FedEx Corp.’s ability to flex its air network from the U.S. to European markets helped stabilize international shipping volumes as President Donald Trump’s new tariffs on e-commerce goods from China pressured consumer demand during a first quarter with overall positive results.

The parcel logistics giant reduced freighter aircraft out of Asia to the United States by 25% because of the change in tariff policy, CEO Ram Subramaniam said Thursday afternoon during an earnings briefing.

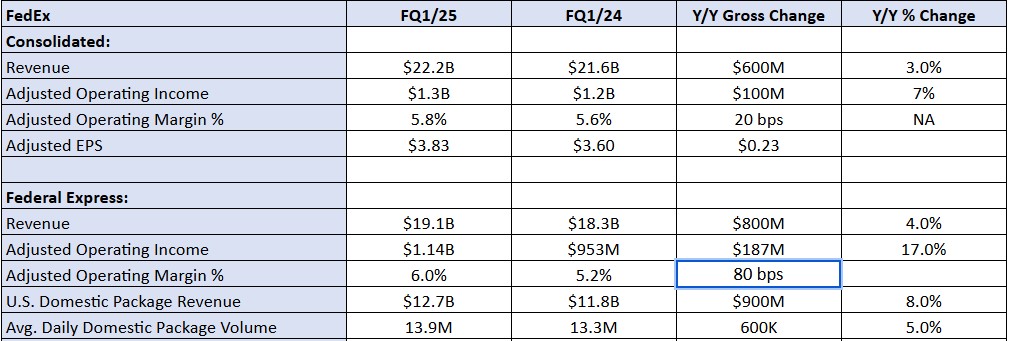

FedEx solidly beat Wall Street expectations for the fiscal year first quarter, posting its strongest year-over-year revenue growth in three years and adjusted earnings per share above the midpoint outlook behind strong domestic package activity and structural cost reductions, which more than offset a decline in international export business due to U.S. tariffs.

Termination of tariff-exempt treatment for direct-to-consumer goods cut first-quarter revenue by about $150 million. Chief Customer Officer Brie Carere said that tariff policies and other revenue pressures and expenses represent a $1 billion headwind for the fiscal year.

Memphis, Tennessee-based FedEx reported revenue grew 3% to $22.2 billion, $550 million ahead of expectations, and adjusted operating income of $1.3 billion, up 7% from the prior year. Earnings per share of $3.83 came in 22 cents above consensus.

Full-year guidance through the end of May is for revenue to increase between 4% and 6%, year over year. FedEx forecast 2026 earnings largely below where most analysts are at $17.20 to $19, reflecting another $1 billion in permanent cost cuts and the uncertain economic environment.

FedEx shares were up 2.6% in late Friday trading.

FedEx’s fiscal first quarter, which ended Aug. 31, was impacted by the end of so-called de minimis exemptions for packages from China and Hong. They represented more than 70% of the 1.4 billion packages imported in fiscal year 2024 under a rule that allowed shipments valued below $800 to clear customs duty free and with minimal paperwork.

President Donald Trump eliminated the de minimis benefit for the rest of the world on Aug. 29.

The $150 million tariff impact during the quarter was $20 million less than Chief Financial Officer John Dietrich suggested at an investor conference in August. Carere attributed most of the $1 billion fiscal-year headwind to the continued reduction in revenue out of China. She added that the ban on global de minimis will dent the bottom line by $100 million with another $300 million in incremental expense for additional customs clearance expenses.

The new tariff environment for small packages has been “particularly challenging for small exporters because they do not have the expertise and the staffing, and that’s where our teams have come in and really partnered with them to help automate some of their clearance inputs from a digital perspective,” Carere told analysts.

Year-over-year comparisons were also hurt by the September 2024 expiration of FedEx’s domestic air cargo contract with the U.S. Postal Service, which produced a $130 million drag on earnings. That overlap won’t be reflected after the second quarter.

