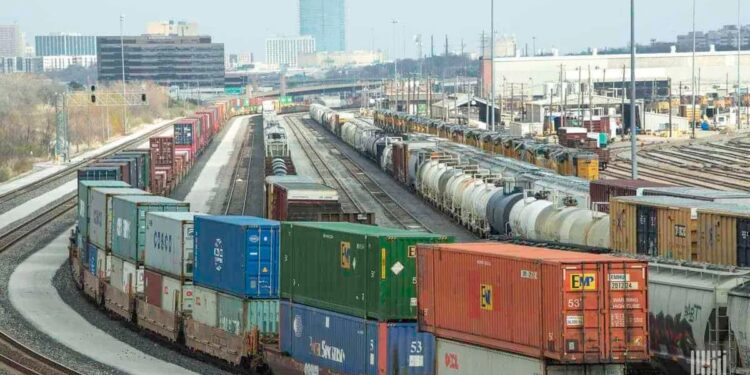

September’s rail volumes indicate a fluctuating U.S. economy with broader economic trends suggesting a mix of careful optimism amid ongoing uncertainty.

Total U.S. rail carloads fell 1.2% year-over-year in September, according to the Association of American Railroads, with losses in 12 of 20 major categories.

But some commodities including metal products, autos and parts, metallic ores, and stone and glass products improved.

For the month total carloads averaged 225,783 per week, ahead of the weekly average of 221,853 through the first nine months of the year. Year-to-date carloads through September increased by 2.1%, or more than 180,000 carloads, over the same period in 2024, and 12 of 20 carload categories posted gains.

Intermodal shipments were lower by 1.3% in September y/y as container and trailer volumes were hit by weaker consumer demand and the effects of U.S. tariff and trade policy. However, average weekly intermodal volume for the month of 275,559 containers and trailers ran well above year-to-date weekly average of 271,121, and year-to-date volume through September was 10.57 million units, up by 3.5%, or 362,000 units from 2024, the most since 2021, and the third highest ever.

“Historically, September and October are peak months for intermodal traffic, but performance this year hinges on several unpredictable factors, including global supply chain shifts and consumer-driven freight demand,” said AAR economist Rand Ghayad, in the report. “To hedge against uncertainty, many businesses have frontloaded shipments ahead of the holiday season, which could impact intermodal volumes going forward.”

Key commodities

The AAR Freight Rail Index (FRI) of seasonally-adjusted intermodal shipments plus carloads excluding coal and grain fell 0.8% in September from August 2025, its fifth decline in the past six months. “Still, the index is only 1% below its level from a year earlier, indicating that recent weakness reflects a gradual adjustment rather than a sharp downturn,” Ghayad said.

Grain carloads averaged 20,966 per week in September, 3.5% better than a year ago and slightly below the weekly average of 21,037 in the first nine months of the year. Year-to-date carloads were up 6%, or nearly 47,000 carloads, from 2024 – the most since 2021.

Coal carloads declined 3.8% in September, the first drop in seven months, while averaging 60,318 per week in September 2025. The only September since 1988 with fewer carloads was September 2020.

While there typically is a seasonal decline in coal consumption going into the fall due to plant maintenance shutdowns, overall usage is increasing in 2025 in large part on the development of data centers, and coal-friendly policies by the Trump administration.

Coal volumes in September were the second-most for any month in 2025, and year-to-date carloads through September gained 4.4%, or more than 95,000 carloads. Those shipments came on easier year-ago comparisons when the Baltimore bridge collapse curtailed exports.

In September carloads excluding coal fell 0.2%, the first year-over-year decline in seven months and only the second in the past 20 months. Year-to-date carloads excluding coal through September climbed 1.4%, or 85,000 carloads – the most since 2019.

Chemical shipments, seen as a general indicator of industrial activity, declined 0.7% in September, only the second year-over-year decline in 25 months. But carloads averaged 32,244 per week, making September a top 6% month all-time for rail chemical shipments. Year-to-date saw a record 1.29 million carloads, up 1.5%, or more than 19,000 carloads, from the year-ago period.

Carloads of steel and other primary metal products increased 2.3% in September, the seventh straight y/y gain following 13 consecutive declines. Iron and steel scrap carloads were 18.4% better for the month, also the seventh straight increase. Year-to-date carloads of scrap were up 9.4% from 2024, the most since 2011. Scrap metal prices were mixed but subdued for the month during plant maintenance closures, along with uncertain Chinese demand and global conditions.

Carloads for the AAR’s combined industrial products category tracking manufacturing output – and a gauge of industrial activity – was 0.1% higher in September y/y, and the fifth straight y/y improvement. “This sustained growth underscores the resilience of some core industrial sectors amid broader economic uncertainty and manufacturing weakness,” Ghayad said.

Economic indicators

In September the report noted ongoing weakness in the jobs market, while the Federal Reserve cut interest rates by a quarter-point to between 4.00% and 4.25%, its lowest level in almost three years and the first cut since December 2024. The change signaled a shift, Ghayad said, since the Fed’s longtime concern “has been inflation, which has exceeded its 2% target for more than four years. The price index for personal consumption expenditures, the inflation measure preferred by the Fed, was up 0.3% in August from July, matching its highest month-to-month gain in six months. The year-over-year increase was 2.7% in August, the highest in 16 months. Meanwhile, the consumer price index was 2.9% higher in August 2025 than in August 2024, its biggest increase in seven months.

“Together, the readings reinforce that inflationary pressures remain sticky enough to complicate the Fed’s rate cut decisions. The Fed’s next steps will hinge on upcoming labor and inflation data, which remain stubbornly at odds.”

Consumer spending has remained resilient, said Ghayad, helping the economy maintain momentum. “With the recent slowdown in the labor market, the resilience of household demand will hinge in part on accumulated savings buffers. However, the savings rate fell to 4.6% in August — its lowest level this year and well below its 2023 (5.6%) and 2024 (5.4%) averages — raising questions about how long consumers can sustain this pace.”

The Manufacturing PMI from the Institute for Supply Management was 49.1% in September, up from 48.7% in August and the 33rd month in the past 35 months it was below the 50% dividing line between manufacturing contraction and expansion. New orders fell to 48.9%, and it has been below 50% seven of the past eight months. The Fed’s preliminary data reported U.S. manufacturing output rose slightly in August from July, to its highest level since October 2022, and up 0.9% y/y, the seventh straight such gain, though all have been minimal.

“The key dynamic remains unchanged,” Ghayad said. “[W]ithout a stronger manufacturing rebound, freight rail volumes will stay constrained.

The ‘resilient’ rail volumes, Ghayad said, point to steady demand across key supply chains.

“Uncertainty remains the dominant theme. [M]ixed economic signals and the added complication of a government shutdown — temporarily disrupting key data flows — reinforce the need for caution as the year enters its final quarter.”

Subscribe to FreightWaves’ Rail e-newsletter and get the latest insights on rail freight right in your inbox.

Find more articles by Stuart Chirls here.

Related coverage:

Drop for rail freight in latest week

Rail regulator Primus sues Trump over firing ‘retaliation’

BNSF to shippers: Speak up about UP-NS merger

Investor: CSX can now search out ‘willing partner’ for rail merger

The post New AAR analysis signals rail freight caution appeared first on FreightWaves.