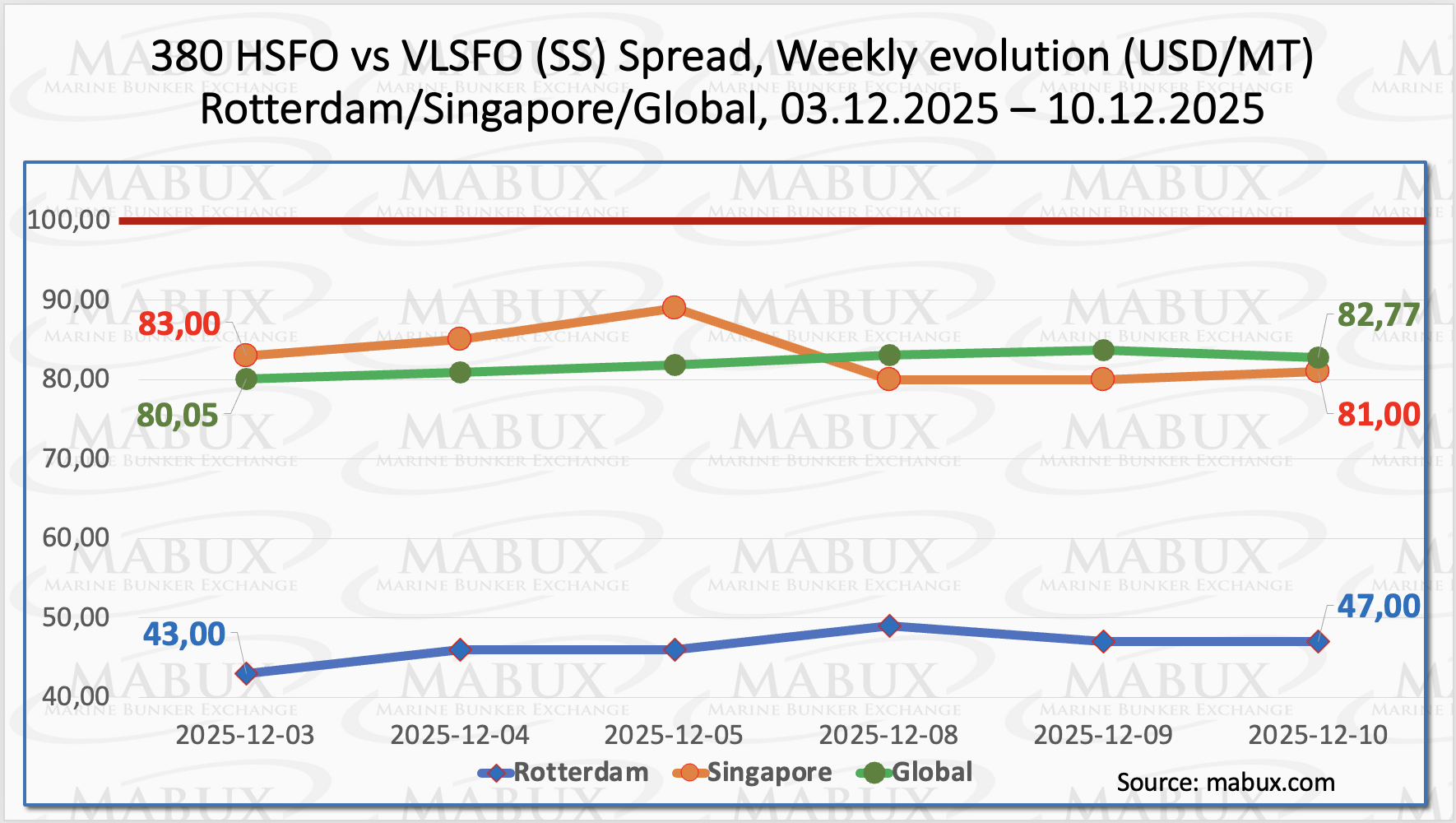

MABUX Global Scrubber Spread (SS)—the price differential between 380 HSFO and VLSFO—increased moderately by US$2.72, to US$82.77. The indicator remains above US$80.00 yet continues to trade steadily below the psychological US$100.00 level (SS breakeven).

Over the week, the average SS value rose marginally by US$0.98. In Rotterdam, the SS Spread widened by a further US$4.00, reaching US$47.00 versus US$43.00 last week, while the weekly average at the port increased by US$2.00.

In Singapore, the SS Spread moved in the opposite direction, narrowing by US$2.00 from US$83.00 last week to US$81.00: however, the weekly average value at the port increased by US$2.00. Overall, the SS Spread continues to lack a clear directional trend, with benchmark ports diverging week to week.