The Network 2.0 program to optimize package flows by consolidating the legacy Express and Ground networks continued to advance, with about 70 additional U.S. stations combined during the first quarter, CEO Raj Subramaniam said. FedEx completed the network integration in Canada earlier this year. Eliminating excess capacity is expected to eventually save the company $2 billion in annual costs. During the quarter, the initiative delivered $200 million in savings. About 360 delivery stations have now been blended across the two countries. By the end of the month, nearly 3 million daily parcels will flow through consolidated facilities.

Analysts are warming up to the likelihood that FedEx can pull off the massive transformation, streamlining costs and increasing network flexibility, and the impending carve out of the Freight unit. FedEx Freight continued to feel weakness in the industrial economy, with revenue down 3%. Executives said the less-than-truckload unit is on track to be spun off in June.

First-quarter performance “helped to de-risk the story. Tariffs and de minimis are still meaningful headwinds, but the company has now quantified the expected impact, in addition to the opportunity from cost savings and commercial wins. Nearly 20% of U.S. average daily volume is now flowing through Network 2.0 optimized stations, and while there’s still a lot of work ahead, the first push into major markets is proceeding well,” said Stifel analyst Bruce Chan in a research note.

Air cargo pivot

Condensing U.S. and European stations, along with implementing other delivery efficiencies and the Tricolor air network redesign allowed FedEx to better adjust transport capacity with demand changes, Subramaniam said.

The Purple network is oriented toward cross-border parcel customers willing to pay for the highest level of speed, with dedicated aircraft timed to arrive overnight at FedEx hubs for next-day delivery. Fewer large freight shipments are being mixed in to maximize aircraft density and sorting efficiency on the ground.

With Orange flights, FedEx is competing directly with all-cargo carriers for priority, high-yield international freight that is more profitable per pound than heavier, general consignments. FedEx has targeted the $80 billion deferred airfreight market as an area for growth. Orange flights are scheduled into primary and regional sortation centers during the daytime, when workers have more time to build dense pallets.

The White network is for low-priority shipments booked on commercial passenger aircraft by FedEx’s freight forwarding arm.

FedEx reduced purple-tail trans-Pacific outbound Asia capacity by 25% year over year and nearly 10% from the prior quarter, and decreased third-party capacity by similar percentages, Subramaniam said. At the same time, FedEx redeployed freighter aircraft to capture revenue on the profitable Asia-to-Europe lane, where there are few new tariffs and demand remains high.

FedEx flight activity is down nearly 20% year over year due to lower package flows from China and the end of Postal Service flying, according to a Barclays analysis. Morgan Stanley data shows FedEx’s domestic flight count is down 22% in August compared to last year following a 15% year-over-year decline in July. Sequentially, FedEx domestic flight hours declined 3% in August.

“Tricolor is also driving greater densification and reduced unit costs across our Purple, Orange and White networks. The strategy is simultaneously focused on enhancing service quality and mitigating congestion at major sort locations. Our execution on this important initiative is bolstering end-to-end solutions for global customers as we grow profitably in the global airfreight market. This strategy supported an impressive 14% year-over-year Q1 revenue growth in international priority and economy freight and high flow through,” Subramaniam said. Revenue per pound for those products grew 9%.

Carere said FedEx’s focus on high-margin healthcare logistics contributed to growth in airfreight business during the quarter. “Almost 50% of the weight growth from a U.S. export perspective came from health care, airfreight, so our health care strategy is working there,” she said.

International export package yield grew 4%, driven by higher fuel surcharges, favorable exchange rate impacts and the reduction in lightweight e-commerce volume due to the change in the de minimis exemption, according to executives.

Click here for more FreightWaves/American Shipper stories by Eric Kulisch.

Write to Eric Kulisch at [email protected].

RELATED READING:

Richard Smith nominated to FedEx board, opening succession path to CEO

FedEx navigates tariff swings to modest profit gain

FedEx opens dedicated freight facility at UK airport

FedEx, DHL relocate to larger air package facilities on Europe’s edge

FedEx deepens presence in Saudi Arabia amid trade growth

FedEx sends specialists to streamline European operations

The post FedEx redeploys air fleet after US ends parcel tariff exemption appeared first on FreightWaves.