Container rates from Asia to the United States got another bump this week ahead of a holiday in China and reconfiguring of vessel schedules by ocean lines.

The Freightos Baltic Index showed Asia-U.S. West Coast rates continuing to rise with an increase of 25% to $2,163 per forty foot equivalent unit as of Sept. 10. Asia-U.S. East Coast prices were up 20% to $3,241 per FEU.

“These increases still put prices at about a third of their levels a year ago,” said Freightos (NASDASQ: CRGO) research chief Judah Levine in a note, “but may hold for now on some bump in demand in the lead up to Golden Week – though overall container demand into the U.S. is trending down – and increases in canceled services and blanked sailings.”

Gemini service partners Maersk (OTC: AMKBY) and Hapag-Lloyd (FRA: HLAG.DE) this week extended the three-week blanking of their TP9/WC6 Trans-Pacific service to a full suspension through the fourth quarter of this year. The direct service connecting Xiamen, China to Long Beach with a stopover in South Korea’s Port of Busan was launched in June.

CMA CGM also announced operational changes to minimize impact from the punitive U.S. port fees on China shipping, but did not offer details.

Golden Week, which begins October 1, celebrates the founding of the People’s Republic of China in 1949 and is the longest holiday after Chinese New Year.

The rising trans-Pacific rates come against a background of weakening demand, a result of the trade war being waged against China by the Trump administration.

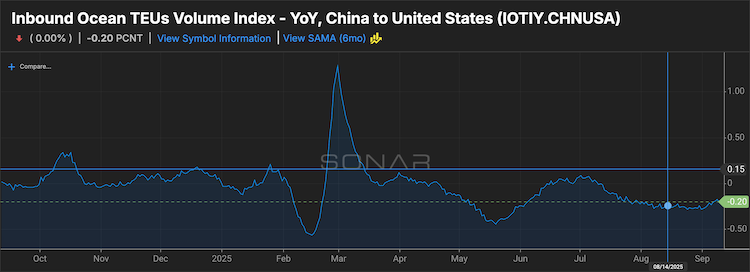

The SONAR index of loaded containers transiting from China to the U.S. as of Sept. 11 fell to -20 year-on-year.

“Even as trans-Pacific volumes sag, though, global container demand has continued to grow, with global bookings up 5% annually in July,” said Levine. “Part of that growth came from a 10% year-on-year bump in Asia-Europe volumes.”

But the peak shipping season demand likely topped out on this lane in July and early August. Asia-North Europe prices decreased 11% to $2,540 per FEU, and Asia-Mediterranean rates fell 3% to $2,949 per FEU.

“Asia-Europe prices have decreased 25% in the last month and 67% compared to last year,” Levine said. “But even with significantly stronger volumes than in 2024 during the July peak, rate highs that month were still 60% lower than a year prior, likely due mostly to capacity growth.”

Find more articles by Stuart Chirls here.

Related coverage:

Ex-FMC chief warns: U.S. maritime push needs deeper look

Container mishap shuts down Port of Long Beach pier

New ‘green’ report for Port of Long Beach on-dock rail

Dubai’s DP World to develop Montreal container terminal

The post Trans-Pacific container rates rally despite trade war’s effects appeared first on FreightWaves.