As truckers celebrate the Thanksgiving holidays, the U.S. trucking industry stands on the brink of another tradition: the annual capacity purge.

The annual capacity purge happens between Thanksgiving and Valentine’s Day, each year and involves a significant increase in motor carriers leaving the industry compared to other times in the year.

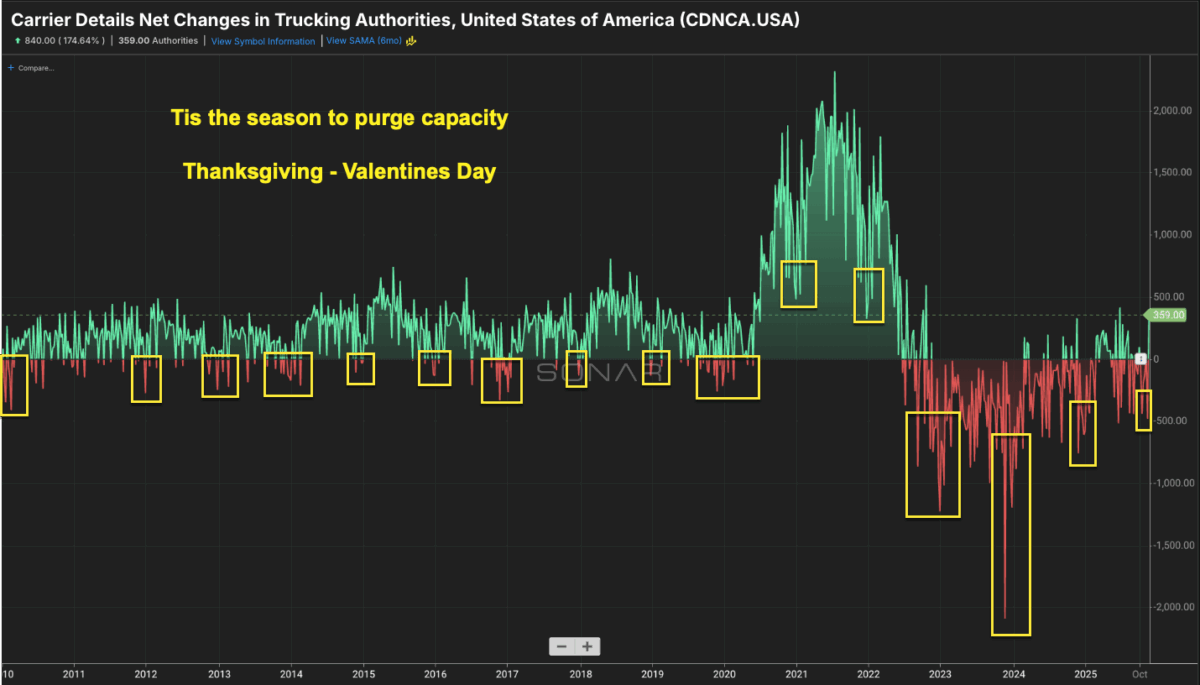

This seasonal trend, clearly captured in SONAR’s Carrier Detail Net Changes in Trucking Authorities (CDNCA) data, shows a consistent surge in net authority losses during this period—outpacing new entrants even in the best economic years. The trucking industry has been an economic backwater for a couple of years and many carrier balance sheets are underwater by the damage done during the Great Freight Recession, the longest economic downturn in trucking history.

This year’s contraction could be more severe than usual.

A Seasonal Pattern Rooted in Data

SONAR’s CDNCA data, which tracks the weekly net change in motor carrier of property trucking authorities by subtracting revocations from granted authorities, highlights a pronounced dip in net capacity from late November to mid-February. This timeframe sees a marked increase in carriers exiting the industry—voluntarily or involuntarily—while new operator startups tend to slow down. Even in strong years like 2018 or 2021, the Thanksgiving-to-Valentine’s window stands out as a period of net attrition.

