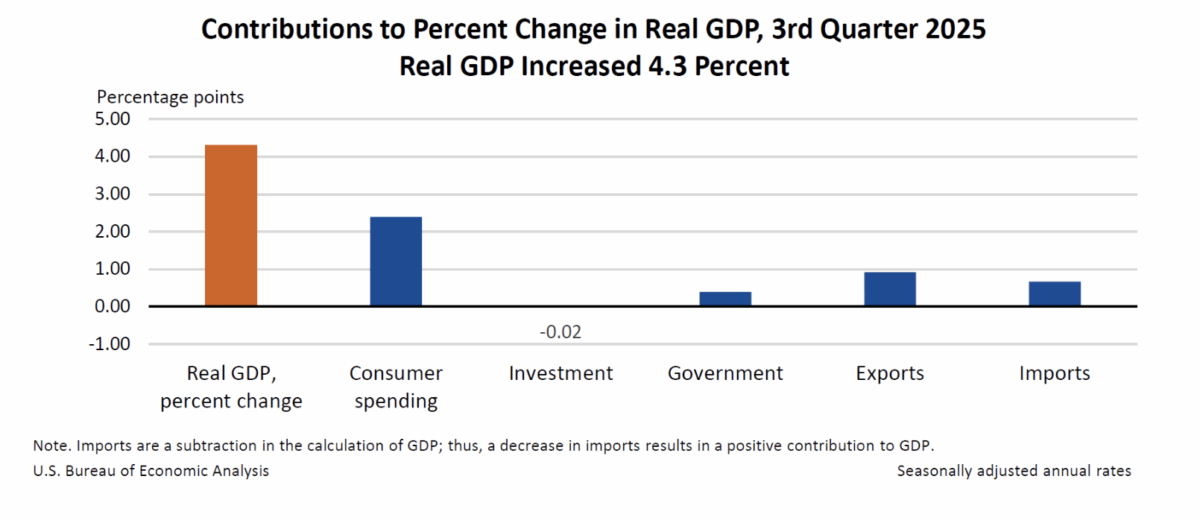

The U.S. economy posted robust growth in the third quarter of 2025, expanding at an annual rate of 4.3% according to the initial estimate released by the Bureau of Economic Analysis. The acceleration from the second quarter’s 3.8% growth rate tells only part of the story, however. A closer examination of the underlying components reveals that the third quarter’s expansion was not only faster but built on a far healthier, more broad-based foundation than the growth recorded earlier in the year.

The distinction matters because GDP can grow for reasons that reflect genuine economic vitality or for reasons that are more technical in nature. In the second quarter, a significant portion of the headline growth figure came from a decline in imports, which are subtracted in the calculation of GDP. When imports fall, all else being equal, GDP rises, but this doesn’t necessarily indicate that the domestic economy is ‘producing more’ or that consumers are better off. By contrast, the third quarter saw growth driven by increases in consumer spending, exports, and government spending, with imports also declining but playing a smaller role in the overall picture.

To understand the shift, consider what drove the second quarter’s numbers. Real GDP increased at an annual rate of 3.3% in the second quarter, according to the second estimate released in August. The Bureau of Economic Analysis noted that this increase “primarily reflected a decrease in imports, which are a subtraction in the calculation of GDP, and an increase in consumer spending.” Investment and exports actually declined during that period, meaning the positive headline number masked some underlying weakness in productive economic activity.

Real final sales to private domestic purchasers, which measures the sum of consumer spending and gross private fixed investment and serves as a gauge of underlying domestic demand, increased just 1.9% in the second quarter. This relatively modest figure suggested that much of the quarter’s GDP growth came from the import arithmetic rather than from Americans spending more or businesses investing in their operations.

The third quarter presented a strikingly different composition. The acceleration in real GDP reflected increases in consumer spending, exports, and government spending that were only partly offset by a decrease in investment. While imports decreased—which again added to the GDP calculation—the Bureau noted that imports decreased less in the third quarter than in the second quarter, meaning this factor contributed less to the overall growth.

Real final sales to private domestic purchasers rose 3% in the third quarter, compared with 2.9% in the second quarter as revised. This uptick indicates that domestic demand strengthened, providing a more sustainable engine for economic expansion.

The consumer spending gains were broad-based, spanning both services and goods. Within services, health care and other services led the way, with outpatient services as well as hospital and nursing home services both increasing. International travel and professional services, particularly legal services, also contributed to the services growth. On the goods side, recreational goods and vehicles—especially information processing equipment—along with prescription drugs drove the increases.

The turnaround in exports was particularly notable. After declining in the second quarter, exports turned positive in the third quarter, with both goods and services increasing. Capital goods except automotive and nondurable consumer goods led the goods exports, while other business services, including professional and management consulting services, drove the services exports.

Investment remained a drag on growth, primarily due to a decrease in private inventory investment led by wholesale trade and manufacturing. However, the decrease in investment was smaller than in the prior quarter, contributing to the overall acceleration.

Government spending also turned positive, with increases in both state and local government spending as well as federal government spending. Defense consumption expenditures led the federal increase, while consumption expenditures drove the state and local gains.

The price picture also showed somewhat more inflation pressure in the third quarter. The personal consumption expenditures price index increased 2.8%, compared with 2.1% in the second quarter, while core PCE excluding food and energy rose 2.9% versus 2.6% previously.

Corporate profits also strengthened considerably, increasing by $166.1 billion year-over-year in the third quarter compared with just $6.8 billion worth of growth in the second quarter. However, these figures were affected by several large settlements finalized during the quarter, including a $2.8 billion antitrust settlement by a domestic health insurance provider and a $2.5 billion settlement by an e-commerce company over deceptive enrollment practices.

The release was delayed from its originally scheduled October 30 date due to a federal government shutdown that occurred in October and November, resulting in delays in many of the principal source data used to produce GDP estimates.

The post GDP grew 4.3% in Q3, and it was ‘healthier’ growth appeared first on FreightWaves.