The container shipping industry remains sensitive to global trade flows, geopolitical tensions, and macroeconomic indicators. This week’s stock performance reflects an environment of cautious optimism, influenced by varying trends in consumer demand, ongoing challenges in global supply chains, and fluctuating fuel prices.

Here’s a company-specific breakdown of their stock movements over the week ending today.

- SITC International Holdings Co Ltd (1308)

HKD

HKD

SITC International showed volatility throughout the week, starting at HKD22.1 and ending slightly lower at HKD21. This fluctuation mirrors concerns over softening demand in the intra-Asia trade lanes, where the company is a major player. Persistent economic uncertainties in China, including slower-than-expected GDP growth, have likely impacted investor confidence.

- Wan Hai Lines Ltd (2615)

TWD

TWD

Wan Hai Lines experienced a consistent decline in its stock price early in the week before closing marginally higher at TWD90.5. The subdued performance aligns with declining container rates and overcapacity concerns in smaller trade routes. The company may also be facing headwinds from regional competition and muted trade activity in Southeast Asia.

- ZIM Integrated Shipping Services Ltd (ZIM)

USD

USD

ZIM exhibited a steady rise, closing at $25.35 on November 14, reflecting a positive investor outlook. The company’s strong focus on specialized and premium cargo services might have shielded it from broader market pressures. This growth may also indicate confidence in ZIM’s strategic adjustments in long-term contracts despite the volatility in the transpacific trade.

- Yang Ming Marine Transport Corp (2609)

TWD

TWD

Yang Ming’s stock displayed minimal movement, ending the week at TWD72.2. The company’s stability suggests resilience amid fluctuating container demand. However, Yang Ming’s focus on east-west trade lanes might leave it more exposed to changes in geopolitical dynamics, such as the U.S.-China trade tensions.

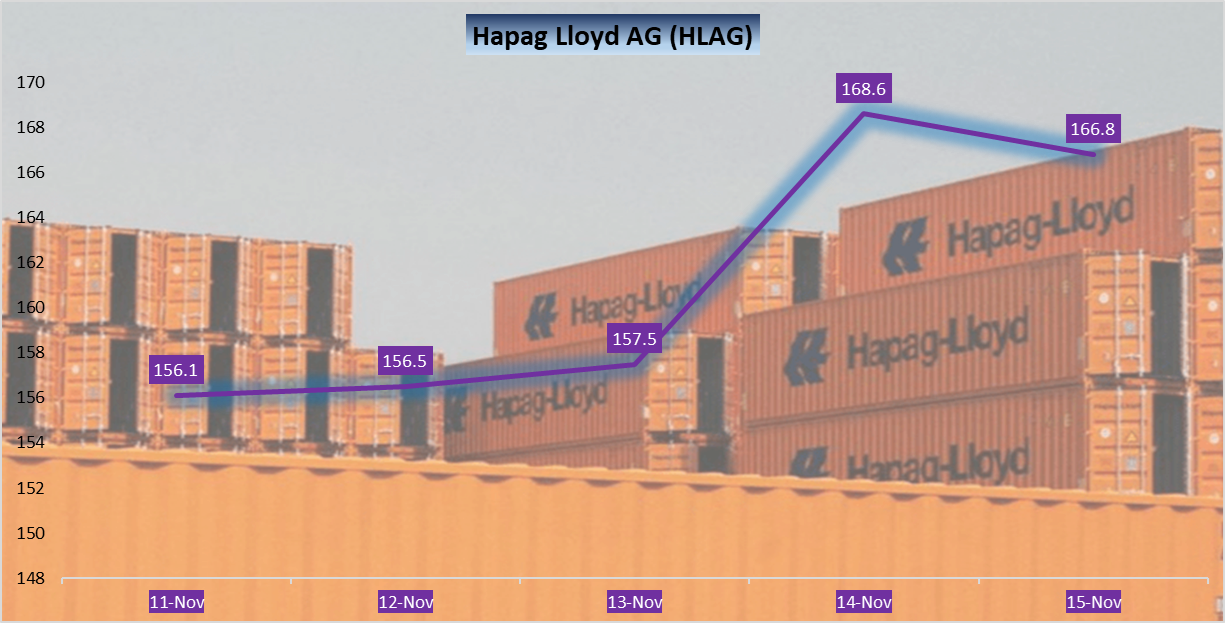

- Hapag Lloyd AG (HLAG)

EUR

EUR

Hapag-Lloyd’s stock surged mid-week, peaking at €168.6 on November 14, before settling at €166.8. This uptick reflects optimism surrounding European trade resilience and the company’s proactive fleet modernization efforts. Improved freight rates in specific niche markets, along with better fuel efficiency, may have bolstered investor confidence.

