Used truck sales surged at the end of 2025, capping the year with a stronger-than-expected rebound, according to the latest data from ACT Research.

Preliminary same-dealer retail sales of used Class 8 trucks increased 12% month over month in December, outperforming typical seasonal expectations that called for a 9% gain, ACT said in its State of the Industry: U.S. Classes 3-8 Used Trucks report.

Total reported preliminary sales were 22% higher than November, aided by a sharp jump in auction volumes.

For carriers and small fleets that rely on the used market rather than new equipment purchases, the December rebound could mark the beginning of the end of a buyer-friendly cycle.

Auction sales rose 50% month over month, while wholesale activity declined for a second consecutive month, falling 7%, according to ACT Vice President Steve Tam. The diverging trends highlight an uneven recovery, with buyer interest returning selectively rather than broadly across all channels.

“The preliminary average retail price of used Class 8 trucks rose month-to-month for the first time in five months in December, advancing 8.0% month-to-month to $57,135,” Tam said in a statement. “December pricing lagged seasonal expectations, which called for a 10% increase.”

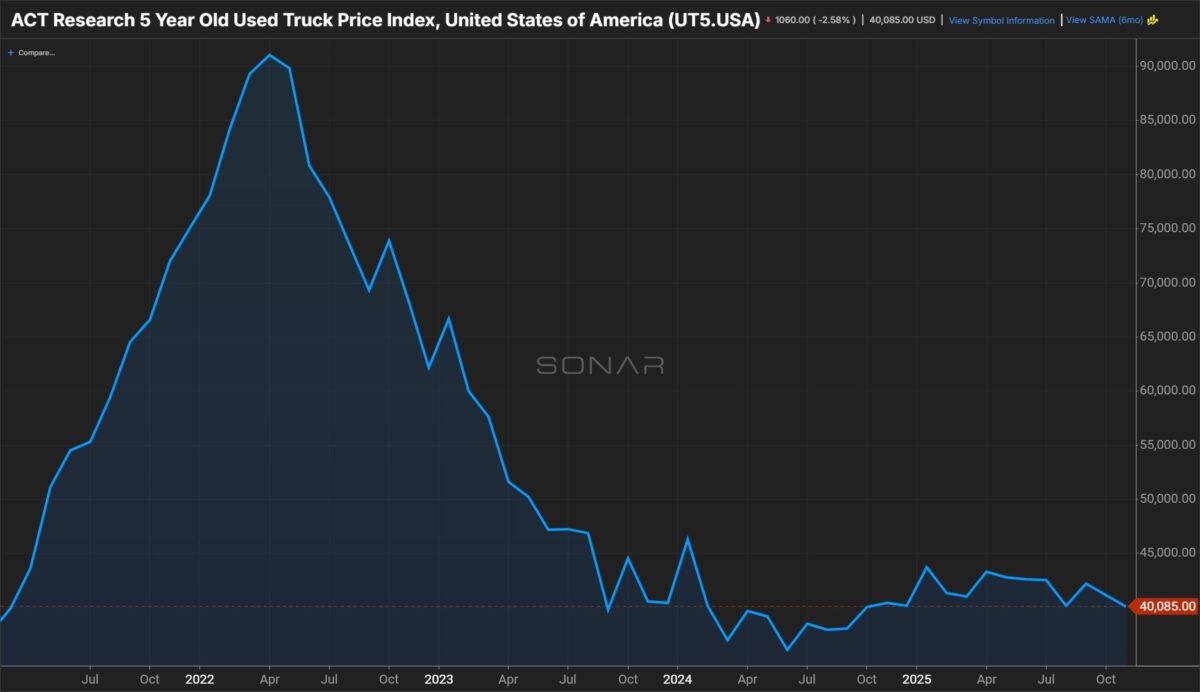

Tam said the move signals that prices may be establishing a floor after nearly two years of declines. That interpretation aligns with ACT’s broader assessment of the used truck market published by FreightWaves in November, which found that prices, mileage and vehicle age across Classes 3-8 were stabilizing after a prolonged post-pandemic correction.

Related: Used Truck Prices Steadying, But Small Carriers Should Pay Close Attention

At the time, ACT noted that retail prices were no longer in freefall, inventories had become “workable,” and sales volumes were steady — conditions that often mark a transition point rather than a long-term plateau.

The ACT Research report provides the average selling price for top-selling Class 8 models for each of the major truck OEMs – Freightliner (Daimler); Kenworth and Peterbilt (Paccar); International (Navistar); and Volvo and Mack (Volvo).

Total Class 8 retail sales in December were still down 16% compared to a year earlier, while average mileage declined 9% year over year and average vehicle age increased 2%, indicating fleets are holding onto equipment longer and bringing fewer late-model trucks to market.

The December rebound suggests that while freight demand remains uneven entering 2026, the used truck market may be transitioning from a buyer-dominated environment toward a more balanced — and potentially tighter — phase later in the cycle.

The post Used Class 8 truck sales jump in December as prices rise to $57,135 appeared first on FreightWaves.