When the Federal Highway Administration or the American Transportation Research Institute (ATRI) puts out new numbers on truck parking, the conversation almost always circles back to the same point: there aren’t enough spaces. But a new all-encompassing study, commissioned by Truck Parking Club and conducted by transport economist Noël Perry, argues the story is more complicated.

There isn’t truly a shortage of truck parking. Instead, the industry suffers from a lack of awareness, poor connectivity, and inefficient use of the spaces that already exist.

Truck parking has been a headline problem for years. Organizations like ATRI and OOIDA have sounded the alarm, policymakers have pledged more funding, and drivers themselves consistently rank parking availability among their top concerns. But even after years of discussion, the experience on the ground hasn’t changed much: drivers still circle crowded truck stops, pull onto ramps, or risk tickets by parking on private property.

The new research reframes the issue: it’s not simply about building more parking spots, but about understanding the market, unlocking underutilized supply, and making information available in real time.

The Scale of the Problem

The U.S. has about 6.6 million heavy-duty trucks, with roughly 4.2 million in active service on any given day. Each of those drivers needs multiple parking slots daily, for sanitary breaks, meals, waiting time, and federally mandated rest. Altogether, trucks demand 14.5 million parking “slots” every day.

On paper, the supply is there. The U.S. has an estimated 23.4 million truck parking spaces spread across 3.8 million entities. But here’s the catch: only 670,000 of those spaces are actually open to the public. That’s just 3% of the potential supply. Most of the rest are tied up in private yards, carrier terminals, shipper facilities, or retail lots that don’t officially allow truck parking.

Drivers know this intuitively. They find a way to park because freight keeps moving, but two-thirds of rest events occur in unauthorized locations. Nearly 79% of the time, a driver can’t find a “good” sanctioned rest spot, and 66% of the time, when they do find a space, it’s in a place that doesn’t align with their hours-of-service needs.

By the Numbers: The True Cost of Truck Parking

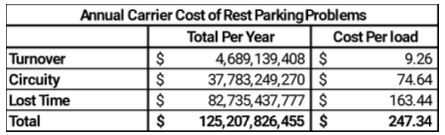

$37 billion — annual cost of circuity, as drivers add miles searching for parking

$82 billion — annual cost of lost driving hours from early shutdowns or missed spots

$10 billion — driver turnover costs tied to stress, dissatisfaction, and poor conditions

$700 million — annual cost of cargo theft tied to unsecured parking

Billions more — liability exposure from crashes involving illegally parked trucks

Total impact: More than $125 billion each year

Parking inefficiency is not just a driver inconvenience, it’s one of the largest hidden costs in the trucking industry, rivaling fuel and equipment expenses.

Why More Government Parking Isn’t the Answer

When most people think of fixing truck parking, they think of the government building new rest areas. But that approach is painfully slow and limited in scope. The report cited that ATRI estimates it costs about $113,000 to build a single public rest area truck space.

Even if funding were abundant, regulatory approvals and construction timelines mean it could take decades. Perry’s model suggests that at the current rate of government buildout, it would take 107 years to meet demand.

Meanwhile, the private sector already provides five times more rest capacity than public rest areas. Truck Parking Club alone has added more than 40,000 spaces by partnering with private landowners, ranging from towing yards to self-storage facilities, who have space but never considered truck parking as an option.

The Hidden Use Cases Nobody Talks About

Most conversations about truck parking fixate on the overnight rest break, but the research highlights how varied the daily use cases are:

- Sanitary breaks: Drivers need quick 20-minute stops multiple times a day.

- Meal breaks: One-hour pauses, often combined with waiting.

- Waiting time: At shippers and receivers, where two hours of detention is common.

- Rest: Ten-hour breaks mandated by federal rules.

Each of these has different time and facility requirements. A diner lot may be fine for a sanitary stop, but not for overnight rest. A shipper yard may work for waiting, but not for meals.

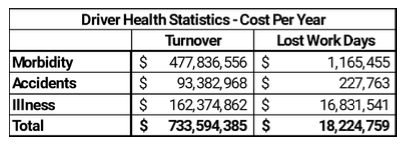

Another hidden cost of inadequate truck parking: the toll on driver health. Morbidity, accidents, and illness linked to stress and fatigue contribute to over $733 million in annual turnover costs and more than 18 million lost workdays. Parking uncertainty forces drivers into irregular schedules, poor sleep environments, and unsafe stop conditions that compound over time. The result isn’t just economic loss but human cost, shortening careers and straining fleets already facing high turnover.

This matters because a single parking space can be used multiple times a day, sometimes dozens of times, if it’s turned over efficiently. That means the raw number of “spaces” is less important than how many “slots” they generate in practice.

Ignoring these nuances creates blind spots. The result is an industry where freight keeps moving, but at tremendous hidden cost.

Counting the Cost

Parking inefficiency chips away at trucking economics in ways fleets and shippers rarely calculate. Perry’s research quantifies the pain points:

Turnover: Poor parking options push drivers to quit, with replacement costs averaging $8,200 per hire.

Theft & liability: Two-thirds of trucks rest in unsecured locations, contributing to nearly $700 million in annual cargo theft. Accidents involving illegally parked trucks add further liability exposure

For drivers, these costs hit twice: in their wallets, through reduced paid miles, and in their quality of life. Perry notes that inadequate parking contributes to health problems, stress, and even lower life expectancy among truckers.

Solutions: Beyond More Asphalt

Solving the truck parking crisis doesn’t hinge on pouring more asphalt. Instead, the study points to a multi-layered approach that rethinks how the industry uses the resources already at its disposal. A major part of the solution lies in unlocking underutilized spaces, millions of potential slots currently sitting idle in private yards, shipper lots, and other properties. Making those accessible to drivers would rapidly expand capacity without years of construction.

Technology plays an equally vital role. Too often, drivers waste precious time circling in search of a spot simply because they lack real-time visibility. Platforms that can show availability and even enable reservations create peace of mind while allowing drivers to maximize their federally limited hours of service. A guaranteed space, even at a cost, is worth far more than the productivity lost to shutting down early.

Finally, the government does have a role to play, in addition to building new rest areas. Policy changes, zoning reforms, and support for data-sharing would empower the private sector to scale solutions much faster than public works projects ever could.

With the right mix of accessibility, technology, and collaboration, parking can become less of a bottleneck and more of a manageable component of the supply chain.

The Private Sector’s Role

One of the most striking conclusions of the study is that the private sector is not just capable of addressing the parking issue, it’s best positioned to do so. Fleets want efficient use of their assets, drivers want peace of mind, and shippers want on-time deliveries. That creates a natural incentive for solutions that make parking accessible, reservable, and visible in real time.

The full report can be found with Truck Parking Club.

The post Exclusive: Truck Parking: Beyond the Myth of a Shortage appeared first on FreightWaves.