Container rates ticked up in the latest week on the benchmark eastbound trans-Pacific from Asia to the United States, but the gains were too slight to offset prices 20%-30% lower than in November.

Spot rates rose 7% or $140 per forty foot equivalent unit in a short-term rebound in pricing after a bottoming out in late November.

But rates remain lower by 32%, or $950 per FEU, according to an update from analysts Xeneta and eeSea, from early November as the market adjusts to earlier capacity and demand shifts.

“The backdrop is still one of oversupply compared to demand and that is seen clearly in the fact rates are still not back to where they were a month ago despite a fairly chunky increase in the past week,” said Xeneta Chief Analyst Peter Sand. “Shippers should reflect on this weaker market the next time a carrier asks for a general rate increase (GRI), because it would not appear to be justified against the level of demand versus capacity.”

Spot rates are an important indicator for compiling rate indexes as shippers and carriers prepare for contract negotiations, which get fully underway in January.

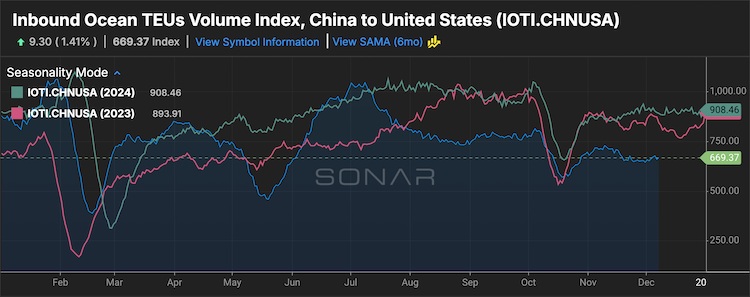

To the West Coast, offered capacity is flat to slightly down at 1%, indicating no meaningful tonnage expansion in the latest week. Capacity is up 7%, or 20,000 twenty foot equivalent units (TEUs) from November, as sharply lower pricing tracks higher supply despite the modest rate recovery.

Week-on-week spot rates increased about 8%, or $220 per FEU, as the Asia-U.S. East Coast trade lane saw a short-term firming. Prices remain weaker by 21%, or $750 per FEU, than a month ago, a significant correction in that span with the latest improvement only a partial recovery.

Capacity this past week was trimmed by 3% which helped boost rates, but was higher by 12%, or about 20,000 TEUs. Xeneta said the tentative stabilization contrasted with more ships and lower rates.

The setting was quite different in other tradelanes.

“Far East to North Europe currently shows both demand and supply strength,” said Sand, “carriers are adding capacity and rates are still edging up rather than softening.”

He said spot rate increases are even stronger from the Far East to the Mediterranean, with sustained double-digit growth over the past month as carriers reduce capacity.

Sand said the Asia-Europe trade could also be benefiting from developments around the Red Sea-Suez Canal route.

“This shows carriers are warming up for a return to the region, but there are a number of steps to go through before this happens at a large scale and transits remain at low numbers compared to before the Red Sea crisis escalated,” he said.

Find more articles by Stuart Chirls here.

Related coverage:

Israel urged to block Hapag-Lloyd offer for Zim: Report

Port of Mobile launches $100M Pier B South overhaul

New gains for container rates as key ocean routes improve

Hacegaba tabbed as new CEO at Port of Long Beach

The post Asia-US container rates uptick can’t obscure recent plunge appeared first on FreightWaves.