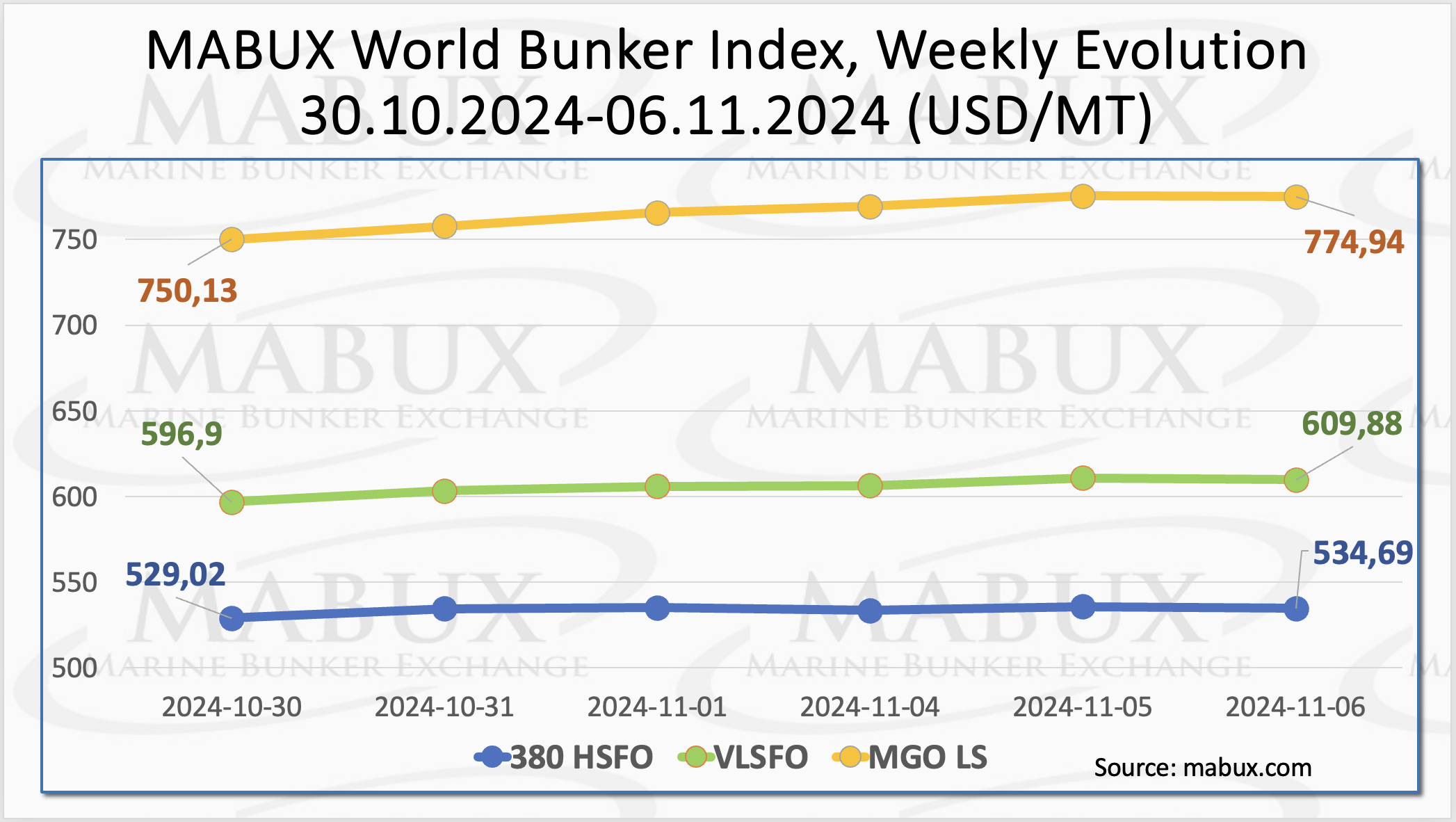

During the 45th week of the year, the Marine Bunker Exchange (MABUX) global indices showed an upward trend across various fuel types.

The 380 HSFO index increased by US$5.67 to 534.69/MT, the VLSFO index saw a more significant rise of US$12.98 to US$609.08/MT and the MGO index also rose by US$24.81 to US$774.94/MT.