The spread remains consistently below US$100.00, sustaining the relatively higher profitability of conventional VLSFO compared with the 380 HSFO + scrubber configuration. We expect the SS Spread to remain broadly unchanged next week.

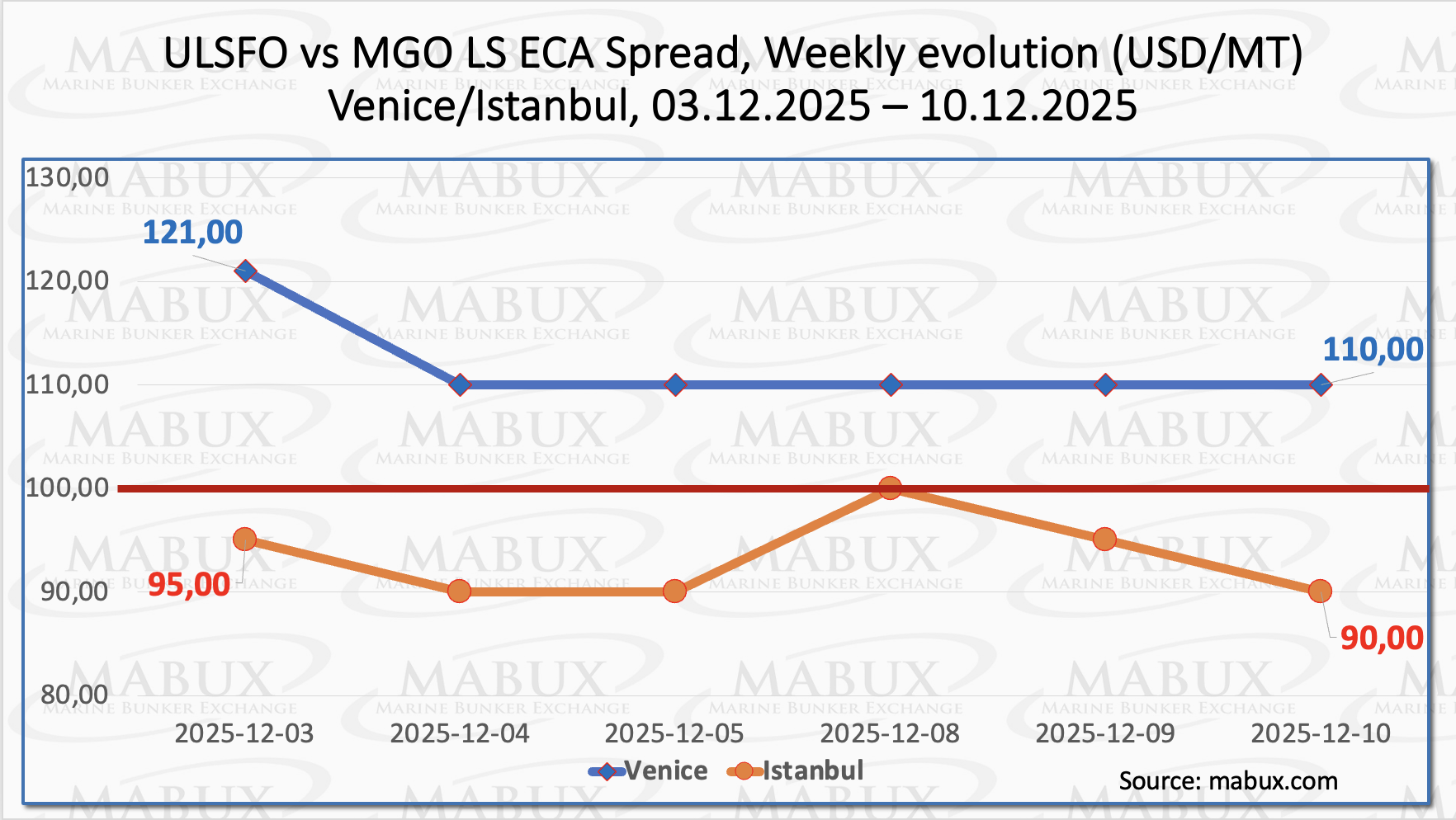

As new Emission Control Areas (ECAs) continue to expand globally—most recently with the Mediterranean ECA entering into force on 1 May 2025—it has become increasingly relevant to compare ULSFO (0.1% sulphur), a conventional fuel option for ecozones, with MGO LS, which remains the costliest grade (ECA Spread). Over the week, Istanbul’s ECA Spread narrowed by US$5.00 (US$90.00 versus US$95.00 last week), while the weekly average declined by US$2.50. In Venice, the ECA Spread decreased by US$11.00 (from US$121.00 to US$110.00), with the weekly average falling by US$17.00. Despite these adjustments, the ECA Spreads in both ports remain at or above the psychological USD 100.00 level, maintaining a comfortable price differential in favour of ULSFO.

