CHATTANOOGA–With the October State of Freight webinar being done in person before an audience here at the FreightWaves Festival of Freight (F3), it had the odd juxtaposition of being a mostly bullish presentation in a sea of freight executives who are otherwise suffering through the tail end of a third year of a freight recession that started sometime in the spring of 2022.

But both FreightWaves and SONAR CEO Craig Fuller and SONAR director of freight market intelligence Zach Strickland said there are indications that the market has at least the chance of turning higher but with a few areas where trucking still faces significant headwinds.

Here are five takeaways from the October webinar held at F3.

Drivers are staying home

The discussion about intermodal and its reliance on rail traffic coming out of the west coast ports led to a focus on the drivers who haul goods coming out of that region when it goes on a chassis pulled by a tractor. Strickland said the trucking market in Southern California “has been extremely erratic this year,” given the back-and-forth of U.S. tariff policies that have led to surge and collapse in imports. “It’s been an up and down market,” he said.

That led Fuller to note a large percentage of drivers who are involved in the SoCal drayage business “tend to be in the very population that the administration is focused on” in its deportation efforts. Some of those drivers are non-domiciled and are working illegally, but another group, he said, are “fully documented, have all their papers, been here for many years and should not be subject to deportation because they’ve paid all their taxes.”

But now, Fuller said, “they’re scared to drive.” In some cases it has led to bankruptcies and “what’s happened is there has been a washout of a lot of capacity.” Fuller estimated that about 70% to 80% of the Southern California trucking market is driven by immigrants.

But “we’re seeing some of our legitimate, fully documented drivers who are scared to drive due to their fear of deportation.” The result has been that “the spot rates in certain markets are starting to melt up.”

He said many of the increases have been “in pockets of cities. It was in the Midwest, Chicago, it was in Southern California, perhaps even Dallas was having that as well,” Fuller said.

How are so many people staying in business?

Fuller cited a recent Morgan Stanley study that said every mile a trucker operates is actually at a loss. “How are they staying in business?” Fuller said.

Looking at the non-domiciled drivers who have been disappearing from the roads and will find their route to a CDL blocked by various policy decisions, “what we’re learning is that those drivers do not care about the consequences of breaking the Hours of Service rules.”

“These guys will run 18 to 20 hours per day when legitimate drivers are only allowed 11,” Fuller said. “So they’re able to run at operating cost below the market, which means you have people out there who are bottom feeding.”

But concerns in that community about operating against the law may be starting to shift. The “strong stance” of the administration against immigrants and non-domiciled drivers “is intimidating to any of these operators, and you’re seeing drivers that would normally drive and not care about rules are either driving and staying in full compliance, or not driving at all,” Fuller said.