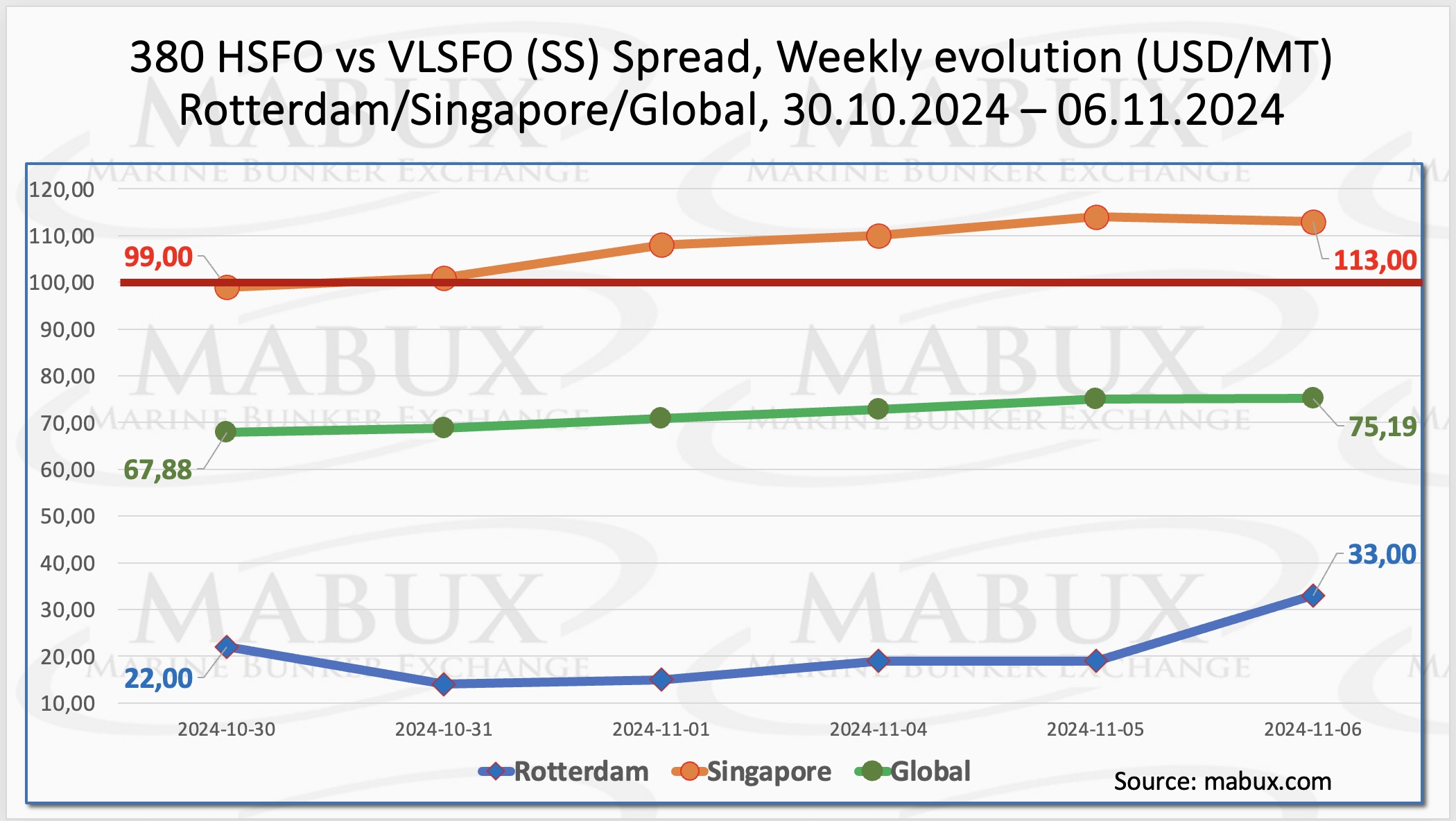

The MABUX Global Scrubber Spread (SS) —the price differential between 380 HSFO and VLSFO— recorded moderate growth, rising by US$7.31 to US$75.19. Despite this increase, the SS remains well below the breakeven point of US$100. The weekly average of the SS index fell slightly by US$0.44.

In Rotterdam, the SS spread widened by US$11, moving from US$22 to US$33, despite reaching a record low of US$10 mid-week. The weekly average in Rotterdam declined by US$13.34. In Singapore, the 380 HSFO/VLSFO spread rose by US$14, from US$99 to US$113, surpassing the US$100 mark.

The weekly average in Singapore increased by US$4.50. The SS spread shows potential for further widening, though values remain near or below the US$100 threshold, highlighting continued low profitability for the 380 HSFO + scrubber combination.

