The long struggle at TFI International (NYSE: TFII) to turn around its U.S. LTL operations showed just a few signs of improvement in the third quarter.

The one key metric that was a step in the right direction was the operating ratio (OR) for the segment, which contains the former UPS Freight LTL operations that TFI bought in 2021. The OR for the U.S. LTL operations at TFI was 92.2%, unchanged from the third quarter of 2024. But it did mark an improvement over the 94% recorded in the second quarter.

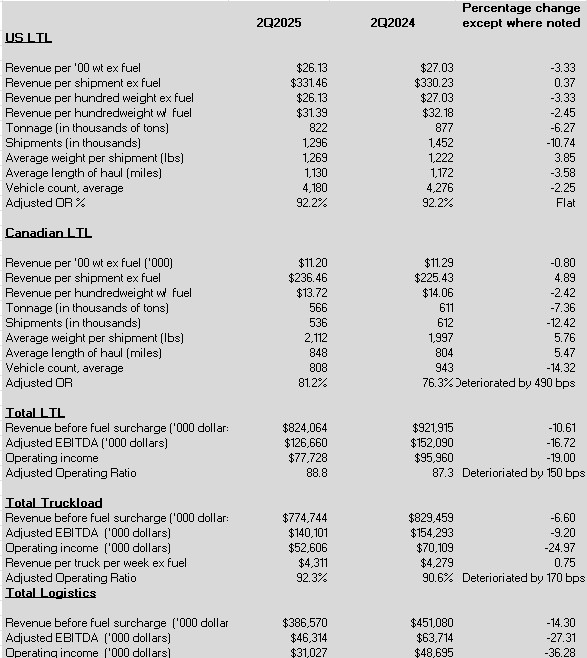

Other key metrics compared to a year ago were mostly lower. Revenue per hundredweight excluding fuel, the all-important yield number, was down 3.33% from the third quarter of 2024. Including fuel, that number was down 2.45%.

Total tons declined 6.27%. But average weight per shipment rose 3.85%, a metric that CEO Alain Bedard has spoken of on earnings calls with analysts as an important measurement.

Revenue per shipment excluding fuel, also an important metric, was up 0.37%.

The overall figure for total LTL at TFI, including its Canadian operations, was grim. Its OR was up 150 bps from a year ago, at 88.8%. The Canadian LTL segment, which Bedard regularly touts as what the U.S. LTL operations should aspire to be, saw its OR deteriorate to 81.2% from 76.3%.

Bedard touted “solid margin performance” in his prepared statement. But the adjusted EBITDA margin was 17.7%, less than the 18.7% of a year earlier.

In the press release accompanying the earnings, Bedard was upbeat about the U.S. LTL operations. He highlighted the OR that was equal to a year earlier. He said it is “but one example of new segment leadership executing through a still muted and uncertain freight environment.”

The financial performance at TFI is strong enough that the company announced a roughly 4% increase in its quarterly dividend to 47 cents per share, up from 45 cents per share. It will be paid out starting in January.

The bottom line at TFI is that its adjusted earnings per share fell to $1.20 from $1.59 a year earlier.

The individual segments reported significantly less operating income than in the year-ago period. The LTL group had operating income of $77.7 million compared to $96 million in 2024’s third quarter. Truckload recorded a drop to $52.6 million from $70.1 million a year ago. Logistics declined to $31 million from $48.7 million.

Non-GAAP EPS of $1.20 was down from $1.58 a year ago. But SeekingAlpha reported it was in line with Wall Street consensus.

TFI’s earnings call with analysts is Friday morning.

More articles by John Kingston

DAT execs in two forums discuss how it seeks to reshape the freight sector

NMFTA’s freight classification overhaul: surprising shipper preparedness

C.H. Robinson’s AI strategy boosts 2026 financial forecast

The post First look: mixed signs of a turnaround at TFI’s U.S. LTL operations appeared first on FreightWaves.