Getting ready for a bull market

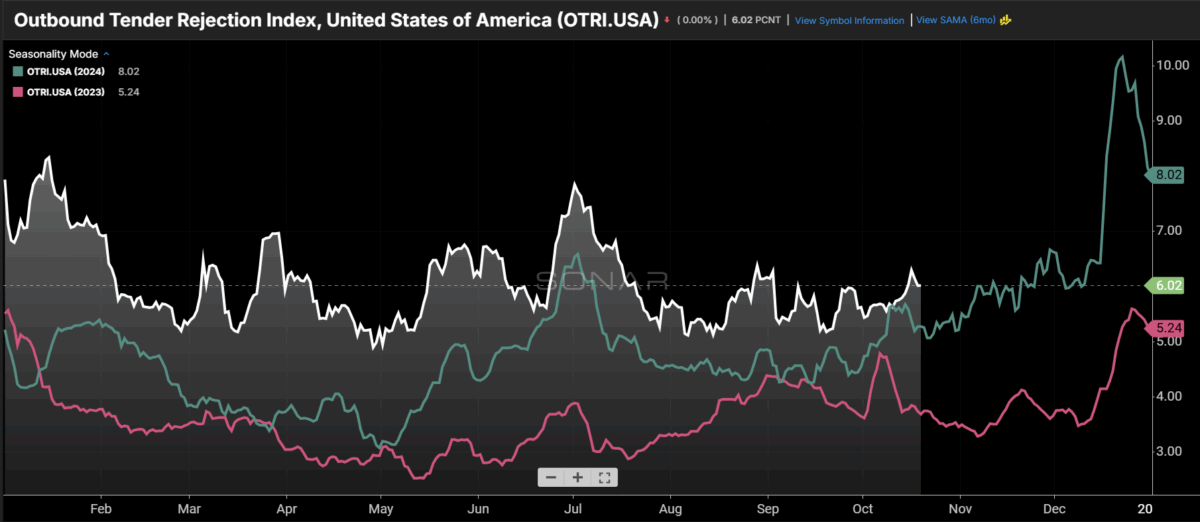

With various indices pointing higher, including rates and the Outbound Tender Rejection Index (OTRI), Fuller cautioned that the long salad days that shippers have enjoyed may be coming to an end. “If we get a volume surge, the economists will tell you that there are a lot of reasons to be bullish,” Fuller said. He cited various reasons for that: tax cuts hitting next year, a possible improvement in the mortgage and auto markets, and mostly strong earnings reports so far.

Strickland said those improvements are coming against strengthening in the OTRI.

The groundwork is being laid for that strengthening to continue, Fuller said. “What I do know is that we continue to lose capacity, and when we lose operating authorities out of the market, that is when you could be on the cusp of a trucking super cycle,” Fuller said.

One thing that’s different this time: the trucking industry would enter it after a prolonged downturn. And the normal rush to buy trucks and add capacity won’t be present. “That scarring from the past few years is going to prevent banks and entrepreneurs and fleet executives from expansion,” he said. On top of that could be the 25% tariff on imported heavy duty trucks.

Capacity in a recovery will be slow to rise, Fuller said. “I think we will look back and say the recovery actually started sometime in the middle of 2025, when we started to see some of these changes,” Fuller said. “And we will look back and say it was slow to start with, and then there was some inflection point.”

But with the memory of the great freight recession in their mind, “at that point, I think carriers are going to be reluctant to add capacity, because they’re going to be like, well, this is short lived,” he said.

What the SONAR volume indicates say about manufacturing

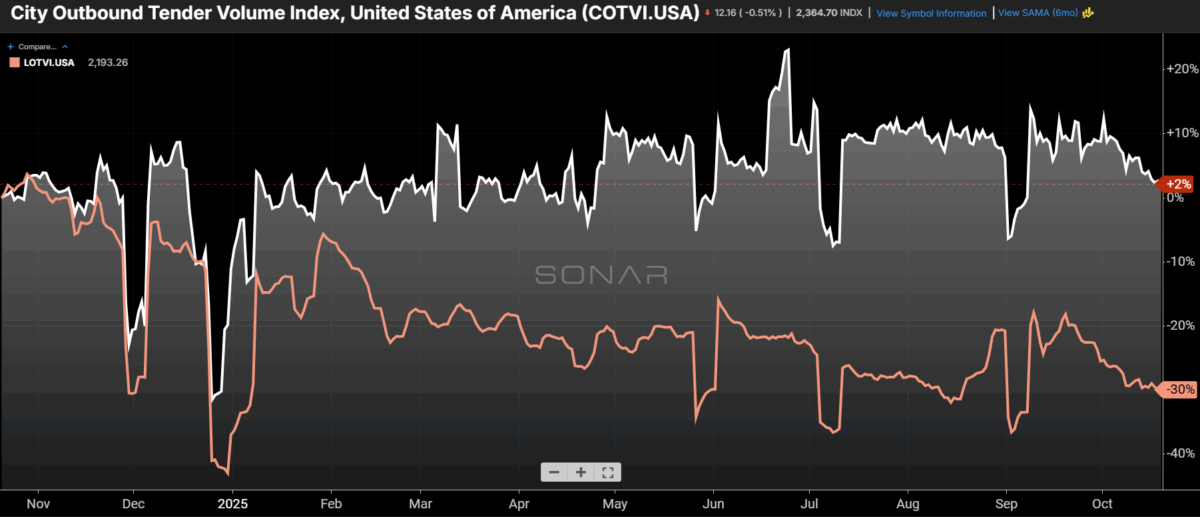

It wasn’t all positive. SONAR measures the Outbound Tender Volume Index for short-haul versus long-haul freight. Fuller said the sharp divergence of the two in recent months is an extremely bearish sign for manufacturing in the U.S.