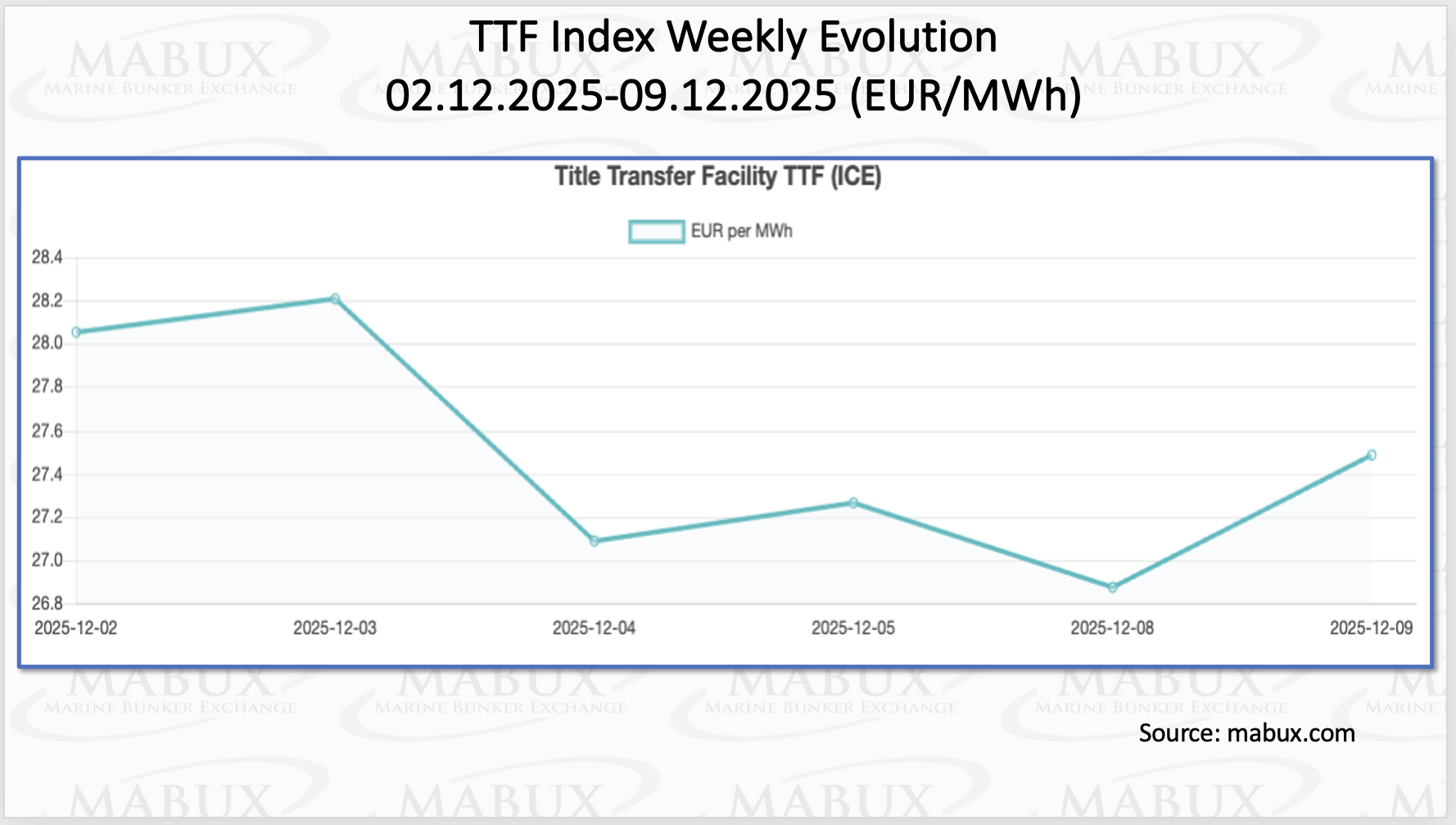

European gas prices remained broadly stable as temperatures gradually declined through November, with higher LNG send-outs and steady Norwegian pipeline flows keeping the market well supplied. Even as storage withdrawals accelerated to roughly 3 bcm over November, expectations of a global LNG surplus continued to cap upside momentum in the TTF benchmark.

