Steady growth in e-commerce parcel volumes and new lines of business are more than offsetting declines in traditional letter mail for global postal operators, but rising operating costs are squeezing profits, according to the latest annual report by International Post Corporation.

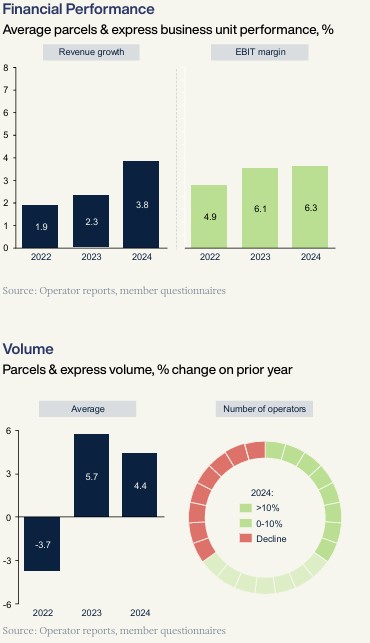

National posts saw the number of parcel shipments increase by 4.4% in 2024, with parcel and express revenue up by 3.8% year over year. Overall revenue for the 53 postal operators covered in the report grew 2% on average to $522 billion, the report said. While growth rates ranged widely, more than two-thirds of participants saw stable or increasing revenues in 2024.

The group’s operating profit margin of -0.8% worsened from -0.5% in 2023, as rising costs for labor, fuel, and transportation and other expenses outpaced gains in parcel revenue. In response to inflation and slowing economic growth, many postal operators are implementing cost-control measures, such as automation and optimizing logistics networks. Many posts and private parcel networks have been forced to increase shipping rates to help cover their costs.

The U.S. Postal Service posted a $2.7 billion operating loss for the fiscal year ended Sept. 30 compared to a $1.8 billion loss the prior year. Canada Post has been in the red for seven consecutive years and is on track for a record loss in 2025.

In the first half of 2025, mail volumes fell almost 10% on average, while parcel volumes grew 4% and parcel revenue increased 3%, according to interim reports from a limited number of posts.

The IPC is a cooperative of 26 member postal operators that provides services to the postal industry.

The increase in postal revenue “is the result of . . . efforts to increase efficiency, diversify and innovate to better respond to the changing needs of e-commerce consumers on delivery markets. The transformation of postal operators into e-commerce consumer-centric companies is more than ever essential,” said IPC Chief Executive Officer Holger Winklbauer, in a news release on Thursday.

Global e-commerce sales reached $4.9 trillion in 2024 and represented 23.3% of total retail sales, according to Euromonitor. Online sales are forecast to reach $7.7 trillion by 2029. Increasing competition has kept postal volume growth below e-commerce growth, but postal operators saw volumes grow faster than private parcel integrators on aggregate.

To support growing parcel volumes, posts have invested in their parcel delivery networks, with increasing use of parcel lockers.

Canada Post, Australia Post and the U.S. Postal Service, for example, are adjusting operations and investing in infrastructure to handle more parcels and provide the consistently reliable service that retailers and consumers seek. Perhaps no postal operator has embraced the secular transition from mail to packages more fully than PostNord in Denmark, which is scheduled to end letter delivery on Dec. 31 to focus on parcel shipping. Still, nine of 23 posts that shared parcel data experienced a decline in parcel volumes last year.

Meanwhile, traditional mail usage has dropped by nearly 37% in the past decade. Since 2019, mail volumes have consistently fallen each year as consumers increasingly rely on email and text for communications, and shop digitally and make payments through their computers or mobile devices. Average mail revenue growth returned to positive territory last year at 1.7%, after contracting for two years.

Postal operators are diversifying their business by adding financial services, telecommunications, retail networks, logistics, and freight transportation to make up for the slowdown in mail revenue.

Click here for more FreightWaves stories by Eric Kulisch.

Sign up for the biweekly PostalMag newsletter The Delivery here.

RECOMMENDED READING:

Denmark says goodbye to letter delivery

Canada Post reports record loss of $385M as parcel revenues plunge

The post Parcel business is bright spot for global postal operators appeared first on FreightWaves.