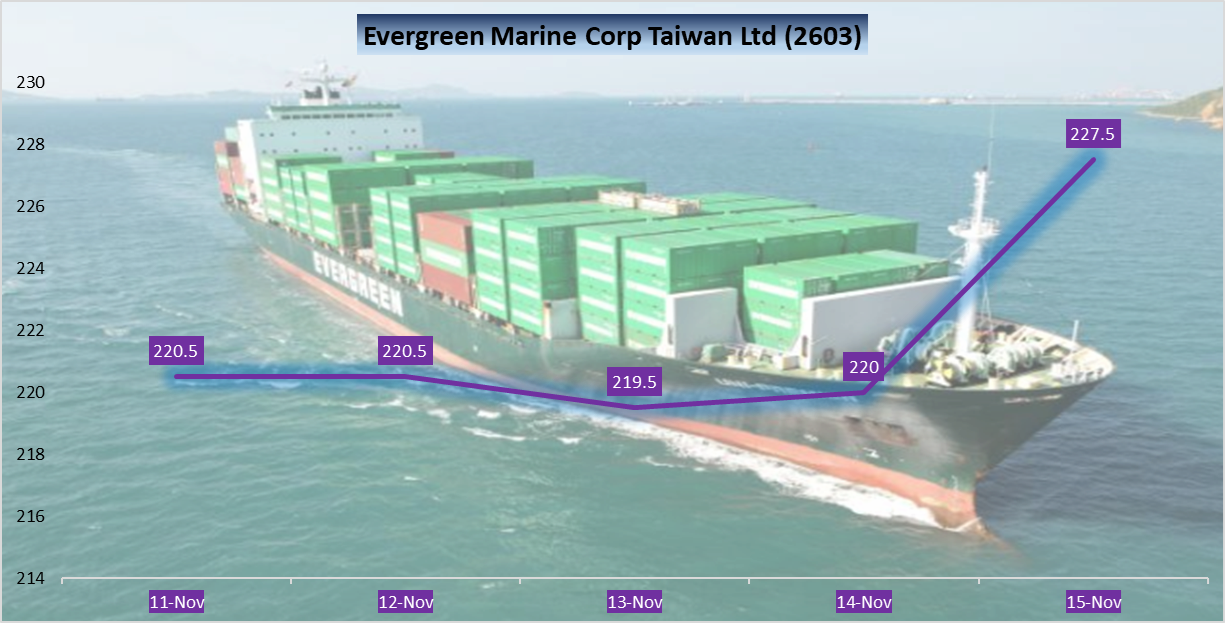

- Evergreen Marine Corp Taiwan Ltd (2603)

TWD

TWD

Evergreen Marine ended the week strong, closing at TWD227.5, a notable increase from earlier levels. Its diversified trade exposure and robust cost management strategies likely supported this growth. The company’s investments in greener and larger vessels seem to be paying dividends in investor sentiment.

- HMM Co Ltd (011200)

KRW

KRW

HMM recorded significant gains, rising steadily to KRW18,240 by the week’s end. This performance reflects the company’s strategic realignment, including expanding its fleet and enhancing digital capabilities. HMM’s focus on profitability over volume, coupled with South Korea’s stable export outlook, likely contributed to the rise.

- COSCO SHIPPING Holdings Co Ltd ADR (CICOY)

USD

USD

COSCO’s ADRs saw slight fluctuations, closing the week at $7.5. This movement indicates a mixed investor sentiment, potentially influenced by concerns over China’s economic recovery. COSCO’s extensive exposure to global trade routes might also make it more susceptible to geopolitical uncertainties, including sanctions and regulatory challenges.

