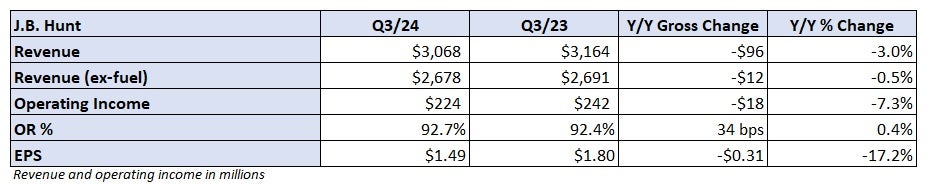

J.B. Hunt Transport Services beat third-quarter expectations Tuesday, sending shares 7% higher in after-hours trading. The multimodal transportation provider saw stabilized, and in some cases improving, trends across its service offerings as it prepares for “an eventual turn in the freight market.”

J.B. Hunt (NASDAQ: JBHT) reported earnings per share of $1.49, which was 8 cents ahead of the consensus estimate but 31 cents lower year over year.

Intermodal puts and takes

J.B. Hunt’s intermodal segment saw demand improve throughout the quarter. Revenue was flat y/y at $1.56 billion as loads increased 5%, but revenue per load was off by a similar percentage.

Total intermodal loads increased 7% y/y in July and were 4% higher in both August and September. By comparison, total intermodal traffic on the U.S. Class I railroads was up 11% y/y in the quarter, according to the Association of American Railroads.

J.B. Hunt’s transcontinental loads were up 7% y/y (up by a double-digit percentage on eastbound transcontinental lanes out of Southern California) while Eastern network loads increased 3%. Eastern volumes are still seeing headwinds from depressed one-way truck pricing as well as some freight diversion ahead of a three-day dockworker strike earlier this month. The company said it could take a few more weeks for Eastern volumes to normalize and that the disruption at the East Coast ports could continue, as only a tentative agreement was reached and workers could strike again in mid-January without a permanent deal in place.

The unit posted a 92.8% operating ratio (operating expenses expressed as a percentage of revenue), which was 100 basis points worse y/y but 10 bps better than the second quarter. The company pointed to a network imbalance, resulting in incremental equipment repositioning costs, and driver hiring ahead of peak season as headwinds. However, Darren Field, president of intermodal, told analysts on a Tuesday evening call that bid compliance among customers is improving, which should reduce costs from lane imbalances moving forward.

Compared with the second quarter, intermodal loads increased 10% but revenue per load was up just slightly. Field said there was likely some volume pull forward ahead of peak season and as some customers altered trade routes around the East Coast to avoid disruptions from the strike. He also said the company has completed its 2024 intermodal bid season and that lower yields will likely linger through the first half of next year.

“We will be living with a large portion of current pricing through the first half of 2025,” Field said. He was a little more constructive on rate negotiations next year. “We just kicked off our 2025 bid season, and we do like our position given our service levels and ability to handle customer surge demand that we have been experiencing.”

J.B. Hunt said it does not expect any material change in its relationship with, or service levels provided by, rail partner BNSF (NYSE: BRK.B), following the railroad’s recent addition of industry veteran Ed Harris. There was some concern among analysts that BNSF’s service could be impacted as the precision scheduled railroading expert looks to cut costs.

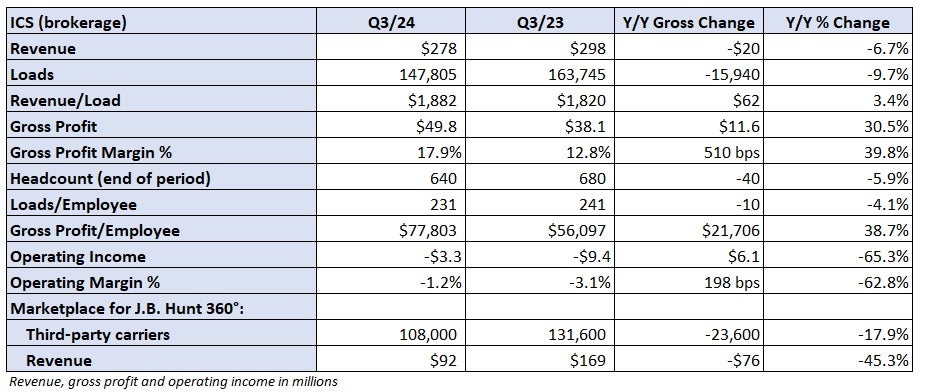

Brokerage may be turning the corner

J.B. Hunt’s brokerage segment reported a $3.3 million operating loss in the period, a $10 million improvement from the second quarter and roughly one-third the loss it booked a year ago.

