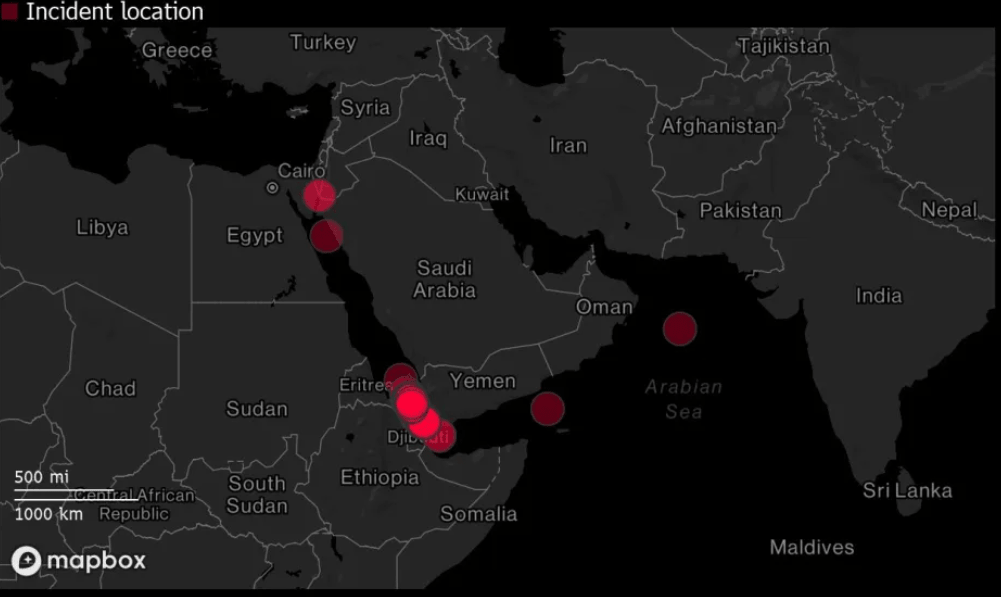

The situation in the Red Sea continues to have far-reaching effects on the maritime industry, with ongoing conflicts impacting commercial vessels. The recent missile attack on the Swan Atlantic, owned by Inventor Chemical Tankers, has raised concerns about the safety of shipping routes in the region. The company attributes the attack to misinformation circulating on the web and emphasizes there is no Israeli connection in the vessel’s ownership, technical management, or cargo logistics.

As a consequence of the Red Sea crisis, major container ship operators have decided to avoid transiting the Suez Canal. Instead, they are opting for longer routes around the Cape of Good Hope, adding approximately 10 days to their journey. This strategic shift is already causing significant disruptions to established shipping schedules and routes.

Notably, Israel-based Zim has taken a proactive stance by diverting all its ships away from the Red Sea. Furthermore, other Israeli-owned vessels are following suit, redirecting their services to avoid the conflict-ridden region. Over the past three weeks, around 42 Israeli-linked vessels have been rerouted, including those on Asia to Europe and Mediterranean services.

Industry analysts, including those at Drewry Shipping Consultants, predict a paradigm shift in the dynamics of container shipping. The balance of power is expected to change, and the fortunes of carriers will hinge on the duration of the Red Sea crisis and the effectiveness of the US-led task force in Operation Prosperity Guardian.

Sailing around the Cape of Good Hope may lead to increased vessel speeds, but maintaining regular schedules poses challenges. Weekly services might require additional vessels to compensate for the extended voyage times. European ports are likely to face difficulties processing ships that deviate from their schedules.

To address the rerouting of vessels around the Cape, adjustments are anticipated in Mediterranean services. Possible changes may include adding calls at Algeciras and Tangier in Morocco near the Gibraltar Strait. Transshipment of cargo to Eastern Mediterranean destinations could also become a viable solution.

As a consequence of these changes, ocean spot rates have witnessed a substantial 20% spike since the announcement by liner companies to avoid the Red Sea region. With the region deemed too dangerous for vessels to sail through, the impact on world trade and the shipping industry is significant. The additional fuel costs for vessels circumnavigating the Cape are estimated to be around $1 million.