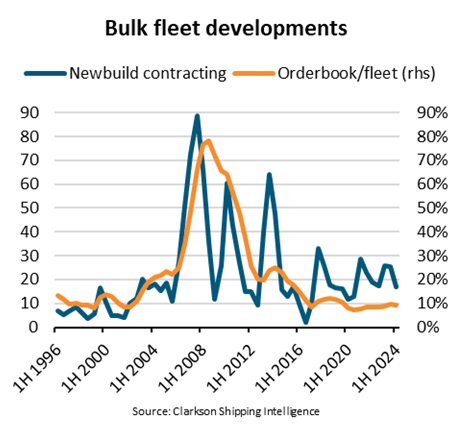

“During the first half of 2024, newbuild contracting in the dry bulk sector fell 34.2% y/y despite favourable market conditions. A 6.5% y/y increase in prices could be deterring contracting, yet in the second-hand market, where prices rose 15.2% y/y, the number of sales still increased 11.7% y/y. Other factors, such as limited shipyard availability and uncertainty on fuels and demand outlook could be contributing to this hesitation,” says Filipe Gouveia, Shipping Analyst at BIMCO.

Shipyards are still occupied by orders for ships in other sectors. The orderbooks for container and LNG ships are sizable and since 2023, contracting for tankers increased. As such, a ship contracted today may only be delivered after the end of 2026, especially in the case of larger ships. By then, there’s a risk that the current strong market conditions have eased.

Uncertainty in deciding which fuel a newbuild ship should use could also be deterring contracting. Shipowners have expressed concern over whether alternative fuels will be available across most ports and regions in the near to medium term.

Lastly, shipowners may be concerned about the demand outlook for certain commodities. Coal shipments may peak this decade, while advances in green steel manufacturing using scrap steel could affect iron ore shipments in the long run.

“The low newbuild contracting is not yet a risk for the dry bulk fleet. The average bulk carrier is 12.3 years old, lower than in the tanker and container sectors, and only 8.9% of the dry bulk deadweight capacity is over 20 years old. The current orderbook is at 9.4% of the fleet capacity and should suffice to replace the recycled ship capacity in the near-term,” says Gouveia.

Supramax and panamax ships are overrepresented in the orderbook, accounting for 34.5% and 32.6% of capacity, respectively. Since the second half of 2023, contracting of panamax ships eased while contracting of capesize ships marginally increased. Handysize ships only account for 3.8% of the orderbook, despite 14.2% of the handysize capacity being over 20 years old. Several of these ships once recycled will likely be replaced by ships in the supramax segment.

“In the medium to long term, newbuild contracting is bound to recover driven by stricter climate regulations. Fleet renewal will become a necessity as it becomes increasingly difficult for older ships to comply with regulations. Furthermore, as the use of alternative fuels increases, a clearer path towards decarbonisation should emerge, reducing uncertainty,” says Gouveia.

Author of the Article: Filipe Gouveia, Shipping Analyst at BIMCO

[script]>

jQuery(document).ready(function(){

jQuery(‘#dd_aeaf06cd0d675c5a12015249cf3ae518’).on(‘change’, function() {

jQuery(‘#amount_aeaf06cd0d675c5a12015249cf3ae518’).val(this.value);

});

});