Revenue was down 7% y/y to $278 million as loads fell 10% and revenue per load improved 3%. A 17.9% gross margin (510 bps better y/y), reduced cargo claims, and a reduction in head count drove the improved result. The period included a $2 million negative impact from the continued integration of BNSF Logistics’ brokerage operations, which J.B. Hunt acquired in September 2023.

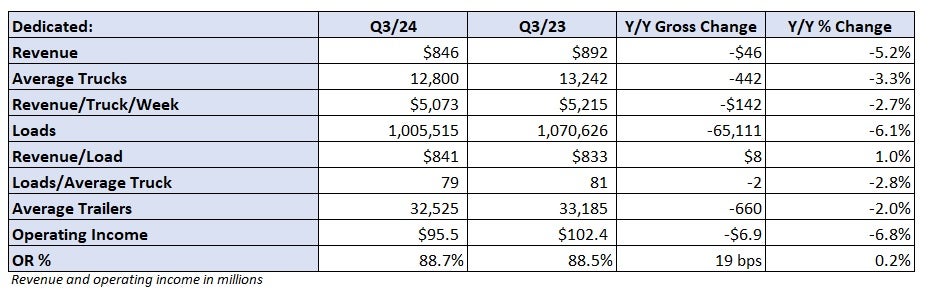

Dedicated backfills lost business

Dedicated revenue fell 5% y/y to $846 million as average trucks in service were down 3% and revenue per truck per week was off by a similar amount. The company sold service on 258 trucks in the quarter (1,273 trucks placed so far this year), but the additions are only partially offsetting attrition within some accounts amid a depressed demand environment.

The unit recorded an 88.7% OR, 20 bps worse y/y and in line with the second quarter. Startup costs within new accounts have weighed on margins.

Other segments at a glance

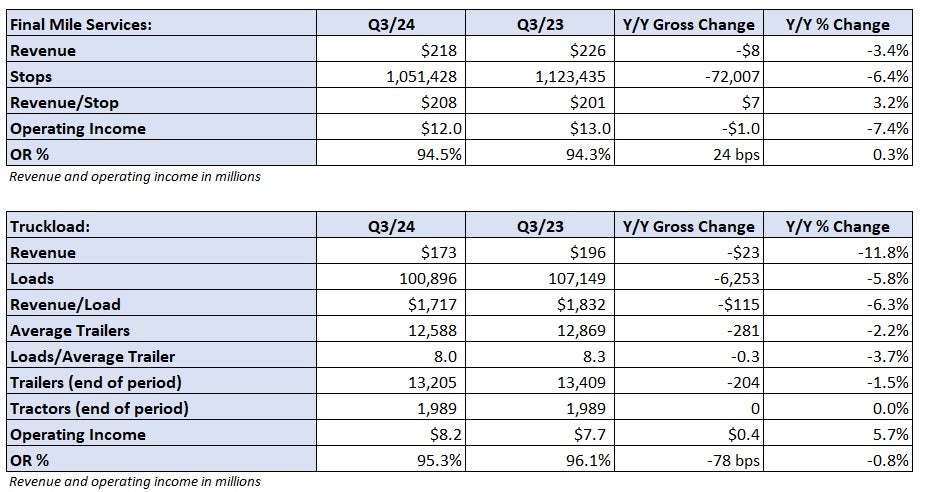

Final-mile revenue dipped 3% y/y to $218 million as total stops fell 6%, but revenue per stop increased 3%. The unit reported $12 million in operating income, a 7% y/y decline.

Operating income in the truckload segment was up 6% y/y to $8.2 million. Revenue declined 12% but OR improved 80 bps.

Shares of JBHT were up 7.1% in after-hours trading on Tuesday.

More FreightWaves articles by Todd Maiden

- LTL survey: Daylight Transport No. 1 overall, Old Dominion top national carrier

- Cass notes ‘signs of price stabilization’ in soft September update

- Descartes acquires inventory, order management platform Sellercloud for $110M

The post J.B. Hunt sees normal seasonality in Q3 appeared first on FreightWaves.