Borderlands Mexico is a weekly rundown of developments in the world of United States-Mexico cross-border trucking and trade. This week: Foreign trade zones gain traction as importers seek tariff relief; Exports drive Mexico’s surprise growth, but USMCA uncertainty clouds outlook; and Port of Victoria partners with Blue Energy on $1B nuclear power project.

Foreign trade zones gain traction as importers seek tariff relief

As shifting trade policies and new tariffs reshape supply chains, U.S. importers are increasingly turning to foreign trade zones (FTZs) and bonded warehouses to manage costs and preserve flexibility, said Andy Smith, chief operating officer at Source Logistics.

“People sometimes perceive FTZs as loopholes — they’re not,” Smith told FreightWaves.

“They’re tightly controlled by U.S. Customs and Border Protection and require licensing, audits and background checks. It’s a very rigorous, formal process that helps companies manage costs in a compliant way.”

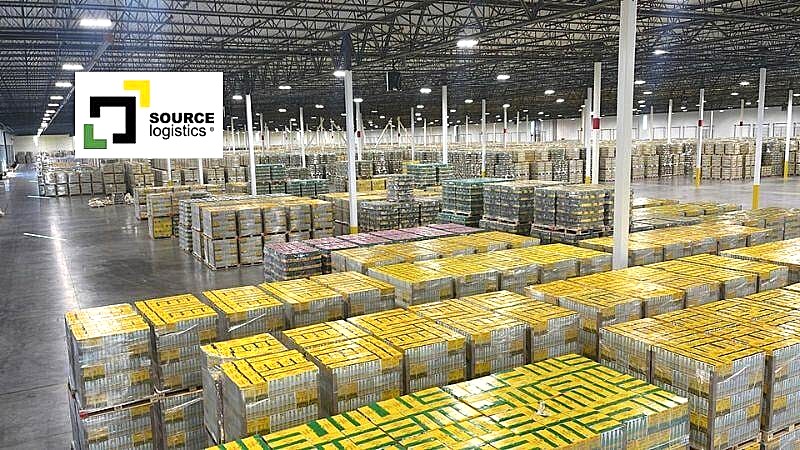

Headquartered near Houston, Source Logistics is a provider of transportation, warehousing, distribution and fulfillment services. The company was founded in 1999 and serves a wide range of sectors and industries, including food and beverage, health and beauty, consumer retail, medical, manufacturing, technology and more.

The company, which operates facilities in Laredo, Houston, Dallas, Los Angeles and New Jersey, recently established an FTZ in Laredo — the busiest U.S.–Mexico truck crossing — to help importers facing tariff uncertainty.

“It’s not cheap to get started,” Smith said, estimating setup costs at nearly $30,000 for licensing and facility modifications to meet federal standards.

Unlike bonded warehouses, where goods can be stored for up to five years, merchandise held in an FTZ can remain indefinitely without paying duties until it officially enters U.S. commerce.

“You can literally hold it there, ride out tariffs or volatility, and if you need to redeploy that inventory overseas, you can do that without paying duties,” Smith said.

Smith described two active use cases: a Mexican furniture retailer storing product in Laredo for U.S. and Canadian distribution, and a U.S. beverage supplier using a bonded warehouse in New Jersey to delay tariffs on imported aluminum cans.

“For the furniture importer, it’s a tax elimination strategy when re-exporting to Canada. For the beverage customer, it’s purely a hedge against U.S. tariffs — a delay tactic,” Smith explained.

While FTZs can defer or eliminate duties, Smith cautioned that they’re not suitable for every importer.

“It has to make economic sense. Between setup costs, compliance requirements, and the paperwork involved, it’s a niche solution. But for those that fit the profile — automotive, furniture, electronics — it’s a powerful tool.”

Smith, a veteran logistics executive who previously held senior roles at FedEx Supply Chain, Genco and Kenco Group, said interest in FTZs is rising as companies look for ways to build resilience.

“There’s limited space out there, and setting up a new FTZ can take three months to a year,” he said. “But for importers trying to navigate today’s tariff volatility, it’s one of the few reliable strategies to control landed costs.”

Exports drive Mexico’s surprise growth, but USMCA uncertainty clouds outlook

Mexico’s economy expanded 1.8% in the first half of 2025 — stronger than expected — as exports surged ahead of potential new U.S. tariffs, according to a new Federal Reserve Bank of Dallas report.

Analysts say the growth was largely fueled by companies front-running trade restrictions under the U.S.–Mexico–Canada Agreement (USMCA), which continues to shield many goods from tariffs.

Roughly 80% of Mexico’s exports go to the U.S., and total bilateral trade reached $635.7 billion in the first six months of the year, up 3%. However, the effective U.S. tariff rate on Mexican goods has risen from 1.6% to 10.6%, creating uncertainty for manufacturers on both sides of the border.

The Dallas Fed said that ongoing USMCA renegotiations and additional U.S. tariffs could disrupt Mexico’s role as a key manufacturing hub. Economists project growth will slow sharply in the second half of 2025 to just 0.7%.

Port of Victoria partners with Blue Energy on $1B nuclear power project

The Port of Victoria in Southeast Texas has signed an option agreement with Blue Energy, a U.S. advanced nuclear power developer, to lease about 70 acres at the Texas Logistics Center.

The agreement is for a proposed modular nuclear power plant capable of generating up to 1.5 gigawatts of clean energy.

Blue Energy’s design — which involves prefabricating components in shipyards and installing modular reactor systems on-site — aims to reduce costs and cut construction time to 36 months or less. The first phase of the project represents an initial investment of more than $1 billion and could create around 100 permanent high-paying jobs in the Victoria region.

“This project represents a major step forward in energy innovation and economic development for our region,” Sean Stibich, executive director of the Port of Victoria, said in a news release.

The Port of Victoria is a shallow-draft inland facility about 117 miles from San Antonio and 125 miles from Houston. The port’s 35-mile Victoria Barge Canal offers shippers access to the Intracoastal Waterway, as well as rail and highway access to Houston, San Antonio and Austin.

The post Borderlands Mexico: Foreign trade zones gain traction as importers seek tariff relief appeared first on FreightWaves.