Import cargo volume at the nation’s major container ports is projected to conclude 2025 with a 5.6% decrease compared to 2024’s volume, according to the latest Global Port Tracker report released today by the National Retail Federation and Hackett Associates.

“While this forecast is still preliminary, it shows the impact the tariffs and the administration’s trade policy are having on the supply chain,” said NRF Vice President for Supply Chain and Customs Policy Jonathan Gold, in a release. “Tariffs are beginning to drive up consumer prices, and fewer imports will eventually mean fewer goods on store shelves. Small businesses especially are grappling with the ability to stay in business. We need binding trade agreements that open markets by lowering tariffs, not raising them.

“Tariffs are taxes paid by U.S. importers that will result in higher prices for U.S. consumers, less hiring, lower business investment and a slower economy.”

The NRF represents Walmart (NYSE: WMT), Target (NYSE: TGT) and other major retailers.

The Trump administration’s on-again off-again trade policy reached a milestone of sorts on Thursday when new tariffs on goods from dozens of countries went into effect amid a flurry of new trade agreements.

“The hither-and-thither approach of on-again, off-again tariffs that have little to do with trade policy is causing confusion and uncertainty for importers, exporters and consumers,” Hackett Associates Founder Ben Hackett said in the release. “Friends, allies and foes are all being hit by distortions in trade flows as importers try to second-guess tariff levels by pulling forward imports before the tariffs take effect. This, in turn, will certainly lead to a downturn in trade volumes by late September because inventories for the holiday season will already be in hand. Meanwhile, U.S. exporters are being left with unsold products as counter tariffs are applied.”

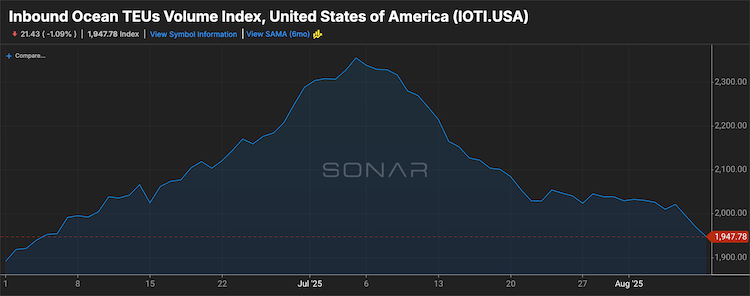

In June, U.S. ports processed 1.96 million twenty foot equivalent units (TEUs), the Global Port Tracker found, an 0.7% increase from May but an 8.4% decrease year-over-year.

Ahead of reported port volume data, the NRF projected that July surged to 2.3 million TEUs as retailers brought in merchandise ahead of this month’s tariffs. That would be a 12-month high, up 17.3% from June and down just 0.5% y/y.

August volume is forecast 5% off at 2.2 million TEUs, and September at 1.83 million TEU, 19.5% weaker y/y. Similarly, October is projected 18.9% off at 1.82 million TEUs, and 21.1% lower in November at 1.71 million TEUs. That would be the lowest monthly total since 1.78 million TEU in April 2023. December is forecast at 1.72 million TEUs, off by 19.3% y.y.

The anticipated decrease in overall import volumes from September to December is primarily due to cargo being pulled forward earlier in the year because of tariffs. Additionally, the significant year-over-year percentage drops are partly attributable to elevated import levels in late 2024, driven by concerns about potential strikes at East Coast and Gulf Coast ports.

Volume for the first half of the year totaled 12.53 million TEUs, better by 3.6% from 2024. Volume for the remainder of this year would bring 2025 to 24.1 million TEUs, a decrease of 5.6% from 25.5 million TEUs in 2024.

Find more articles by Stuart Chirls here.

Related coverage:

Nothing can stop falling trans-Pacific container rates: Analyst

Savannah containers post best FY since pandemic

Maersk raises guidance on higher Q2 volumes

Container rates unmoved by latest tariff deadline

The post Retailers: Tariff-battered import volumes to be 5.6% weaker in 2025 appeared first on FreightWaves.