After Strickland showed a chart showing a collapse in long-haul volume versus short-term volume, Fuller noted that the short-term volume “is highly correlated to distribution and retail.”

“And the reason that it is so highly correlated is that it’s local within 100 miles,” Fuller said. “It’s typically retail goods being distributed locally.” Fuller, a heavy user of X formerly known as Twitter, said he has been criticized online on that forum by people who say “wait, retail sales are doing OK, and e-commerce sales are at record highs. How can you possibly say that the goods economy is bad?”

Noting that the long-haul volume index is down 30%, Fuller said “that long haul stuff is a lot of manufactured goods that are moving through the economy, and that tends to be a large piece of the over the road truckload market.”

Given the divergence, Fuller said “if you’re in local distribution, you’re OK. The consumer has not slowed down its spending.”

But that isn’t the case with manufacturing. “There is an absolute utter collapse in the manufacturing business economy,” Fuller said. He said the irony is that the Trump administration has focused on a revival of U.S. manufacturing, “and what the data tells us is the exact opposite.”

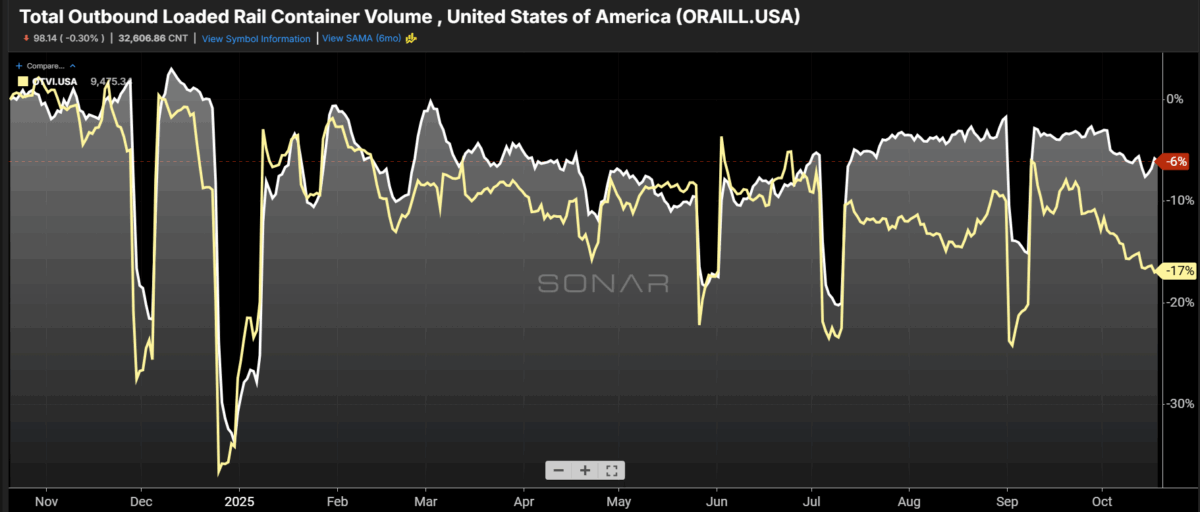

Losing market share to intermodal

Coming off a strong earnings report out of J.B.Hunt, Fuller said the bottom line at the trucking company that is also a huge intermodal operator suggests there is a sign of “sort of an intermodal renaissance.”

J.B. Hunt told us “their intermodal business is doing well, and they’re bullish on it,” he said. Intermodal in general has picked up significant market share, and Fuller said the efficiencies that would be generated by a merger of Union Pacific (NYSE: UNP) and Norfolk Southern (NYSE: NSC) is likely to accelerate that trend.

“And this is what the truckers are fighting right now and this is what brokers are fighting, a deterioration in the volume available to them because of intermodal,” Fuller said.

More articles by John Kingston

China expert Miller: why supply chain ‘choke points’ matter most

Factoring companies squeezed by slowing shipper payments: Alsobrooks

DAT execs in two forums discuss how it seeks to reshape the freight sector

The post State of Freight takeaways: some signs are pointing higher appeared first on FreightWaves.