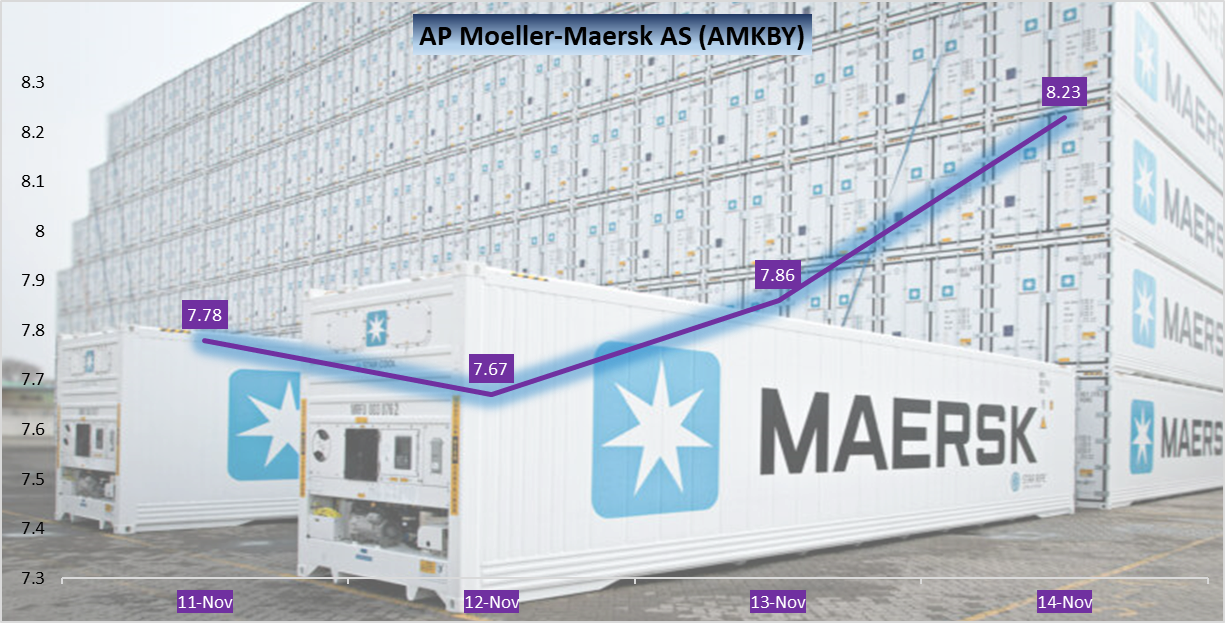

- AP Moeller-Maersk AS (AMKBY)

USD

USD

Maersk showed steady growth, ending at $8.23 after beginning the week at $7.78. The stock’s rise reflects optimism in Maersk’s transformation strategy, focusing on end-to-end logistics services and digital solutions. Improved freight rate stability in Europe and a commitment to sustainability initiatives are likely appealing to investors.

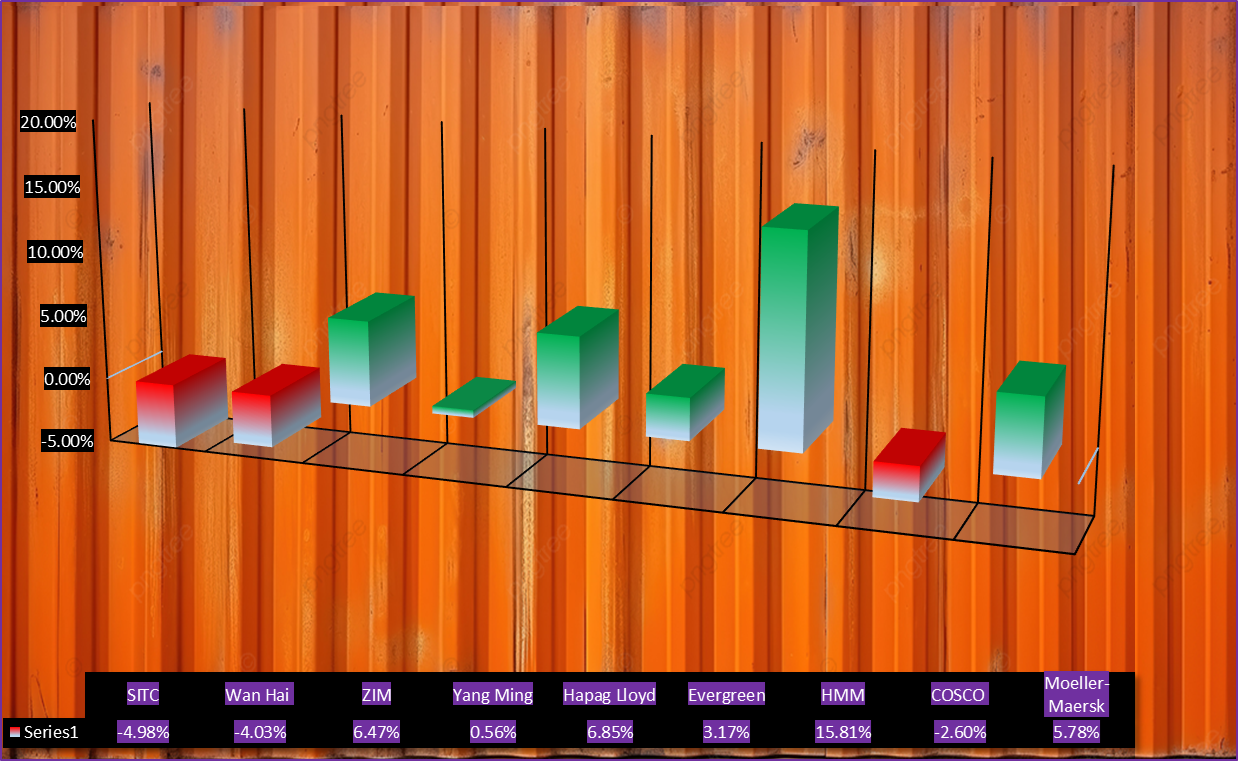

The performance of container shipping stocks this week highlights the diverse reactions of companies to the shifting dynamics in global trade and economic conditions. HMM led the pack with an impressive +15.81%, reflecting strong investor confidence in its strategic initiatives and growth potential. Maersk and ZIM also showed solid gains, benefiting from their adaptive strategies and focus on higher-margin logistics solutions.

On the other hand, SITC and Wan Hai faced notable declines, potentially due to challenges in the intra-Asia trade lanes and declining container rates. Evergreen’s steady growth and Yang Ming’s slight improvement underscore the resilience of key players despite market volatility. Overall, the varied performances signal a sector in transition, where agility and innovation are proving to be the keys to navigating an uncertain future.