Norfolk Southern and ocean carrier CMA CGM are partnering on a new intermodal option combining rail’s network reach with the flexibility of truckload service.

The offering under NS’s Triple Crown brand is a door-to-door offering built around 40-foot high-cube containers. Sources say the service will initially be offered on lanes from the key maritime import hub of Los Angeles to Cleveland and Columbus, Ohio, and Detroit. It could also provide backhaul opportunities from the midwest markets.

“This service is designed to look and feel like a truck move while delivering the efficiency, sustainability and scale advantages of intermodal,” an NS spokesperson told FreightWaves. “By using 40‑foot high‑cube containers and a door‑to‑door operating model, we’re reducing complexity for brokers and shippers and creating a more seamless way to convert long‑haul highway freight to rail.”

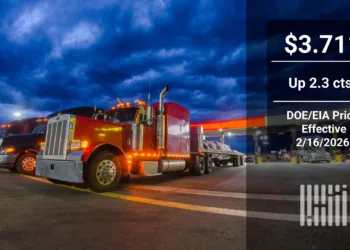

The new service comes amid rising truckload rates as the over-the-road sector emerges from a years-long freight recession. In that time railroads grew volumes from cost-conscious shippers. But, as FreightWaves Chief Executive Craig Fuller reported, with truckload rates firming, rail could lose that momentum by holding intermodal pricing flat. “Expect selective increases to capture better margins, especially on high-volume lanes,” Fuller wrote.

Norfolk Southern (NYSE: NSC) is in the process of being acquired by western rail giant Union Pacific (NYSE: UNP), an historic transcontinental merger the carriers claim will convert 2 million highway truckloads to rail over 10 years.

In October UP and NS launched a new domestic intermodal service, a bi-directional service originating and terminating in the Louisville market, interchanging between the partners in Kansas City, site of UP’s new Kansas City Intermodal Terminal (KCIT). Destinations include Los Angeles, Lathrop, Calif., Seattle, Portland, Oregon, Salt Lake City, and Houston.

“For Norfolk Southern, this kind of collaboration allows us to better utilize our intermodal network, improve asset efficiency, and offer customers a reliable alternative for key long‑haul lanes,” the spokesperson said. “It’s another example of how we’re working with partners to expand intermodal participation and deliver smarter, more flexible supply‑chain solutions.

CMA CGM of France is the world’s fourth-largest container line, with an estimated 24 million twenty foot equivalent units (TEUs) carried in 2025. It owns Fenix Marine Services, one of the busiest terminals in Los Angeles, handling around 2.5 million TEUs annually.

The liner also operates at Long Beach Container Terminal at the neighboring Port of Long Beach, where annual throughput is 3.5 million TEUs.

In January CMA CGM formed United Ports LLC, a joint venture with private equity investor Stonepeak including FMS and nine other global terminals. The venture will fund expansions such as yard extensions, new berths, and rail upgrades. The carrier last year also announced a $20 billion U.S. investment plan to boost port connectivity at Los Angeles and other sites.

Read more articles by Stuart Chirls here.

Related coverage:

Union Pacific, Norfolk Southern set new date to re-file merger application

Rail freight outlook waits for improved indicators

Red state AGs want Justice to review rail merger

Intermodal spot rates haven’t kept pace with trucking’s spot market surge — but that’s about to change in 2026

The post EXCLUSIVE: Norfolk Southern, CMA CGM launch new ‘truck-like’ intermodal service appeared first on FreightWaves.