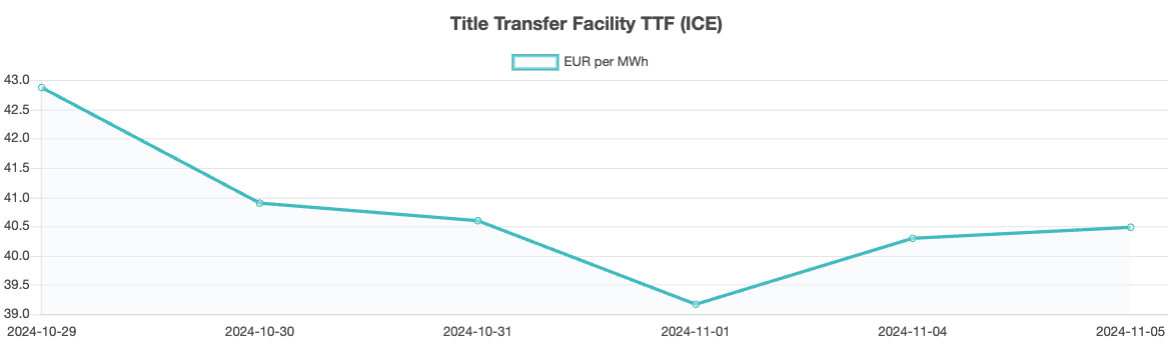

In Europe, gas prices rose unexpectedly amid recent supply disruptions from Norway and the U.S., creating a cautious market environment. According to Standard Chartered, gas withdrawals have been occurring on weekdays, with replenishments on weekends. This pattern may indicate that Europe’s seasonal peak in gas storage is either imminent or has already been reached, with storage levels at 95.33% as of November 4. The European gas benchmark TTF closed the week down €2.377/MWh, settling at €40.492/MWh, down from €42.869/MWh the previous week.

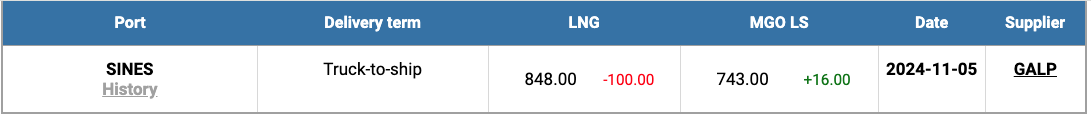

At the Port of Sines in Portugal, LNG bunker fuel prices dropped sharply by US$100 over the week, reaching US$848/MT on 5 November. The price gap between LNG and traditional bunker fuel narrowed significantly, with MGO LS priced at US$743/MT in Sines, making it US$105 cheaper than LNG—a notable decrease from the US$229 difference a week earlier.

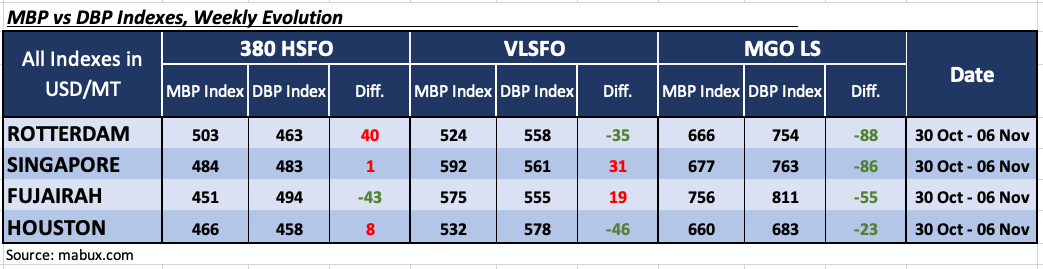

In terms of the MDI index (the correlation ratio of MABUX market bunker prices vs. MABUX digital bunker benchmark prices), the four major hubs—Rotterdam, Singapore, Fujairah, and Houston—exhibited the following trends:

- 380 HSFO segment: Rotterdam, Singapore, and Houston remained overvalued. The weekly average increased by 3 points in Rotterdam but fell by 1 point in Houston, with Singapore holding steady near the 100% correlation mark between the market price and the MABUX benchmark. Fujairah was the only undervalued port, with no change in its index.

- VLSFO segment: Singapore and Fujairah stayed in the overvalued zone, with weekly averages increasing by 5 points in Singapore and 4 points in Fujairah. Rotterdam and Houston remained undervalued; Rotterdam’s average rose by 10 points, while Fujairah’s dropped by 5 points.

- MGO LS segment: All four ports—Rotterdam, Singapore, Fujairah, and Houston—were undervalued. Fujairah’s weekly average rose by 4 points, while Singapore’s decreased by 8 points. The MDI indices for Rotterdam and Houston held steady. All ports remained well below the US$100 mark on the MDI.

“We expect the upward trend across all bunker fuel segments to persist into next week,” stated Sergey Ivanov, Director of MABUX.