As I noted in my recent X post:

“Tis the season to purge capacity. The trucking industry typically experiences a purge of net capacity from Thanksgiving – Valentine’s Day. Even in the good years, fewer new carriers were started during this period.”

The accompanying chart, drawn from CDNCA, visually confirms the spike in authority losses, marked by yellow indicators, which correlate to the purge season.

Why the Seasonal Exodus?

Several factors drive this annual capacity purge. The winter freight slowdown, slashes revenue per mile and squeezes carrier profitability. Winter weather, rising maintenance costs, and reduced driver availability further compound the pressure, pushing marginal operators to the edge.

During the holidays, many truck drivers go home only to realize that they have lost the desire to return to the industry and deal with the headaches and challenges of being a truck driver, seeking out alternative employment.

This is more likely to impact employee truck drivers, but their unwillingness to return can put financial strain on the operators, further contributing to a decline of capacity.

This year we could also see a substantial purge of foreign born drivers leaving the country, with no plans to return to the U.S. and therefore leaving the American trucking industry behind. This shift, tied to visa uncertainties and the immigration crackdown, could accelerate the capacity churn.

A Prolonged Correction Cycle

The industry’s capacity correction phase, ongoing since 2023, amplifies this seasonal trend.

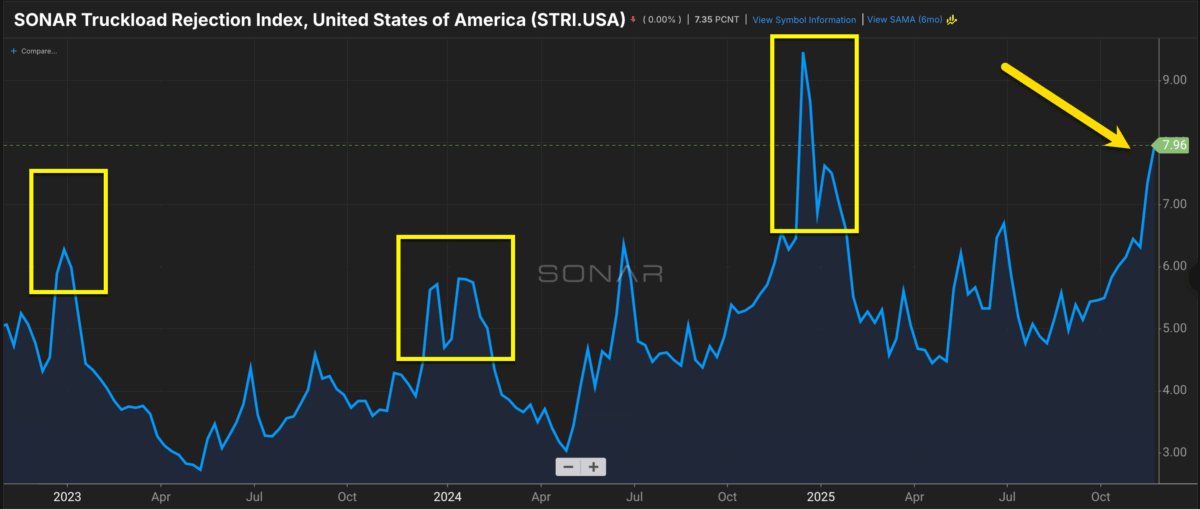

With carrier profitability at historically weak levels and truck builds focused on basic replacements rather than expansion, the Thanksgiving-to-Valentine’s period becomes a natural point for authority revocations. SONAR’s tender rejection data always shows a tightening of capacity in late November through mid January, as capacity tends to dry up during this period.

Looking Ahead

While the Thanksgiving-to-Valentine’s capacity purge is a predictable annual event, its magnitude in 2025 could reshape the industry.

The question for the trucking industry is not whether authorities will be lost, but how many—and who will endure trucking’s never ending cold winter.

The post ‘Tis the season for the annual capacity purge appeared first on FreightWaves.

(@FreightAlley) November 27, 2025

(@FreightAlley) November 27, 2025