As of Dec. 09, European regional gas storage facilities were 71.83% full, down 3.12 percentage points week on week. Gas withdrawals continue to exceed injections, with storage levels nearing the early-2025 reference target of 71.33% and exceeding it by just 0.50 percentage points. Meanwhile, the European TTF gas benchmark extended its moderate decline in Week 50, falling by EUR 0.561/MWh to EUR 27.489/MWh versus EUR 28.050/MWh the previous week.

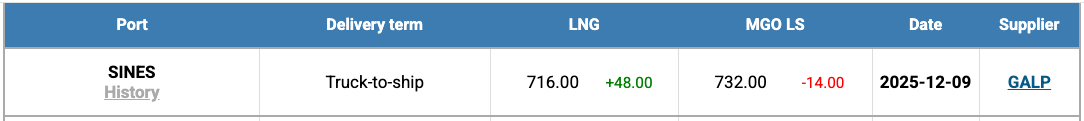

The price of LNG as a bunker fuel at the port of Sines (Portugal) increased by US$48.00/MT this week, rising to US$716/MT from US$668/MT last week. As a result, the price spread between LNG and conventional fuel has narrowed sharply, though it still favors LNG: US$16/MT compared with US$85/MT the week before. As of December 9, MGO LS at Sines was quoted at US$732/MT.

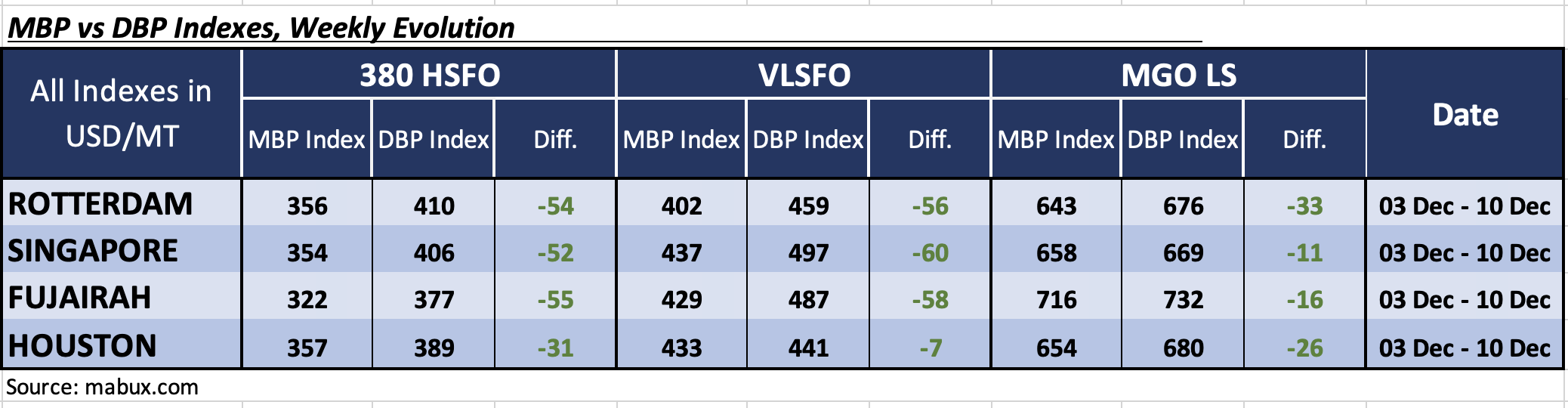

By the end of Week 50, the MABUX Market Differential Index (MDI)—reflecting the ratio of market bunker prices (MBP) to the MABUX Digital Bunker Benchmark (DBP)—continued to indicate undervaluation across all key fuel grades in the world’s largest bunkering hubs: Rotterdam, Singapore, Fujairah, and Houston:

• 380 HSFO segment: Average weekly MDI values increased by 4 points in Rotterdam, 3 points in Singapore, 7 points in Fujairah, and 4 points in Houston.

• VLSFO segment: The MDI remained unchanged in Rotterdam, Singapore, and Houston, while rising by 3 points in Fujairah. Notably, Houston’s MDI continues to hover near the 100% parity level between MBP and DBP.

• MGO LS segment: Undervaluation deepened as MDI values rose by 9 points in Rotterdam, 3 points in Singapore, and 15 points in Houston, while declining by 11 points in Fujairah.

By the end of the week, the overall balance of overvalued versus undervalued ports remained unchanged, with the market still firmly in the undervalued zone. We expect this undervaluation trend to persist across the global bunker market next week.

”The global bunker market continues to follow a relatively stable trajectory. We expect global bunker indices to post mixed fluctuations next week, with no clear or sustained directional dynamic”, commented Sergey Ivanov, Director, MABUX.

The post Bunker market sees mild downtrend appeared first on Container News.